6.4 Net Stable Funding Ratio (NSFR)

- a.NSFR is the ratio of the available amount of stable funding relative to the required amount of stable funding. It is a structural ratio that aims to ensure that the banks have sufficient long-term funding beyond the LCR’s 30 day time horizon to meet both the funding of its long term assets and the funding of a portion of contingent liability.

- b.The intention of the NSFR is to promote better stable funding of the assets and activities of banking institutions. The NSFR is applicable to IBs approved by the Central Bank to operate under the LCR/NSFR regulatory framework. The purpose of the NSFR is to promote resilience over a longer time horizon than the LCR by creating additional incentives for institutions to fund their activities with more stable sources of funding on an ongoing basis. The NSFR supplements the LCR and has a time horizon of one year. It has been developed to promote a sustainable maturity structure of assets and liabilities. It ensures that longer-term assets are funded with at least a minimum amount of stable liabilities over a 12-month time horizon.

- c.The NSFR can be summarised as the requirement for a minimum amount of “stable funding” over a one-year time horizon based on liquidity risk factors assigned to assets, OBS liquidity exposures and other contingent funding obligations. The objective of the ratio is to ensure stable funding on an ongoing, viable entity basis, over one year.

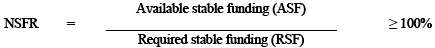

6.4.1 Formula for Calculating NSFR

- a.There are two components of the NSFR:

- -available stable funding (ASF); and

- -required stable funding (RSF).

The NSFR is defined as the ratio of the amount of available amount of stable funding to the amount of required stable funding. This ratio must be equal to at least 100% on an ongoing basis. Available stable funding is defined as the portion of those types and amounts of equity and liability financing expected to be reliable sources of funds over a one-year time horizon. Required stable funding is based on the liquidity characteristics and residual maturities of the various kinds of assets held by IBs as well as those included in its OBS exposures.

- b.

- c.The amount of ASF is composed of the total amount of an IB’s (1) capital, (2) UIA with a maturity equal to or greater than one year, (3) liabilities or Sukuk issued with effective or remaining maturities of one year or greater, and (4) that portion of “stable” deposits and/or UIA with maturities of less than one year that would be expected to stay with the IB. On the other hand, the amount of RSF is measured using supervisory assumptions about the broad characteristics of the liquidity risk profiles of an IB’s assets and OBS exposures. A certain RSF factor is assigned to each asset type, with those assets deemed to be more liquid receiving a lower RSF factor and therefore requiring less stable funding.

- d.The ASF and RSF are based on a presumed degree of stability of liabilities and liquidity characteristics of assets under the extended stress conditions, respectively. On the liability side (ASF), funding tenor and funding type and counterparty are two dimensions that must be taken into account. For example, longer-term liabilities are assumed to be more stable than short-term liabilities, and deposits or UIA from retail and small business customers are more stable than wholesale funding with the same maturity. Mostly, IBs rely on deposits and UIA provided by retail customers. These deposits and UIA are behaviorally more stable than other types of deposit. However, on the asset side (RSF), resilient credit creation, IBs behaviour, asset tenor, asset quality and liquidity value are the criteria for the appropriate amount of required stable funding. There is trade-off between these criteria. The difficulties for the IBS are lack of HQLA, unavailability of a Shari’ah-compliant repo mechanism to securitise and trade, and the absence of a secondary market.

Available Stable Funding

- e.The amount of available stable funding (ASF) is calculated by multiplying the carrying values of funding side items by the applicable ASF factors which are based on the broad characteristics of the relative stability of an IB’s funding sources, including the contractual maturity of its liabilities and the differences in the propensity of different types of funding providers to withdraw their funding. Five categories are mentioned in this standard, IBs must first assign the carrying value of an IB’s capital and liabilities to one of the five categories as presented below. The amount assigned to each category is then multiplied by an ASF factor, and the total ASF is the sum of the weighted amounts. Carrying value represents the amount at which a liability or equity instrument is recorded before the application of any regulatory deductions, filters or other adjustments.

- f.When determining the maturity of an equity-based or liability instrument, investors are assumed to redeem a call option at the earliest possible date in Shari’ah-compliant ways. For funding with options exercisable at the IB’s discretion, the reputational factors that may limit an IB’s ability not to exercise the option, must be taken into account. In particular, where the market expects certain liabilities to be redeemed before their legal final maturity date, IBs must assume such behaviour for the purpose of the NSFR and include these liabilities in the corresponding ASF category. For long-dated liabilities, only the portion of cash flows falling at or beyond the six-month and one-year time horizons must be treated as having an effective residual maturity of six months or more and one year or more, respectively.

- g.RIA do not count as ASF, but retail UIA may fall into one of the categories mentioned below mostly receiving ASF factors in the 100%, the 95% or the 90% category. Sukuk issued with an effective maturity of one year or more would also qualify for a 100% ASF.

- h.The first category of ASF is the liabilities and capital instruments receiving a 100% ASF factor. This category comprises:

- i.the total amount of regulatory capital, before the application of capital deductions, excluding the proportion of Tier 2 instruments with residual maturity of less than one year;

- ii.the total amount of any capital instrument not included in (a) that has an effective residual maturity of one year or more, but excluding any instruments with explicit or embedded options that, if exercised, would reduce the expected maturity to less than one year; and

- iii.the total amount of secured and unsecured funding and liabilities (including deposits and/or UIA) with effective residual maturities of one year or more. Cash flows falling below the one-year horizon but arising from liabilities with a final maturity greater than one year do not qualify for the 100% ASF factor.

- i.The second category is the liabilities receiving a 95% ASF factor. This category comprises “stable” deposits and/or UIA with residual maturities of less than one year provided by retail and small business customers.

- j.The third category is the liabilities of IB receiving a 90% ASF factor. It comprises “less stable” deposits and/or UIA with residual maturities of less than one year provided by retail and small business customers.

- k.The fourth category is the liabilities receiving a 50% ASF factor which comprises:

- i.funding (secured and unsecured) with a residual maturity of less than one year provided by non-financial corporate customers;

- ii.operational accounts;

- iii.funding with residual maturity of less than one year from sovereigns, public sector entities (PSEs), and multilateral and national development banks; and

- iv.other funding (secured and unsecured) not included in the categories above with residual maturity between six months and less than one year, including funding from central banks and financial institutions.

- l.The last category is the liabilities receiving a 0% ASF which are:

- i.all other liabilities and equity categories not included in the above categories, including other funding with residual maturity of less than six months from central banks and financial institutions;

- ii.other liabilities without a stated maturity. Two exceptions can be recognised for liabilities without a stated maturity:

- a.first, deferred tax liabilities, which must be treated according to the nearest possible date on which such liabilities could be realised; and

- b.second, minority interest, which must be treated according to the term of the instrument, usually in perpetuity.

These liabilities would then be assigned either a 100% ASF factor if the effective maturity is one year or greater, or 50% if the effective maturity is between six months and less than one year

- iii.net NSFR Shari’ah-compliant hedging liabilities, and

- iv.“trade date” payables arising from purchases of financial instruments, foreign currencies and commodities that

- a.are expected to settle within the standard settlement cycle or period that is customary for the relevant exchange or type of transaction, or

- b.have failed to, but are still expected to, settle.

- m.Calculation of Shari’ah-compliant Hedging Liability Amounts

Shari’ah-compliant hedging liabilities (e.g. Islamic swaps) are calculated first based on the replacement cost for the Shari’ah-compliant hedging contracts (obtained by marking to market), where the contract has a negative value. When an eligible bilateral netting contract is in place, the replacement cost for the set of Shari’ah-compliant hedging exposures covered by the contract will be the net replacement cost. - n.In calculating NSFR Shari’ah-compliant hedging liabilities, collateral posted in the form of variation margin that follows Shari’ah principles in connection with Shari’ah-compliant hedging contracts as in the TMA contract, regardless of the asset type, must be deducted from the negative replacement cost amount

- o.Required Stable Funding

The amount of required stable funding (RSF) is calculated by multiplying the carrying values of assets and OBS exposures by the applicable RSF factors which are based on the broad characteristics of liquidity risk profile of an IB’s assets and OBS exposures. Eight categories are mentioned in this standard, IBs must first assign the carrying values of an IB’s assets to one of eight categories as presented below. The amount assigned to each category is then multiplied by an RSF factor. The total RSF is the sum of the weighted amounts of each asset category and the amount of OBS activity (or potential liquidity exposure) multiplied by its associated RSF factor. - p.The RSF factors assigned to various types of assets are intended to approximate the amount of a particular asset that would have to be funded, either because it will be rolled over, or because it could not be monetized through sale or used as collateral in a secured financing transaction over the course of one year without significant expense.

- q.Asset categorisation to the various types of RSF is based on their residual maturity or liquidity value. When determining the maturity of an instrument, investors must be assumed to exercise any option to extend maturity. For assets with options exercisable at the IB’s discretion, reputational factors that may limit IB’s ability not to exercise the option must be taken into account. In particular, where the market expects certain assets to be extended in their maturity, IBs must assume such behaviour for the purpose of the NSFR and include these assets in the corresponding RSF category.

- r.For purposes of determining its RSF, an IB must: (a) include financial instruments, foreign currencies and commodities for which a purchase order has been executed; and (b) exclude financial instruments, foreign currencies and commodities for which a sales order has been executed, even if such transactions have not been reflected in the balance sheet under a settlement-date accounting model, provided that (i) such transactions are not reflected as Shari’ah-compliant hedging contracts or secured financing transactions in the IB’s balance sheet, and (ii) the effects of such transactions will be reflected in the IB’s balance sheet when settled.

- s.The first category is the assets assigned a 0% RSF factor and comprises:

- i.coins and banknotes immediately available to meet obligations;

- ii.all central bank reserves (including required reserves and excess reserves);

- iii.all claims on central banks with residual maturities of less than six months; and

- iv.“trade date” receivables arising from sales of Shari’ah-compliant financial instruments, foreign currencies and commodities that (i) are expected to settle within the standard settlement cycle or period that is customary for the relevant exchange or type of transaction, or (ii) have failed to, but are still expected to, settle.

- t.The second category is the assets assigned a 5% RSF factor and comprises unencumbered Level 1 assets, excluding assets receiving a 0% RSF as specified above, and including: Sukuk and other Shari’ah-compliant marketable securities issued or guaranteed by sovereigns, central banks, public sector entities (PSEs), multilateral development banks (MDBs) or relevant international organisations which are assigned a 0% risk weight.

- u.The third category is the assets assigned a 10% RSF factor which consist of the unencumbered financings to financial institutions with residual maturities of less than six months, where the financing is secured against Level 1 assets.

- v.The fourth category is the assets assigned a 15% RSF factor which comprise:

- i.unencumbered Level 2A assets, including: (i) Sukuk and other Shari’ah-compliant marketable securities issued or guaranteed by sovereigns, central banks, PSEs, MDBs or relevant international organisations, which are assigned a 20% risk weight based on standardized approach as implemented in the UAE; and (ii) corporate Sukuk with a credit rating equal or equivalent to at least AA–; and

- ii.all other unencumbered financings to financial institutions with residual maturities of less than six months not included in the second category.

- w.The fifth category is the assets assigned a 50% RSF factor which comprise:

- i.unencumbered Level 2B assets as defined and subject to the conditions set forth in paragraph 31, including: (i) Sukuk and other Shari’ah-compliant securities backed by commodity(ies) and other real asset(s) with a credit rating of at least AA; (ii) corporate Sukuk and other Shari’ah-compliant securities with a credit rating of between A+ and BBB–; and (iii) Shari’ah-compliant equity shares not issued by financial institutions or their affiliates;

- ii.any HQLA as defined in the LCR that are uncumbered for a period of between six months and less than one year;

- iii.all financings to financial institutions and central banks with a residual maturity of between six months and less than one year; and

- iv.deposits or UIA held at other financial institutions for operational purposes that are subject to the 50% ASF factor;

- v.all other non-HQLA not included in the above categories that have a residual maturity of less than one year, including financing to non-financial corporate clients, financings to retail customers (ie natural persons) and small business customers, and financings to sovereigns and PSEs.

- x.The sixth category is the assets assigned a 65% RSF factor which comprise:

- i.unencumbered residential real estate financing with a residual maturity of one year or more that would qualify for a 35% or lower risk weight based on standardized approach as implemented in the UAE; and

- ii.other unencumbered financing not included in the above categories, excluding financing to financial institutions, with a residual maturity of one year or more that would qualify for a 35% or lower risk weight based on standardized approach as implemented in the UAE.

- y.The seventh category is the assets assigned an 85% RSF factor which comprise:

- i.cash, securities or other assets posted as initial margin for Shari’ah-compliant hedging contracts and cash or other assets provided to contribute to the default fund of a central counterparty;

- ii.other unencumbered Sukuk and other Shari’ah-compliant securities with a remaining maturity of one year or more and Shari’ah-compliant equity shares, that are not in default and do not qualify as HQLA according to the LCR;

- iii.other unencumbered performing financing assets that do not qualify for the 35% or lower risk weight based on standardized approach as implemented in the UAE and have residual maturities of one year or more, excluding financing to financial institutions;

- iv.physical traded commodities

- z.The last category is the assets assigned a 100% RSF factor, which comprise:

- i.all assets that are encumbered for a period of one year or more;

- ii.net NSFR Shari’ah-compliant hedging assets as calculated according to this standard

- iii.all other assets not included in the above categories, including non-performing financing, financing to financial institutions with a residual maturity of one year or more, non-exchange-traded Shari’ah-compliant equities, fixed assets, items deducted from regulatory capital, insurance assets, and defaulted Shari’ah-compliant securities; and

- ii.20% of Shari’ah-compliant hedging liabilities (i.e. negative replacement cost amounts) as calculated according to this standard (before deducting variation margin posted).

- aa.Encumbered Assets

Assets on the balance sheet that are encumbered for one year or more receive a 100% RSF factor. Assets encumbered for a period of between six months and less than one year that would, if unencumbered, receive an RSF factor lower than or equal to 50% receive a 50% RSF factor. Assets encumbered for between six months and less than one year that would, if unencumbered, receive an RSF factor higher than 50% retain that higher RSF factor. Where assets have less than six months remaining in the encumbrance period, those assets may receive the same RSF factor as an equivalent asset that is unencumbered. - bb.Secured Financing Transactions

For secured funding arrangements, use of balance sheet and accounting treatments must generally result in IBs excluding, from their assets, Shari’ah-compliant securities which they have used in securities financing transactions where they do not have beneficial ownership. Where IBs have encumbered securities in Shari’ah-compliant repos or other securities financing transactions, but have retained beneficial ownership and those assets remain on the IBs’ balance sheet, the IB must allocate such securities to the appropriate RSF category. - cc.Securities financing transactions with a single counterparty may be measured net when calculating the NSFR only where a valid netting agreement exists or when the inflow and outflow occurs within the same business day.

- dd.Calculation of Shari’ah-compliant Hedging Asset Amounts

Shari’ah-compliant hedging assets (e.g. Islamic swaps) are calculated first based on the replacement cost for the Shari’ah-compliant hedging contracts (obtained by marking to market), where the contract has a positive value. When an eligible bilateral netting contract is in place, the replacement cost for the set of Shari’ah-compliant hedging exposures covered by the contract will be the net replacement cost. - ee.In calculating NSFR Shari’ah-compliant hedging assets, collateral received in connection with Shari’ah-compliant hedging contracts may not offset the positive replacement cost amount, regardless of whether or not netting is permitted under the IB’s operative accounting or risk-based framework, unless it is received in the form of cash variation margin. Any remaining balance sheet liability associated with initial margin received may not offset Shari’ah-compliant hedging assets and must be assigned a 0% ASF factor.

- ff.Interdependent Assets and Liabilities

Central Bank in limited circumstances may determine whether certain asset and liability items, on the basis of contractual arrangements, are interdependent such that the liability cannot fall due while the asset remains on the balance sheet, the principal payment flows from the asset cannot be used for something other than repaying the liability, and the liability cannot be used to fund other assets. For interdependent items, supervisors may adjust RSF and ASF factors so that they are both 0%, subject to the following criteria:

a) The individual interdependent asset and liability items must be clearly identifiable.

b) The maturity and principal amount of both the liability and its interdependent asset must be the same.

c) The bank is acting solely as a pass-through unit to channel the funding received (the interdependent liability) into the corresponding interdependent asset.

d) The counterparties for each pair of interdependent liabilities and assets must not be the same. - gg.Off-balance Sheet Exposures (OBS)

Off-balance sheet exposures also attract RSF factors. Many potential OBS liquidity exposures require little direct or immediate funding but can lead to significant liquidity drains over a longer time horizon. The NSFR assigns an RSF factor to various OBS activities in order to ensure that Islamic Bank hold stable funding for the portion of OBS exposures that may be expected to require funding within a one-year horizon. - hh.Consistent with the LCR, the NSFR identified OBS exposure categories based broadly on whether the commitment is a credit or liquidity facility or some other contingent funding obligation.

- a.There are two components of the NSFR: