كتاب روابط اجتياز لـ B. General Design of the Capital Requirement

B. General Design of the Capital Requirement

C 52/2017 GUI يسري تنفيذه من تاريخ 1/4/20216.At a high level, the framework is designed such that the risk-weight for a bank’s equity investment in a fund depends on the average risk weight that would be applicable to the assets of the fund, and on the extent of use of leverage by the fund. The approach to the average risk weight for any fund will reflect one or more of the three approaches described briefly above (and described more fully in the Standards).

7.The illustration below gives a general overview of how the average risk weight and leverage are combined, subject to a cap of 1250%, and then applied to the bank’s equity investment in the funds.

8.For example, if the average risk weight of the assets held by the fund is 80%, and the fund is financed through half debt and half equity, then the ratio of assets to equity would be 2.0 and the risk weight applied to a bank’s investment in the fund would be:

80% x 2.0 = 160%

If instead the same fund is financed 90% by debt, then the ratio of assets to equity would be 10, and the risk weight applied to the bank’s investment in the fund would be 800% (80% x 10).

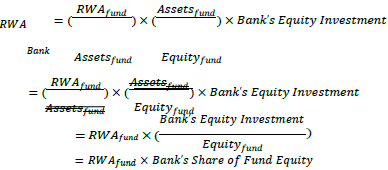

9.Another way to view the capital requirement for equity investments in funds is that a bank generally must count a proportional amount of the risk-weighted assets (RWA) of the fund as the bank’s own RWA for capital purposes, in proportion to the bank’s share of the equity of the fund. Ignoring the 1250% limit for simplicity, the RWA calculation can be written as:

The rearrangement of the terms in the equation highlights that the bank’s RWA from the EIF is the bank’s proportional share of the fund’s RWA – if the bank holds a 5% share of the equity in the fund, then the bank’s RWA is 5% of the total RWA of the fund. This is a logical treatment – if a bank effectively owns 5% of a fund, the bank must hold capital as if it owns 5% of the fund’s risk-weighted assets.