Liquidity

Regulations Re Liquidity at Banks

C 33/2015 Effective from 1/7/2015Introduction

Following consultation with banks operating in the UAE and after reviewing international best practices in the area of liquidity risk management and regulations, the Central Bank has decided to enact these Regulations for controlling and monitoring of liquidity at banks. All banks must abide by the provisions of these Regulations and the Guidance Manual, which will be issued at a later stage, at all times.

Scope

All Banks must comply with the provisions of these Regulations at all times.

Objective

The objective of these Regulations is to ensure that liquidity risks are well managed at banks operating in the UAE and are in line with the Basel Committee for Banking Supervision (BCBS) recommendations and international best practice.

Article (1): Definitions

Terminology and concepts used in the qualitative requirements section: As defined by the Basel Committee for Banking Supervision (BCBS) in the document titled "Principles for Sound Liquidity Management and Supervision" dated September 2008.

Eligible Liquid Assets Ratio (ELAR): Ratio of the stock of eligible liquid assets to total liabilities (excluding liabilities allowed in the regulatory capital base).

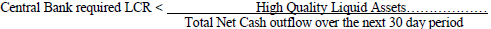

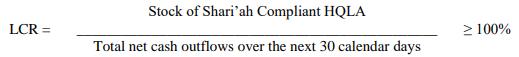

Liquidity Coverage Ratio (LCR): Ratio of the stock of high quality liquid assets to total net cash outflows over the next 30 days as defined by the Basel Committee for Banking Supervision (BCBS) in the document titled "Basel III: The Liquidity Coverage Ratio and Liquidity Risk Monitoring Tools" issued in January 2013.

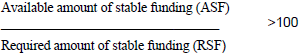

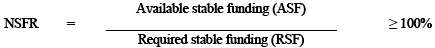

Net Stable Funding Ratio (NSFR): The ratio of available amount of stable funding to the required amount of stable funding, as defined by the Basel Committee for Banking Supervision (BCBS) in the document titled "Basel III: the net stable funding ratio", issued in October 2014.

Article (2): Qualitative Requirements

A Liquidity Risk Management Framework is an integral part of risk management within all banks. The framework should ensure that liquidity risk is well managed to minimize the likelihood of a liquidity stress occurring at a bank and its impact when it occurs

The Central Bank believes that liquidity risk governance, measurement and management is equally important and complements the quantitative requirements.

When reviewing the liquidity framework, the Central Bank will apply a proportionate approach which will take into account the size of the bank, scope of operations, interconnectedness, and its possible impact on the UAE financial system.

A robust Liquidity Risk Management Framework should incorporate the following requirements:

- Banks are responsible for managing their liquidity risk in a prudent manner using all available liquidity management tools at their disposal.

- The bank’s Board of Directors bears ultimate responsibility for liquidity risk management within the bank.

The bank’s Board should clearly articulate liquidity risk tolerance for the bank in line with the bank’s objectives, strategy and overall risk appetite.

- Board members should familiarize themselves with liquidity risk and how it is managed. At least one board member should have a detailed understanding of liquidity risk management.

- Senior management is to develop strategies, policies and practices to manage liquidity risk in accordance with the board of directors' approved risk tolerance and ensure that the bank maintains sufficient liquidity.

The bank's liquidity management strategy should be continuously reviewed and compliance should be reported to the board of directors on a regular basis.

- A bank must incorporate liquidity costs, benefits and risks into the product pricing and approval process for all significant business activities.

- A bank must have sound processes and systems for identifying, measuring, monitoring and controlling liquidity risk in a timely and accurate manner.

- A bank must establish a forward-looking funding strategy that provides effective diversification in the sources and tenor of funding.

- A bank must establish a liquidity risk management framework including limits, warning indicators, communication and escalation procedures. The framework should be shared with the Central Bank upon request.

- A bank must conduct its own internal liquidity stress tests on a regular basis for a variety of institution specific and market wide stress scenarios (individually and in combination). The scenarios should be based on the individual bank specific circumstances and business model.

A bank should use its internal stress testing outcomes to adjust its liquidity risk management strategies, policies and position and develop effective contingency funding plans.

The scenarios and results of the stress tests should be shared with the Board of Directors on a regular basis and the Central Bank upon request.

- A bank must have a formal contingency funding plan (CFP) that clearly sets out the strategies for addressing liquidity shortfalls in emergency situations. The CFP should be shared with the Central Bank upon request.

- A bank must maintain an adequate cushion of unencumbered, high quality liquid assets to be held as insurance against a range of liquidity stress scenarios.

- A bank is required to develop a transfer-pricing framework to reflect the actual cost of funding. The sophistication of the framework should be commensurate with the bank’s liquidity risk tolerance and complexity.

- Banks are responsible for managing their liquidity risk in a prudent manner using all available liquidity management tools at their disposal.

Article (3): Quantitative Requirements

A minimum level of liquid assets should be held at banks to ensure their ability to sustain a short term liquidity stress (both bank specific and market wide).

Banks should also structure their funding profile to limit the impact of long term market disruptions and avoid cliff effects (A large amount of liabilities maturing at the same time).

To achieve these two objectives, the Central Bank requires banks to comply with the following ratios, at all times;

- The Eligible Liquid Assets Ratio (ELAR); or

The Liquidity Coverage Ratio (LCR) - following approval from the Central Bank.

The transition to the LCR ratio will take effect from 1 January 2016. Banks must demonstrate that both the qualitative and quantitative measures have been adequately addressed before adoption of the LCR ratio.

All banks approved to move to the LCR are expected to implement the LCR by the final Basel III implementation date of 1 January 2019.

- Banks approved to move onto the LCR will also be required to comply with the Net Stable Funding Ratio (NSFR) when this ratio comes into effect by 1 January 2018.

The Central Bank will set up a liquidity task force to ensure a smooth implementation of the LCR and NSFR. The team will visit banks and request a "road map" with clear milestones explaining how the bank will meet the LCR and the NSFR by their respective due dates. The team will then assess the plan and provide guidance. The team will also monitor the progress of the bank against its internally set milestones.

- The Eligible Liquid Assets Ratio (ELAR); or

Article (4) Eligible Liquid Assets Ratio (ELAR)

Banks are required to hold an amount equivalent to the specified percentage set by the Central Bank of their total liabilities in eligible liquid assets, consisting of the following items:

- Account balances at the Central Bank.

- Physical cash at the bank.

- Central Bank Certificates of Deposit (CDs).

- UAE Federal Government bonds and Sukuk.

- Reserve requirements.

- UAE local governments and public sector entities publicly traded debt securities, provided they are assigned a 0% risk weighting under Basel II standardized approach (limited to 20% of eligible liquid assets).

- Foreign, Sovereign debt instruments or instruments issued by their respective central banks, which receive 0% Risk Weight under Basel II Standardized approach (limited to 15% of eligible liquid assets).

This ratio will become effective on 1 July 2015. The initial compliance level for this ratio is set at 10 percent. The Central Bank will periodically review this ratio to ensure consistency between banks in the application of liquidity requirements in the UAE.

- Account balances at the Central Bank.

Article (5): Liquidity Coverage Ratio (LCR) (Effective Transition From 1 January 2016 for Approved Banks)

The LCR is taken from Basel III requirements. It represents a 30 day stress scenario with combined assumptions covering both bank specific and market wide stresses that the bank should be able to survive using a stock of high quality liquid assets.

The LCR requires that banks should always be able to cover the net cash outflow with high quality liquid assets.

The Basel III accord requires that the minimum LCR is 100%, starting on 1 January 2015 with 60% minimum coverage and increasing by 10% each year to reach 100% by 1 January 2019.

High quality liquid assets are separated into two categories - Level 1 and Level 2. The composition of Level 1 and Level 2 high quality liquid assets and ‘run off rates’ for cash outflows will be based on the definitions and conditions contained in the document "Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools" - issued in January 2013.

The full details of the level 1 and level 2 high quality liquid assets and cash outflows that will apply for the LCR will be contained the Guidance Manual, which is required to be published under Article (10) of these Regulations, taking account of international and local regulatory developments and local market practices.

Article (6): Net Stable Funding Ratio (NSFR) (Effective 1 January 2018 for Approved Banks)

This is a structural ratio that aims to ensure that long term assets on the banks’ balance sheets are funded using a sufficient amount of stable liabilities. It also requires an amount of stable funding to cover a portion of the contingent liabilities. The NSFR mirrors the Basel III standard.

The NSFR identifies the key uses of funds and the different types of funding sources used by banks. It assigns Available Stable Funding (ASF) factors to the sources of funds and Required Stable Funding (RSF) (usage) factors to asset classes and the off balance sheet contingent exposures.

The assigned ASF factor depends on the term of funding and the perceived stability of the funding source. The assigned RSF factor will depend on the liquidity of the asset being funded under a market wide stress. Both factors will follow the Basel III NSFR standard.

Under Article (10) below, the Banking Supervision Department within the Central Bank is required, to issue a Guidance Manual that specifies the stability factors to be assigned to funding sources and the required stable funding (Usage) factors of various asset classes.

The Loans to Stable Resources Ratio specified in Circular No. 394 dated 12/07/1986 shall continue to apply, except for those banks approved to move to the NSFR.

Article (7): Reporting Requirements

The frequency and scope of reporting requirements under the ELAR and LCR will be set out in the Guidance Manual.

From time to time, banks will be required to complete a liquidity report to enable the Central Bank to monitor effectively the liquidity positions at banks and to take appropriate and timely action at early signs of a liquidity stress.

The report should be based on contractual data with no behavioral assumptions made.

The Central Bank will apply homogeneous assumptions to the data to perform its liquidity analysis on both micro and macro prudential levels.

Banks are required to use the liquidity reporting templates mentioned in the Guidance Manual, to be issued afterward.

Article (8): Commencement of these Regulations

The Eligible Liquid Assets Ratio (ELAR) will take effect from 1 July 2015.

The Qualitative Requirements of these Regulations also take effect from 1 July 2015.

The transition phase for the Liquidity Coverage Ratio (LCR) will commence on 1 January 2016 for those banks approved to move to this ratio.

The transition phase for the Net Stable Funding Ratio (NSFR) will also commence on 1 January 2016 for those banks approved to move to this ratio. Approved banks will be required to comply with the NSFR from 1 January 2018.

Article (9): Cancellation of Previous Regulations

Circular No. 30/2012 dated 12/7/2012, regarding Liquidity Regulations at Banks is withdrawn from the date these Regulations become effective.

Article (10): Guidance Manual

The Central Bank will issue a Guidance Manual on compliance with the Eligible Liquid Assets Ratio (ELAR), Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR).

The Guidance Manual will also include definitions and assumptions for the LCR and NSFR calculation which will follow the standards set out in Basel III.

The Guidance Manual will also include liquidity reporting templates and a more detailed explanation of what is expected from banks under the qualitative rules.

The manual will be updated with any changes to Basel III liquidity standards that might take place between the date of these Regulations and the respective implementation date.

Article (11): Interpretation

Reference shall be made to the Regulatory Development Division of the Central Bank for interpretation of these Regulations, and this interpretation shall be final.

Article (12): Notification and Publication

These Regulations shall be communicated to all concerned parties for implementation as per the phases specified in Article (8) of these Regulations and shall be published in the Official Gazette in both Arabic and English.

Yours faithfully,,,

Guidance Manual for Circular Number 33/2015 Liquidity Regulations at Banks

C 33/2015 GUI Effective from 1/12/2015Introduction and Overview

This manual explains how banks can comply with the requirements of Circular Number 33/2015 - Regulations re Liquidity at Banks. It must be read in conjunction with these Regulations.

Banks fulfill an important role in the economy by providing maturity transformation (borrow short term and lend long term). The aim of these liquidity regulations is to ensure that banks have a robust liquidity risk management and governance process in place to mitigate this imbalance.

It also ensures that banks are holding sufficient liquid assets to withstand a liquidity stress for a reasonable period of time.

This manual follows the structure of the Regulations and is set out in three parts:

- 1) Qualitative requirements;

- 2) Quantitative requirements;

- A – Eligible Liquid Assets Ratio (ELAR)

- B – Advances to Stable Resources Ratio (ASRR)

- C – Liquidity Coverage Ratio (LCR)

- D – Net Stable Funding Ratio (NSFR)

- 3) Reporting requirements

These three parts cover the key requirements of liquidity risk management and governance in banks and form the basis of the regulations.

Note this Manual will remain a working document and under constant review throughout the period of the LCR transition period.

1. Qualitative Requirements

The manual addresses each of the qualitative requirements contained in the regulations and emphasizes the key focus of the Central Bank in its on and off site examination of banks.

The qualitative rules come into force on 1 July 2015. Any bank that expects to be in breach of the regulation when the regulation commences should approach the Central Bank to discuss a remediation plan. Breaches will be dealt with on case by case basis. The Central Bank will apply proportionality in determining the suitability of some of the more complex requirements for smaller banks.

Those banks that are aspiring to be Basel III approved will not have proportionality applied in relation to qualitative requirements, given such banks are expected to comply with all of the qualitative requirements before they can be considered for approval.

2. Quantitative Requirements

The quantitative requirements come into force on 1 July 2015.

Banks that apply and are approved to be assessed under the Basel III requirements cannot elect to revert to the ELAR regulatory framework and once approved must comply with both the LCR and the NSFR when they become effective - i.e. on 1 January 2016 and 1 January 2018 respectively.

There are four ratios under quantitative requirements (see below), two of which are provided by the Basel Committee on Banking Supervision (BCBS) in what is commonly called the Basel III framework. The Liquidity Coverage Ratio (LCR) is fully described in their publication 'Basel III: The Liquidity Coverage ratio and liquidity risk monitoring tools' dated January 2013. The Net Stable Funding Ratio (NSFR) is fully described in their publication ‘Basle III: the net stable funding ratio’ dated October 2014

The ratios are as follows:

A – Eligible Liquid Assets Ratio (ELAR)

This is a measure to ensure banks hold minimum buffers of liquid assets.

The ratio requires the bank to hold an amount equivalent to 10% of its total balance sheet liabilities (excluding those included in regulatory capital) in high quality liquid assets, as described in detail later in this manual.

This ratio will be periodically reassessed and if necessary adjusted to reflect the appropriate Central Bank policy as well as any recalibration necessary to keep it aligned with the LCR.

B – Advances to Stable Resources Ratio (ASRR)

The ASRR is a measure that recognizes both the actual uses as well as the likely uses of funds in terms of the contractual maturity and behavioral profile of the sources of funds available to the bank, in order to ensure that there are limited maturity mismatches and cliff effects. Central Bank reporting for BRF 7 details the requirements of the ratio.

C – Liquidity Coverage Ratio (LCR)

This is a short term (30 days) stress test that covers bank specific and market wide stresses. It is determined by the Basel III standards and will be effective from 1 January 2016 at a compliance level of 70%. Subsequent years will see a flight path of an extra 10% per year until full (100%) compliance on 1 January 2019. Those banks that are permitted to use the Basel III ratios will comply at a 70% level as at 1 January 2016, 80% level at 1 January 2017, 90% at 1 January 2018 and 100% at 1 January 2019.

The relevant section in this manual will provide the definitions and assumptions used in the LCR calibration. Most of these assumptions are taken from the Basel Committee for Banking Supervision (BCBS) document titled “Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools “issued January 2013. The section will also provide guidance over areas where national discretion has been utilized.

This section will be updated with any changes to the Basel III liquidity framework between the date of issuance of this manual and the effective date of the Basel III standards.

D – Net Stable Funding Ratio (NSFR)

This is a structural ratio that aims to ensure that the banks have sufficient long term funding beyond the LCR’s 30 day time horizon to meet both the funding of its long term assets and the funding of a portion of contingent liability drawdowns under a period of market wide stress.

Like the LCR, the relevant section of the manual will provide guidance in a local context but fundamentally the guidance is derived from the October 2014 paper from the BCBS. Any subsequent changes will be updated accordingly.

Banks approved by the Central Bank to move onto the LCR will also be required to comply with the NSFR. However, the date for compliance will be 1 January 2018 and until then banks must comply with the Advances to Stable Resources Ratio described in these guidelines.

From the date of these Regulations the ratios that all banks must comply with are the ELAR and the ASRR. Only those banks approved by the Central Bank to do so will be able to use the LCR and the NSFR for regulatory compliance.

3. Reporting Requirements

All banks are required to report their liquidity position to the Central Bank in accordance with ELAR and ASRR reporting requirements as issued by the Central Bank.

Those banks approved to move to the Basel III liquidity standards (LCR and NSFR) will be required to report their liquidity position to the Central Bank in a form and manner prescribed by the Central Bank.

Banks may also be required to provide the Central Bank with ad hoc reports on liquidity as and when requested to do so.

Part One: Qualitative Requirements

- 1) The qualitative requirements are based on the Basel Committee on Banking Supervision (BCBS) document titled “Principles for Sound Liquidity Management and Supervision" dated September 2008. We encourage banks to familiarize themselves with the content of this document.

- 2) The Regulations requires banks to comply with 12 criteria when setting up their liquidity risk management and governance frameworks. These criteria are essential for a robust framework designed to minimize liquidity risk at banks. These criteria are discussed below in details:

- Banks are responsible to manage their liquidity risk in a prudent manner using all available liquidity management tools at their disposal.

- 3) A bank should establish a robust liquidity risk management framework that is well integrated into the bank-wide risk management process. A primary objective of the liquidity risk management framework should be to ensure with a high degree of confidence that the firm is in a position to both address its daily liquidity obligations and withstand a period of liquidity stress affecting its funding sources, the source of which could be bank-specific or market-wide.

- The Board of directors bears ultimate responsibility for liquidity risk management within the bank. The board should clearly articulate liquidity risk tolerance for the bank in line with the banks objectives, strategy and overall risk appetite.

- 4) The board of directors is ultimately responsible for the liquidity risk assumed by the bank as well as the manner in which this risk is managed and, therefore, should establish the bank’s liquidity risk tolerance.

- 5) Liquidity risk tolerance is defined as the level of liquidity risk that the bank is willing to assume, it should be appropriate for the business strategy of the bank and its role in the financial system and should reflect the bank’s financial condition and funding capacity. The tolerance level should ensure that the firm manages its liquidity well in normal times to enable it to withstand a prolonged period of stress. There are a variety of ways in which a bank can express its risk tolerance. For example, a bank may quantify its liquidity risk tolerance in terms of the level of funding gap the bank decides to assume under normal and stressed business conditions for different maturity buckets.

- Board members should familiarize themselves with liquidity risk and how it is managed. At least one board member should have detailed understanding of liquidity risks management.

- 6) The board of directors, as a whole, should have a thorough understanding of the close links between funding liquidity risk (capacity to meet expected and unexpected cash flows without significant interruptions to bank’s operations and financial position) and market liquidity risk (the ability to close positions in the market at a reasonable cost). The board should also understand how other risks affect the bank’s overall liquidity risk strategy, i.e. how a tighter funding market will impact the bank’s liquidity and how other risks, if materialized, could result in a liquidity run on the bank.

- 7) The board should have in place a system to review liquidity reports sent to it by management and identify liquidity concerns and follow up on remedial action undertaken by management. It should also ensure that senior management and appropriate personnel have the necessary expertise and systems to measure and monitor all sources of liquidity risk.

- 8) The board should ensure that senior management translates the strategy into clear policies, controls and procedures.

- Senior management is to develop a strategy, policies and practices to manage liquidity risk in accordance with the board of directors' approved risk tolerance and ensure that the bank maintains sufficient liquidity. The bank's strategy should be continually reviewed and compliance should be reported to the board of directors on a regular basis.

- 9) Senior management has an integral role in liquidity risk management as it is responsible to implement the board approved risk appetite.

Strategy

- 10) The strategy should include specific policies on liquidity management, such as:

- • the composition of assets and liabilities;

- • the diversity and stability of funding sources;

- • the approach to managing liquidity in different currencies, across borders, and across business lines and legal entities;

- • the approach to intraday liquidity management; and

- • The assumptions on the liquidity and marketability of assets.

- 11) The strategy should take account of liquidity needs under normal conditions as well as under periods of liquidity stress as a result of firm specific or a market wide crisis and a combination of these two. The strategy may include various high-level quantitative and qualitative targets. The board of directors should approve the strategy and critical policies and practices and review them at least annually.

- 12) The liquidity strategy should be appropriate for the nature, scale and complexity of the bank’s activities. In formulating this strategy, the bank should take into consideration its legal structures, key business lines, the breadth and diversity of markets, products, and jurisdictions in which it operates, and the regulatory requirements it is subject to.

- 10) The strategy should include specific policies on liquidity management, such as:

Policies and Processes

- 13) Senior management should determine the structure, responsibilities and controls for managing liquidity risk and for overseeing the liquidity positions of all legal entities, branches and subsidiaries in the jurisdictions in which a bank is active, and outline these elements clearly in the bank’s liquidity policies. The structure for managing liquidity should take into consideration any legal, regulatory or operational restrictions on the transfer of funds.

- 14) Processes should be in place to ensure that the group’s senior management is actively monitoring and quickly responding to all material developments across the group and reporting to the board of directors as appropriate.

- 15) Senior management should have a thorough understanding of the close links between funding liquidity risk and market liquidity risk, as well as how other risks, including credit, market, operational and reputation risks affect the bank’s overall liquidity risk strategy.

Market Monitoring

- 16) Senior management should closely monitor current trends and potential market developments that may present significant, unprecedented and complex challenges for managing liquidity risk so that they can make appropriate and timely changes to the liquidity strategy as needed.

- 17) Senior management should define the specific procedures and approvals necessary for exceptions to policies and limits, including the escalation procedures and follow-up actions to be taken for breaches of limits.

- 18) Senior management should present to the board regular reports on the liquidity position of the bank. The board should be informed immediately of new or emerging liquidity concerns. These include increasing funding costs or concentrations, the growing size of a funding gap, the drying up of alternative sources of liquidity, material and/or persistent breaches of limits, or a significant decline in the cushion of unencumbered, highly liquid assets. The board should ensure that senior management takes appropriate remedial actions to address the concerns.

Individuals Responsible for Liquidity Management

- 19) The liquidity strategy, key policies for implementing the strategy, and the liquidity risk management structure should be communicated throughout the organization by senior management. All individuals within business units conducting activities that have a material impact on liquidity should be fully aware of the liquidity strategy and operate under the approved policies, procedures, limits and controls.

- 20) Individuals responsible for liquidity risk management should maintain close links with those monitoring market conditions, as well as with other individuals with access to critical information, such as credit risk managers.

- 21) Individuals with direct responsibility over liquidity risk management at the banks should meet the fit and proper criteria of the Central Bank including appropriate academic qualifications, good character and sound financial position.

Independent Oversight

- 22) Senior management should ensure that operationally independent, appropriately trained and competent personnel are responsible for implementing internal controls.

- 23) Independent oversight and verification should be performed by middle office and/or risk management staff who are capable of assessing treasury’s adherence to liquidity limits, policies and procedures.

- 24) It is critical that personnel in independent control functions have the skills and authority to challenge information and modeling assumptions provided by business lines. When significant changes impact the effectiveness of controls and revisions or enhancements to internal controls are warranted, senior management should ensure that necessary changes are implemented in a timely manner.

- 25) Internal audit should regularly review the implementation and effectiveness of the agreed framework for controlling liquidity risk.

- A bank must incorporate liquidity costs, benefits and risks into the product pricing and approval process for all significant business activities.

- 26) Senior management should appropriately incorporate liquidity costs, benefits and risks in the product pricing, and new product approval process for all significant business activities (both on- and off-balance sheet).

- 27) This quantification of liquidity costs, benefits and risks should incorporate factors related to the anticipated holding periods of assets and liabilities, their market liquidity risk characteristics, and any other relevant factors, including the benefits from having access to relatively stable sources of funding, such as some types of retail deposits.

- 28) The quantification and attribution of these risks should be explicit and transparent at the line management level and should include consideration of how liquidity would be affected under stressed conditions.

- 29) Liquidity risk costs, benefits and risks should be addressed explicitly in the new product approval process.

- Banks must have sound processes and systems for identifying, measuring, monitoring and controlling liquidity risk in a timely and accurate manner.

A. Identifying Liquidity Risk

- 30) A bank should define and identify the liquidity risk it is exposed to in all jurisdictions in which it operates directly or through its subsidiaries, branches and related entities. A bank should evaluate each major on and off balance sheet position, including contingent exposures that may affect the bank’s sources and uses of funds, and determine how it can affect liquidity risk.

- 31) A bank should consider the interactions between exposures to funding liquidity risk and market liquidity risk1. A bank that obtains liquidity from capital markets and interbank markets should recognize that these sources may be more volatile than traditional retail deposits. For example, under conditions of stress, investors in money market instruments may demand higher compensation for risk, require roll over at considerably shorter maturities, or refuse to extend financing at all. Moreover, reliance on the full functioning and liquidity of financial markets may not be realistic as asset and funding markets may dry up in times of stress. Market illiquidity may make it difficult for a bank to raise funds by selling assets and thus increase the need for funding liquidity.

- 32) A bank should ensure that assets are prudently valued according to relevant financial reporting and supervisory standards. A bank should fully factor into its risk management the consideration that valuations may deteriorate under market stress, and take this into account in assessing the feasibility and impact of asset sales during stress on its liquidity position.

- 33) A bank should recognize and consider the strong interactions between liquidity risk and the other types of risk to which it is exposed. These include interest rate, credit, operational, legal and reputational risks, which may influence a bank’s liquidity profile. Liquidity risk often can arise from perceived or actual weaknesses, failures or problems in the management of other types of risk. A bank should identify events that could have an impact on market and public perceptions about its soundness, particularly in wholesale markets.

1 See paragraph 6 for definitions of funding liquidity risk and market liquidity risk.

B. Measurement of Liquidity Risk

- 34) Liquidity measurement involves assessing a bank’s cash inflows against its outflows and the liquidity value of its assets to identify the potential for future net funding shortfalls. A bank should be able to measure and forecast its prospective cash flows for assets, liabilities, off-balance sheet commitments and derivatives over a variety of time horizons, under normal conditions and under a range of stress scenarios, including scenarios of severe stress. It should also consider funding needs in currencies in which the bank is active and liquidity needs arising from correspondent banking and settlement activities. Below is an overview of what is expected under the above mentioned risk drivers.

- Future cash flows of assets and liabilities

- 35) A bank should have a robust liquidity risk management framework providing prospective, dynamic cash flow forecasts that include assumptions on the likely behavioral responses of key counterparties to changes in conditions and are carried out at a sufficiently granular level. A bank should make realistic assumptions about its future liquidity needs for both the short- and long-term that reflect the complexities of its underlying businesses, products and markets. The Central Bank reporting format attached to this manual can provide a good starting point.

- 36) A bank should analyze the quality of assets that could be used as collateral, in order to assess their potential for providing secured funding in stressed conditions. A bank should also manage the timing of incoming flows in relation to known outgoing sources in order to obtain an appropriate maturity distribution for its sources and uses of funds.

- 37) In estimating the cash flows arising from its liabilities, a bank should assess the “stickiness” of its funding sources. In particular, for large wholesale funds providers, both secured and unsecured, a bank should assess the likelihood of roll-over of funding lines and how the r fund providers are likely to behave under stress - and therefore consider the possibility that secured and unsecured funding might dry up in times of stress. For secured funding with overnight maturity, a bank should not assume that the funding will automatically roll over. In addition, a bank should assess the availability of term funding back up facilities and the circumstances under which they can be utilized. In assessing the ‘stickiness’ of retail deposits a bank should also consider factors such as size, interest-rate sensitivity, geographical location of depositors and the deposit channel (e.g. short term high interest rate promotion).

- 38) Regarding the time horizons over which to identify measure, monitor and control liquidity risk, a bank should ensure that its liquidity risk management practices integrate and consider a variety of factors. These include vulnerabilities to changes in liquidity needs and funding capacity on an intraday basis; day-to-day liquidity needs and funding capacity over short and medium-term horizons up to one year; longer-term liquidity needs over one year; and vulnerabilities to events, activities and strategies that can put a significant strain on internal cash generation capability.

- Sources of contingent liquidity demand

- 39) A bank should identify measure, monitor and control potential cash flows relating to off-balance sheet commitments and other contingent liabilities. This should include a robust framework for projecting the potential consequences of undrawn commitments being drawn, considering the nature of the commitment and credit worthiness of the counterparty, as well as exposures to business and geographical sectors, as counterparties in the same sectors may be affected by stress at the same time.

- 40) For banks engaged in securitization activities, they should monitor the existence of recourse provisions in asset sales, the extension of liquidity facilities to securitization vehicles and the early amortization triggers of certain asset securitization transactions. Banks should also consider the nature and size of the bank’s potential non-contractual “obligations”, where the support provided to securitization and conduit programmes is critical to maintaining ongoing access to funding and the bank reputation in the market.

- 41) A bank should incorporate cash flows related to the re-pricing, exercise or maturity of financial derivatives contracts in its liquidity risk analysis, including the potential for counterparties to demand additional collateral in an event such as a decline in the bank’s credit rating or creditworthiness or a decline in the price of the underlying asset.

- Guarantees and commitments

- 42) Undrawn loan commitments, letters of credit and financial guarantees represent a potentially significant drain of funds for a bank. A bank may be able to ascertain a "normal" level of cash outflows under routine conditions, and then estimate the scope for an increase in these flows during periods of stress. For example, an episode of financial market stress may trigger a substantial increase in the amount of draw-downs of letters of credit provided by the bank to its customers. Similarly, liquidity issues can arise when a bank relies on committed lines of credit provided by others.

- Currencies in which a bank is active

- 43) A bank should assess its aggregate foreign currency liquidity needs and determine acceptable currency mismatches. A bank should undertake a separate analysis of its strategy for each currency in which it has significant activity, considering potential constraints in times of stress. The size of foreign currency mismatches should take into account: (a) the bank’s ability to raise funds in foreign currency markets; (b) the likely extent of foreign currency back-up facilities available in its domestic market; (c) the ability to transfer a liquidity surplus from one currency to another, and across jurisdictions and legal entities; and (d) the likely convertibility of currencies in which the bank is active, including the potential for impairment or complete closure of foreign exchange swap markets for particular currency pairs.

- 44) A bank should be aware of, and have the capacity to manage, liquidity risk exposures arising from the use of foreign currency deposits and short-term credit lines to fund domestic currency assets as well as the funding of foreign currency assets with domestic currency. A bank should take account of the risks of sudden changes in foreign exchange rates or market liquidity, or both, which could sharply widen liquidity mismatches and alter the effectiveness of foreign exchange hedges and hedging strategies.

- Correspondent, custody and settlement activities

- 45) Where relevant, a bank should understand and have the capacity to manage correspondent, custodian and settlement bank services and how they can affect its cash flows. Given that the gross value of customers’ payment traffic (inflows and outflows) can be very large, unexpected changes in these flows can result in large net deposits, withdrawals or line-of credit draw-downs that impact the overall liquidity position of the correspondent or custodian bank, both on an intraday and overnight basis. A bank also should understand and have the capacity to manage the potential liquidity needs it would face as a result of the failure-to-settle procedures of payment and settlement systems in which it is a direct participant.

C. Measurement Tools

- 46) A bank should employ a range of customized internal measurement tools, or metrics, as there is no single metric that can comprehensively quantify liquidity risk. To obtain a forward looking view of liquidity risk exposures, a bank should use metrics that assess the structure of the balance sheet (e.g. by source and tenor of funding and liquid assets composition) as well as metrics that project cash flows and future liquidity positions, taking into account off-balance sheet risks (liquidity gap reports). These metrics should span vulnerabilities across business-as-usual and stressed conditions over various time horizons.

- 47) Under business-as usual conditions, the report should identify needs that may arise from projected outflows relative to routine sources of funding. Under stress conditions, the reports should be able to identify funding gaps at various horizons, and in turn serve as a basis for liquidity risk limits and early warning indicators.

- 48) The scenarios for the reports can be based on assumptions of the future behavior of assets, liabilities and off-balance sheet items, and then used to calculate the cumulative net excess or shortfall over the time frame for the liquidity assessment. Measurement should be performed over incremental time periods to identify projected and contingent flows taking into account the underlying assumptions associated with potential changes in cash flows of assets and liabilities.

- 49) Management should tailor the measurement and analysis of liquidity risk to the bank’s business mix, complexity and risk profile.

- 50) A bank should take steps to ensure that its assumptions are reasonable and appropriate, documented and periodically reviewed and approved. They should also be updated in-line with changes observed in the market.

D. Monitoring System

- 51) A bank should have a reliable management information system designed to provide the board of directors, senior management and other appropriate personnel with timely and forward-looking information on the liquidity position of the bank.

- 52) The management information system should have the ability to calculate liquidity positions in all of the currencies in which the bank conducts business – both on a subsidiary/branch basis in all jurisdictions in which the bank is active and on an aggregate group basis. It should capture all sources of liquidity risk, including contingent risks and the related triggers and those arising from new activities, and have the ability to deliver more granular and time sensitive information during stress events.

- 53) To effectively manage and monitor its net funding requirements, a bank should have the ability to calculate liquidity positions on an intraday basis, on a day-to-day basis for the shorter time horizons, and over a series of more distant time periods thereafter. The management information system should be used in day-to-day liquidity risk management to monitor compliance with the bank’s established policies, procedures and limits.

- 54) To facilitate liquidity risk monitoring, senior management should agree on a set of reporting criteria, specifying the scope, manner and frequency of reporting for various recipients (such as the board, senior management, and asset – liability committee) and the parties responsible for preparing the reports.

- 55) Reporting of risk measures should be done on a frequent basis (e.g. daily reporting for those responsible for managing liquidity risk, and at each board meeting during normal times, with reporting increasing in times of stress) and should compare current liquidity exposures to established limits to identify any emerging pressures and limit breaches.

- A bank must establish a forward-looking funding strategy that provides effective diversification in the sources and tenor of funding.

- 56) A bank should diversify available funding sources in the short-, medium- and long term. Diversification targets should be part of the medium- to long-term funding plans and is aligned with the budgeting and business planning process.

- 57) Funding plans should take into account correlations between sources of funds and market conditions. The desired diversification should also include limits by counterparty, secured versus unsecured market funding, instrument type, tenor, securitization vehicle, currency, and geographic market. As a general liquidity management practice, banks should limit concentration in any one particular funding source or tenor.

- 58) For institutions active in multiple currencies, access to diverse sources of liquidity in each currency is required, since banks are not always able to swap liquidity easily from one currency to another.

- 59) Senior management should be aware of the composition, characteristics and diversification of the bank’s assets and funding sources. Senior management should regularly review the funding strategy in light of any changes in the internal or external environments.

- 60) An essential component of ensuring funding diversity is maintaining market access. Market access is critical for effective liquidity risk management, as it affects both the ability to raise new funds and to liquidate assets. Senior management should ensure that market access is being actively managed, monitored and tested by the appropriate staff.

- 61) Managing market access can include developing markets for asset sales or strengthening arrangements under which a bank can borrow on a secured or unsecured basis. A bank should maintain an active presence within markets relevant to its funding strategy. This requires an ongoing commitment and investment in adequate and appropriate infrastructures, processes and information collection.

- 62) A bank should not assume it can access markets in a timely manner for which it has not established the necessary systems or documentation, or where these arrangements have not been periodically utilized or the bank has not confirmed that willing counterparties are in place.

- 63) A bank should have full knowledge of the legal framework governing potential asset sales, and ensure that documentation is reliable and legally robust.

- 64) A bank should identify and build strong relationships with current and potential investors. The frequency of contact and the frequency of use of a funding source are two possible indicators of the strength of a funding relationship. A bank should also establish and maintain a relationship with the Central Bank.

- 65) A bank needs to identify alternative sources of funding that strengthen its capacity to withstand a variety of severe yet plausible institution-specific and market-wide liquidity shocks. Depending on the nature, severity and duration of the liquidity shock, potential sources of funding include the following:

- • Deposit growth.

- • The lengthening of maturities of liabilities.

- • New issues of short- and long-term debt instruments.

- • Intra-group fund transfers, new capital issues, the sale of subsidiaries or lines of business.

- • Asset securitization.

- • The sale or repo of unencumbered, highly liquid assets.

- • Drawing-down committed facilities.

- • Borrowing from the central bank’s marginal lending facilities.

- A Bank must establish a liquidity risk management framework including limits, warning indicators, communication and escalation procedures.

Setting up Limits

- 66) A bank should set limits to control its liquidity risk exposure and vulnerabilities. A bank should regularly review such limits and corresponding escalation procedures. Limits should be relevant to the business in terms of its location, complexity, and nature of products, currencies and markets served.

- 67) Limits should be used for managing day-to-day liquidity within and across lines of business and legal entities under “normal” conditions. The limit framework should also include measures aimed at ensuring that the bank can continue to operate in a period of market stress, bank-specific stress and a combination of the two.

- 68) For example a commonly used simple limit is the size of cumulative net cash outflow (based on board approved assumptions) and covers various time horizons. The limit may also include estimates of outflows resulting from the drawdown of commitments or other obligations of the bank.

Early Warning Indicators

- 69) A bank should design a set of indicators to aid this process to identify the emergence of increased risk or vulnerabilities in its liquidity risk position or potential funding needs. Such early warning indicators should identify any negative trend and cause an assessment and potential response by management in order to mitigate the bank’s exposure to the emerging risk.

- 70) Early warning indicators can be qualitative or quantitative in nature and may include but are not limited to:

- • Rapid asset growth, especially when funded with potentially volatile liabilities.

- • Growing concentrations in assets or liabilities.

- • Increases in currency mismatches.

- • A decrease of weighted average maturity of liabilities.

- • Repeated incidents of positions approaching or breaching internal or regulator limits.

- • Negative trends or heightened risk associated with a particular product line, such as rising delinquencies.

- • Significant deterioration in the bank’s earnings, asset quality, and financial condition.

- • Negative publicity.

- • A credit rating downgrade.

- • Stock price declines or rising debt costs.

- • Widening debt or credit-default-swap spreads.

- • Rising wholesale or retail funding costs.

- • Counterparties that begin requesting or request additional collateral for credit.

- • Correspondent banks that eliminate or decrease their credit lines.

- • Increasing retail deposit outflows.

- • Increasing redemptions of CDs before maturity.

- • Difficulty accessing longer-term funding.

- 71) Early warning indicators should be closely monitored by senior management on a regular basis. Limits and analysis of the indicators above should be reviewed and breaches/emerging trends should be escalated up to the board committees or the full board if significant enough.

- 72) Clear procedures and escalation criteria should be put in place based on the warning indicators; these include the circumstances where the Contingency Funding Plan (CFP) should be invoked.

- A bank must conduct its own internal stress tests on a regular basis for a variety of institution specific and market wide stress scenarios (individually and in combination). The scenarios should be based on the individual bank specific circumstances and business model.

- 73) While a bank typically manages liquidity under “normal” circumstances, it should also be prepared to manage liquidity under stressed conditions. A bank should perform stress tests or scenario analyses on a regular basis in order to identify and quantify its exposures to possible future liquidity stresses, analyzing possible impacts on the institution’s cash flows, liquidity position, profitability and solvency.

- Stress testing process

- 74) Tests should be :

- • Test should be done on individual entity basis, group basis and business lines.

- • Tests should consider the implication of the scenarios across different time horizons, including on an intraday basis.

- • The extent and frequency of testing should be commensurate with the size of the bank and its liquidity risk exposures.

- • Banks should build in the capability to increase the frequency of tests in special circumstances, such as in volatile market conditions or at the request of the Central Bank.

- • Senior management should be actively involved in the stress test demanding rigorous assumptions and challenging the results.

- • The board should be informed of the stress testing results and should be able to challenge outcomes, assumptions and actions taken on the basis of the tests.

Scenarios and Assumptions

- 75) Banks should take into account the nature of the bank’s business, activities and vulnerabilities in designing stress scenarios. The scenarios should incorporate the major funding and market liquidity risks to which the bank is exposed. These include risks associated with its business activities, products (including complex financial instruments and off-balance sheet items) and funding sources. The defined scenarios should allow the bank to evaluate the potential adverse impact these factors can have on its liquidity position. Regardless of how strong its current liquidity situation appears to be, a bank should consider the potential impact of severe stress scenarios.

- 76) Historical data and past experiences in addition to sound judgment should be used in the scenarios. A bank should consider short-term and long term stresses as well as institution-specific and market-wide scenarios and a combination of both in the stress tests scenarios. The stress test scenarios should consider the following:

- • A simultaneous drying up of market liquidity in several previously highly liquid markets (inter-bank money markets, non UAE funding markets, securitization).

- • Severe constraints in accessing secured and unsecured wholesale funding;

- • The run-off of retail funding

- • Contingent claims and more specifically, potential draws on committed lines extended to third parties or the bank's subsidiaries, branches or head office and the liquidity absorbed by off-balance activities.

- • Severe operational or settlement disruptions affecting one or more payment or settlement systems.

- • Take into account the link between reductions in market liquidity and constraints on funding liquidity. This is particularly important for banks with significant market share in, or heavy reliance upon, specific funding markets.

- • A bank should also consider the results of stress tests performed for various other risk types and consider possible interactions between liquidity risk and these other types of risk (e.g. capital stress tests).

- • Tests should reflect accurate time-frames for the settlement cycles of assets that might be liquidated (i.e. time to receive the sale proceeds).

- • If a bank relies upon liquidity outflows from one system to meet obligations in another, it should consider the risk that operational or settlement disruptions might prevent or delay expected flows across systems. This is particularly relevant for firms relying upon intra-group transfers or centralized liquidity management.

- • Additional margin calls and collateral requirements.

- • The availability of contingent lines extended to the bank.

- • The impact of credit rating triggers.

- • The access to Central Bank facilities.

- • The potential reputational impact when executing contingency /remedial action.

- • Estimates of future balance sheet growth.

- • A bank should consider the likely behavioral response of other market participants (similar response to market stress might amplify market strain).

- • A bank should consider the likely impact of its own behavior on other market participants.

- • Where a bank uses a correspondent or custodian to conduct settlement, the analysis should include the impact of those agents restricting their provision of intraday credit.

- The scenario design should be subject to regular reviews to ensure that the nature and severity of the tested scenarios remain appropriate and relevant to the bank.

Utilization of Results

- 77) Senior management should review stress test scenarios and assumptions as well as the results of the stress tests. The bank’s choice of scenarios and related assumptions should be well documented and reviewed together with the stress test results. Stress test results and vulnerabilities and any resulting actions should be reported to and discussed with the board and the Central Bank.

- 78) Senior management should integrate the results of the stress testing process into the bank’s strategic planning process (e.g. bank management could adjust its asset-liability composition) and the firm's day-to-day risk management practices (e.g. through monitoring sensitive cash flows or reducing concentration limits). The results of the stress tests should be explicitly considered in the setting of internal limits.

- 79) Senior management should decide how to incorporate the results of stress tests in assessing and planning for related potential funding shortfalls in the institution's contingency funding plan. To the extent that projected funding deficits are larger than (or projected funding surpluses are smaller than) implied by the bank’s liquidity risk tolerance, management should consider whether to adjust its liquidity position or to bolster the bank’s contingency plan in consultation with the board.

- A bank must have a formal contingency funding plan (CFP) that clearly sets out the strategies for addressing liquidity shortfalls in emergency situations.

- 80) A bank should put in place plans for responding to severe disruptions to its ability to fund some or all of its activities in a timely manner and at a reasonable cost.

CFPs should have the following characteristics.- • Be commensurate with a bank’s complexity, risk profile, scope of operations and role in the financial systems in which the bank operates.

- • Include a clear description of a diversified set of contingency measures for preserving liquidity and making up cash flow shortfalls in various adverse situations.

- • CFP should articulate available potential contingency funding sources and the amount of funds a bank estimates can be derived from these sources; clear escalation/prioritization procedures detailing when and how each of the actions can and should be activated; and the lead time needed to tap additional funds from each of the contingency sources.

- • The CFP's design, plans and procedures should be closely integrated with the firm’s ongoing analysis of liquidity risk and with the results of the scenarios and assumptions used in stress tests (requirement 9).

- • CFPs should prepare the bank to manage a range of scenarios of severe liquidity stress that include both firm-specific and more generalized market-wide stress, as well as the potential interaction between them.

- • The plan should include a diversified menu of options in order for management to have an overview of the potentially available contingency measures. Banks should also examine the time periods for which measures can be carried out under various assumptions and stresses.

- • CFPs should contain clear specification of roles and responsibilities, including the authority to invoke the CFP.

- • The establishment of a formal "crisis team" should facilitate internal coordination and decision-making during a liquidity crisis; names and contact details of members of the team responsible for implementing the CFP and the locations of team members; and the designation of alternates for key roles should also be clearly stated.

- • To facilitate the timely response needed to manage disruptions, the plan should set out a clear decision-making process on what actions to take at what time, who can take them, and what issues need to be escalated to more senior levels in the bank.

- • The plan should explicitly set out the procedures to deliver effective internal coordination and communication across the bank’s different business lines and locations. It should also address when and how to contact external parties, the Central Bank, stakeholders, market participants, and the media.

- • A bank’s CFP (as well as the bank's day-to-day liquidity risk management) should reflect Central Bank lending programmes and collateral requirements.

- • The plan should be reviewed and tested regularly to ensure their effectiveness and operational feasibility timely action should be taken by management to remedy any issue identified. Key aspects of this testing include:

- ▪ ensuring that roles and responsibilities are appropriate and understood,

- ▪ confirming that contact information is up to date,

- ▪ proving the transferability of cash and collateral,

- ▪ reviewing that the necessary legal and operational documentation is in place to execute the plan at short notice,

- ▪ The ability to sell or repo certain assets or periodically draw down credit lines.

- • Senior management should review and update the CFP at least every year for the board’s approval, or more often as business or market circumstances change.

- • The CFP should be consistent with the bank’s business continuity plans and should be operational under situations where business continuity arrangements have been invoked.

- A Bank must maintain a cushion of unencumbered, high quality liquid assets to be held as insurance against a range of liquidity stress scenarios.

- 81) Although the predefined stress test in the LCR will result in a regulatory liquid asset requirement to be held by the bank to cover the stressed outflows, the bank should assess the need for holding liquid assets that can be sold or pledged to obtain funds in a range of stress scenarios beyond the regulatory minimum established by the LCR.

- 82) The internal stress testing referred to in requirement 9 above should be used to determine the size and composition of the liquid asset pool required to maintain sufficient resilience to unexpected stress while the bank continues to meet its daily payment and settlement obligations on a timely basis for the duration of the stress.

- 83) The liquidity cushion should include cash and high quality government bonds or similar instruments, to guard against the most severe stress scenarios. For insuring against less intense, but longer duration stress events, a bank may choose to widen the composition of the cushion to hold other unencumbered liquid assets which are marketable.

- 84) A bank should be realistic about how much cash it will be able to obtain from the Central Bank against eligible assets. Moreover, a bank should not rely on the Central Bank altering the amount of or the terms on which it provides liquidity.

- Banks are required to develop a transfer-pricing framework to reflect the actual cost of funding.

- 85) Senior management should appropriately incorporate liquidity costs, benefits and risks in the internal pricing and performance measurement for all significant business activities (both on- and off-balance sheet). The sophistication of the transfer pricing framework should be in line with the bank level of sophistication and business complexity.

- 86) These costs, benefits and risks should then be explicitly attributed to the relevant activity so that line management incentives are consistent with and reinforce the overarching liquidity risk tolerance and strategy of the bank, with a liquidity charge assigned as appropriate to positions, portfolios, or individual transactions.

- 87) This assignment of liquidity costs, benefits and risks should incorporate factors related to the anticipated holding periods of assets and liabilities, their market liquidity risk characteristics, and any other relevant factors, including the benefits from having access to relatively stable sources of funding, such as some types of retail deposits.

- 88) The quantification and attribution of these risks should be explicit and transparent at the line management level and should include consideration of how liquidity would be affected under stressed conditions.

- 89) The analytical framework should be reviewed as appropriate to reflect changing business and financial market conditions and so maintain the appropriate alignment of incentives.

Part Two: Quantitative Requirements

A. Eligible Liquid Assets Ratio (ELAR)

This is a ratio all banks must comply with. Eligibility is limited as follows:

- a. Account balances at the Central Bank

- b. Physical cash at the bank

- c. Central Bank CDs

- d. UAE Federal Government bonds and sukuks

- e. Reserve requirements

- f. UAE local government and PSE’s publicly traded debt securities that are assigned 0% credit risk weighting under Basel II Standardized approach (limited to a maximum of 20% of eligible liquid assets)

- g. Foreign, Sovereign debt instruments or instruments issued by their central banks, also multilateral development banks all of which receive 0% credit risk weighting under Basel II Standardized approach (limited to a maximum of 15% of eligible liquid assets)

Banks must hold an amount equivalent to at least 10% (or some other percentage as set by the Central Bank) of their total on balance sheet liabilities at all times in the above assets. This ratio will be subject to upward revisions from time to time either as a result of Central Bank policy or as a result of a recalibration exercise when assessing the impact of the LCR.

B. Advances to Stable Resources Ratio (ASRR)

This measure detailed in the current Central Bank reporting (BRF7) continues to be in effect until an individual bank is permitted to apply the NSFR under the Basel III rules.

The NSFR will come into effect on 1 January 2018.In the meantime all banks must comply with the ASRR.

C. Liquidity Coverage Ratio (LCR)

- 90) The LCR ratio comes directly from the BCBS recommendations mentioned at the beginning of this manual. It is therefore recommended that banks familiarize themselves with the BCBS final recommendations on liquidity titled “Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools' issued January 2013. This guidance manual concentrates on the more common factors that affect the liquidity of banks in the UAE. There will undoubtedly be some specific issues that will affect individual banks but are not detailed in this manual. The manual also attempts to simplify some of these factors for the sake of brevity as well as exercise national discretion where warranted and the possibility for such discretion exists. In the event that any confusion is created as a result then the BCBS document referred to above takes precedence.

- 91) LCR is a coverage ratio of liquid assets to net cash outflows. It represents a 30 days stress scenario with combined assumptions covering both bank specific and market wide stresses. Therefore, the LCR aims to promote short-term resilience of a bank’s liquidity risk profile by ensuring that it has sufficient high-quality liquid assets to survive a significant stress scenario lasting for one month.

- 92) The LCR assumptions are applied to contractual data representing the main liquidity risk drivers (liabilities and contingent liabilities) at banks to determine the total cash outflows within the 30 days stress period.

- 93) Total cash inflow is also calculated based on assumptions applied to contractual inflows during the 30 day period. The total cash outflow is then reduced by the total cash inflow to arrive at the net cash outflow in 30 days. A cap on the amount of inflows that can be used to offset outflows is set at 75% of the outflows2.

- Total net cash outflows over the next 30 calendar days = Outflows – Inflows (restricted to 75% of outflows)

- 94) Banks should always be able to cover the net cash outflow with high quality liquid assets at the minimum LCR determined by the Central Bank.

2 The 75% max reduction limit is to ensure that the banks always have a net cash outflow of at least 25% which they are required to hold liquid assets against.

Current LCR and Expected Glide Path

- 95) Compliance with the LCR will be on a glide path basis. This starts in January 2016 with a compliance level of 70% and banks are expected to be at the minimum compliance level of 100% by January 2019. The table below sets out the timetable for compliance:

Table 1 Glide Path

1 January 2016 1 January 2017 1 January 2018 1 January 2019 Minimum LCR 70% 80% 90% 100% The Central Bank will set up a liquidity task force to ensure a smooth implementation of the LCR by its implementation date. Banks wishing to move to the Basel III liquidity framework must apply in writing to the Central Bank for approval to do so. Prior to approval, banks will be required to provide the Central Bank with suitable validation of adequate governance, systems and controls in place to demonstrate the bank’s ability to comply with the requirements of the Basel III liquidity framework in full.

The Central Bank task force team will engage closely with these banks as part of the on–boarding process. Banks must provide the Central Bank team with a “road map” setting out clear milestones explaining how the bank will meet the LCR and the NSFR by their respective due dates. The team will then assess the plan and provide guidance. The team will also monitor the progress of the bank against its internally set milestones.

High Quality Liquid Assets

- 96) High quality liquid assets are strictly defined in the LCR to ensure that these assets remain liquid3 under severe stress scenarios both firm specific and market wide. It is worth mentioning that the asset that is usually liquid under normal conditions might not be liquid under a severe stress scenario. Therefore, these assets must fulfill certain pre-defined criteria before they can be considered eligible, they must be:

- • traded in large, deep and active repo or cash markets characterized by a low level of concentration;

- • have a proven record as a reliable source of liquidity in the markets (repo or sale) even during stressed market conditions. Level 2A and 2B must meet a predefined test that the maximum decline of price must not exceed volatility targets over a 30 day period during a relevant period of significant liquidity stress;

- • not an obligation of a financial institution or any of its affiliated entities

- 97) High quality liquid assets are separated into two categories, Level 1 and Level 2 liquid assets. Level 1 liquid assets must only be those assigned a 0% risk weight under Basel II Standardized Approach for credit risk and are allowed with no haircuts and no cap applied to them. These assets are:

- • Cash at Central Bank and physical cash at the bank.

- • Reserves and account balances held at the Central Bank

- • Central Bank CDs and all debt issued or explicitly guaranteed by UAE Federal Government or Local Governments.

- • Debt issued by multilateral development banks and the IMF.

- • Foreign Sovereign or Central Bank debt or guaranteed debt receiving 0% Risk Weight under Basel II standardized approach.

- • UAE Public Sector Entities’ (PSE or GRE) debt securities which receive 0% Risk Weight under Basel II Standardized approach

- Those assets that are 0% risk weighted and unrated are unlikely to have the same depth of market as those that are rated above investment grade in a stress scenario. Banks must take this into account when assessing an asset’s suitability and a liquidity premium charged. In any case, 0% risk weighted assets that are not rated cannot exceed 25% of the total Level 1 HQLA.

- 98) Level 2 liquid assets (comprising Level 2A and Level2B) are also classified as highly liquid assets. However, the realizable market value under a liquidity stress might be lower than the normal market value. Level 2 assets are allowed up to 40% in total of high quality liquid assets. The following assets, after being reduced by the corresponding haircuts, are eligible as Level 2A liquid assets (‘Corporate’ in this sense may include Sovereign securities).

Table 2 Level 2 A Liquid Assests

Level 2B assets (subject to a 15% ceiling of the total) consist of residential mortgage backed securities, lower rated debt securities and common equity shares. The qualifying tests for these types of assets are to be strictly applied as per the Basel rules and it is unlikely that many domestic assets will qualify, if any. (‘Corporate’ in this sense may include Sovereign securities).

Table 3 Level 2B Liquid Assets

Level 2 B liquid assets Value Residential Mortgage Backed Securities (RMBS) 75% Corporate bonds holding a rating of between A+ and BBB-. 50% Common equity shares (strict qualifying conditions) 50% - 99) Only unencumbered liquid assets that meet the above criteria are eligible for the LCR.

- 100) Banks should endeavor to hold eligible liquid assets in the currencies that match the currencies of the net cash outflow.

- 101) Liquid asset portfolio should be well diversified in terms of counterparties and tenor and held for the sole purpose of managing liquidity risk.

- The Central Bank recognizes that given the nascent debt markets that exist in the UAE, the qualitative requirements placed by Basel around the robustness of markets that underpins the liquidity and pricing of these assets may require a less strict interpretation – except in the case of Level 2 B assets. However, banks must be able to demonstrate to the Central Bank that assets held in the LCR are liquid.

- Unrated UAE domiciled GRE or PSE issuers that do not receive a 0% risk weighting can be included in Level 2A liquid assets with a 30% haircut, for the time being at least.

- Given that the UAE Dirham is pegged to the US Dollar, for the sake of flexibility US$/AED currency mismatches can be offset. It should be noted though that Basel III requires that liquid assets be held in the currency of the net outflow, including both the US$ and AED individually, and banks are expected to comply where possible. However, net outflows in other GCC currencies pegged to the US$ that exceed 15% of the total LCR net outflows must be matched. Other pegged and free floating currencies must be matched if they exceed 10% of total net LCR outflows.

- Where no suitable HQLA exists in the currency of the net outflow O/N placements, in that currency, with either the relevant Central Bank or a bank rated at A or better will suffice.

3 Liquidity is the ability to convert the asset immediately into cash at little or no loss in market value under a liquidity stress.

- 96) High quality liquid assets are strictly defined in the LCR to ensure that these assets remain liquid3 under severe stress scenarios both firm specific and market wide. It is worth mentioning that the asset that is usually liquid under normal conditions might not be liquid under a severe stress scenario. Therefore, these assets must fulfill certain pre-defined criteria before they can be considered eligible, they must be:

Cash Outflows

- 102) Cash outflows are calculated by assigned run off assumptions against various liabilities both on and off balance sheet.

- Liabilities maturing outside the 30 days stress period - 0% run off

- 103) All liabilities that have a contractual maturity over 30 days and where the bank is not contractually obliged to pay the customer before the maturity date receive 0% run off.

- 104) Where the bank has guaranteed payment to the customer prior to maturity upon request, the liability is treated as being contractually due immediately and is subject to the applicable run off assumptions listed below.

Retail Deposits4

- 105) Retail deposits include both term deposits (maturity over 1 day) and current/savings/at call deposits which banks are under contractual obligation to pay immediately.

- 106) Retail deposits are separated into stable and less stable deposits.

Stable retail deposits receives 5% run off & less stable receives 10% run off - 107) Current retail deposits are considered stable if:

- ▪ They are resident deposits and,

- ▪ A relationship with the customer has been well established, for example the customer has been dealing with the bank for over 1 year; or

- ▪ The customer uses the account for transactions such as salary being deposited in the account, paying bills and standing orders.

- 108) Retail term deposits which are maturing within the 30 day period are classified as stable if:

- ▪ They are resident deposits and,

- ▪ A relationship with the customer has been well established, for example the term deposit has a history of being rolled over at maturity with the bank or the relationship has been established for over 1 year with the customer.

- 109) No more than 60% of retail deposits maturing within 30 days can be classified as stable. This cap will only be applicable during the transition period until 1 January 2019 after which all banks are expected to be in a position to comply with the Basel III requirements in full.

- 110) All other retail deposits that do not meet the criteria for classification as “stable” are considered less stable retail deposit and receive 10% run off factor against them.

- 111) Deposits from small and medium size entities (SMEs)5 can be treated as retail deposits (and sections (107) to 110) apply to them), if their deposit amount is less than AED 206 Million.

- Unsecured deposits from non-financial corporates – 40% run off for Non-operational & 25% run off for operational.