كتاب روابط اجتياز لـ 4.3.2.4. Legal Arrangements - Common Situations

4.3.2.4. Legal Arrangements - Common Situations

يسري تنفيذه من تاريخ 7/6/2021Legal arrangements may not present the layered ownership structures seen in legal persons. This does not mean, however, that identifying the beneficial owners of legal arrangements is always straightforward. In particular, the very different forms of legal arrangements that may be formed in different jurisdictions can make it difficult to identify the individuals who hold roles analogous to settlor, trustee, and beneficiary. LFIs should always identify the following individuals:

| • | The legal entities or individuals who have the power to control the property of the legal arrangements. These legal entities or individuals are analogous to trustees. If a legal entity (such as a financial institution) acts as trustee, LFIs must identify the beneficial owners of that legal entity. | |||

| • | The legal entities or individuals for whose present or future benefit the trustees are safeguarding the legal arrangement property. These legal entities or individuals are analogous to the beneficiaries. | |||

| o | Beneficiaries may be defined as a class which can change over time (e.g., “all the underage grandchildren of the settlor”). | |||

| o | LFIs should identify the class of beneficiaries, and all beneficiaries currently in existence, at the time of onboarding the customer. During periodic CDD refresh, they should ascertain whether additional identifiable individuals have joined or left the beneficiary class (e.g. a new child has been born, a beneficiary has come of legal age). | |||

| o | If a legal entity is the named beneficiary, LFIs must identify the beneficial owners of that legal entity. | |||

| • | The legal entities or individuals who assigned control of the legal arrangement property to the trustees (or individuals holding a similar position). This individual or legal entity is analogous to the settlor. A settlor may or may not retain underlying legal ownership of the legal arrangement property. If a legal entity acts as settlor, LFIs must identify the beneficial owners of that legal entity. | |||

In addition, where trustees are financial institutions, lawyers or any other professional with secrecy rules in a foreign jurisdiction, it may be difficult to obtain the information LFIs need. LFIs should be aware that if they cannot obtain this information, they should not establish the business relationship or continue an existing relationship.

Legal arrangements may also be part of the ownership structures of other legal persons or arrangements. Because trusts do not have shares or equity, LFIs should treat all participants in a trust or similar legal arrangement as if they own 100% of the legal arrangement.

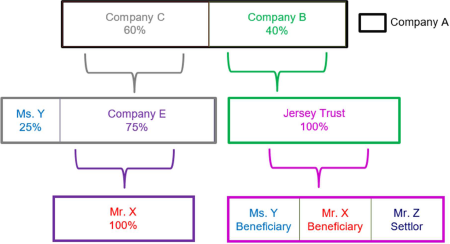

In the example above, Company A is 40% owned by Company B, which is in turn wholly owned by a trust established in the Isle of Jersey. Ms. Y and Mr. X are beneficiaries of the trust and also indirectly own shares of the Company A through Company C. Mr. X has to be identified and verified based solely on his indirect 45% ownership of Company A through Company E. Ms. Y and Mr. Z, must also be identified and verified because they are beneficial owners of a legal arrangement that owns 40% of Company A.