VI. Credit Valuation Adjustment (CVA)

I. Introduction

1.This Standard articulates specific requirements for the calculation of the risk- weighted assets (RWA) for Credit Valuation Adjustment (CVA) risk for banks in the UAE. It is based closely on requirements of the framework for capital adequacy developed by the Basel Committee on Banking Supervision, specifically the Standardized Approach for CVA as articulated in Basel III: A global regulatory framework for more resilient banks and banking systems, December 2010 (rev June 2011), and subsequent clarifications thereto by the Basel Committee.

2.This Standard covers all derivative transactions except those transacted directly with a central counterparty. In addition, it covers all securities financing transactions (SFTs) that are subject to fair-value accounting, unless the Central Bank concludes that the bank's CVA loss exposures arising from fair-valued SFTs are not material. The CVA capital calculation encompasses a bank's CVA portfolio, which includes the bank's entire portfolio of covered transactions as well as eligible CVA hedges.

3.This Standard formulates capital adequacy requirements that needs to be applied to all banks in UAE on a consolidated basis.

II. Definitions

In general, terms in this Standard have the meanings defined in other Regulations and Standards issued by the Central Bank. In addition, for this Standard, the following terms have the meanings defined in this section.

- (a)Credit Default Swap (CDS): A financial swap agreement in which the seller of the CDS agrees to compensate the buyer in the event of a default or other credit event by the reference obligor in exchange for a series of payments during the life of the CDS.

- (b)Contingent CDS: A CDS in which one or more aspects of the payout are contingent on both the occurrence of a credit event and some other event specified in the contract, such as the level of or change in a particular market variable.

- (c)Credit Valuation Adjustment (CVA): Reflects the adjustment of default risk-free prices of derivatives due to a potential default of the counterparty. Regulatory CVA may differ from CVA used for accounting purposes. Unless explicitly specified otherwise, the term CVA in this document means regulatory CVA.

- (d)CVA portfolio: Includes all CVA hedges that meet the eligibility requirements stated in these Standards, as well as all covered transactions.

- (e)CVA Risk: Defined as the risk of losses arising from changing CVA values in response to changes in counterparty credit spreads and market risk factors that drive prices of derivative transactions.

- (f)Derivatives Transactions: Transactions concerning financial contracts that are traded in the Market, their values are dependent on the value of the financial assets underlying such contracts - such as commodities, indexes, currencies or any other financial products considered as such by the Central Bank.

- (g)Qualified Financial Contract: Any financial agreement, contract or transaction, including any terms and conditions incorporated by reference in any such financial agreement, contract or transaction, pursuant to which payment or delivery obligations are due to be performed at a certain time or within a certain period of time and whether or not subject to any condition or contingency excluding securities and commodities or any other agreement, contract or transaction as notified by the Central Bank at any time.

- (h)Securities Financing Transactions (SFTs): Transactions such as repurchase agreements, reverse repurchase agreements, security lending and borrowing, and margin lending transactions, where the value of the transactions depends on market valuations and the transactions are often subject to margin agreements.

III. Requirements

Banks are required to calculate RWA for CVA as a multiple of capital for CVA risk calculated as specified in these Standards. The calculation relies on regulatory measures of counterparty credit risk exposure, and recognizes the impact of differences in maturity, as well as adjustments to reflect certain common hedging activities that banks use to manage CVA risk. The relevant requirements are described in this Standard.

A. Counterparty Exposure for CVA Calculations

4.A bank must use a measure of exposure at default (EAD) for each counterparty to calculate CVA capital for the CVA portfolio. For derivatives exposures, the bank must use the EAD for each counterparty as calculated under the Central Bank's Counterparty Credit Risk Standard (the CCR Standard), including any effects of collateral or offsets per that Standards.

5.For SFTs, the bank must use the measure of counterparty exposure as calculated for the leverage ratio exposure measure. For that measure, the EAD for SFTs is calculated as current exposure without an add-on for potential future exposure, with current exposure calculated as follows:

- (a)Where a qualifying master netting agreement (MNA) is in place, the current exposure (E*) is the greater of zero and the total fair value of securities and cash lent to a counterparty for all transactions included in the qualifying MNA (>Ei), less the total fair value of cash and securities received from the counterparty for those transactions (>Ci). This is illustrated in the following formula:

E* = max {0, [∑Ei − ∑Ci]}

where E* = current exposure,

∑Ei = total fair value of securities and cash lent to counterparty “i” and

∑Ci = total fair value of securities and cash received from “i”.

- (b)Where no qualifying MNA is in place, the current exposure for transactions with a counterparty must be calculated on a transaction-by-transaction basis – that is, each transaction is treated as its own netting set, as shown in the following formula:

E* = max {0, [E − C]}

where E* = current exposure,

E = total fair value of securities and cash lent in the transaction, and

C = total fair value of securities and cash received in the transaction.

- (a)Where a qualifying master netting agreement (MNA) is in place, the current exposure (E*) is the greater of zero and the total fair value of securities and cash lent to a counterparty for all transactions included in the qualifying MNA (>Ei), less the total fair value of cash and securities received from the counterparty for those transactions (>Ci). This is illustrated in the following formula:

B. CVA Hedges

6.To qualify as an eligible CVA hedge for purposes of the CVA capital calculation, hedge transactions must meet the eligibility requirements stated here:

- (a)The hedge instrument must be an index CDS, or a single-name CDS, single-name contingent CDS, or equivalent hedging instrument that directly references the counterparty being hedged; and

- (b)The transaction must be a component of the bank's CVA risk management program, entered into with the intent to mitigate the counterparty credit spread component of CVA risk and managed by the bank in a manner consistent with that intent.

7.Eligible hedges that are included in the CVA calculation as CVA hedges are excluded from a bank's market risk capital calculations. A bank must treat transactions that are not eligible as CVA hedges as they would any other similar instrument for regulatory capital purposes.

C. CVA Capital Calculation

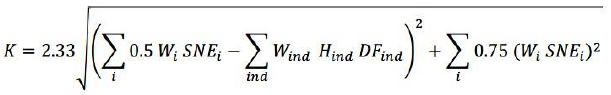

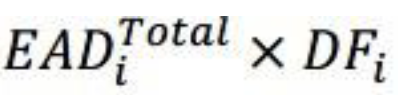

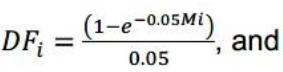

8.The bank must calculate the discounted counterparty exposure for each counterparty by multiplying the total EAD for the counterparty as calculated under these Standards by a supervisory discount factor (DF) for each netting set that reflects notional weighted-average maturity of the counterparty exposures:

where

is the sum of the EADs for all of the exposures to counterparty “i” within the netting set,

Mi is the weighted average maturity for the netting set for counterparty “i”, using notional values for the weighting.

If the bank has more than one netting set with a counterparty, the bank should perform this calculation for each netting set with that counterparty separately, and sum across the netting sets.

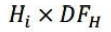

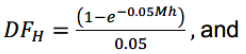

9.For any eligible single-name hedges for the counterparty, the bank computes the discounted value of the hedges, again using a supervisory discount factor that depends on the maturity of the hedge:

where

Hi is the notional value of a purchased eligible single-name hedge referencing counterparty ‘i’ and used to hedge the CVA risk,

Mh is the maturity of that hedge instrument.

If the bank has more than one instrument hedging single-name CVA risk for the counterparty, the bank should sum the discounted values of the individual hedges within each netting set.

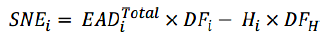

10.For each counterparty, the bank should calculate single-name exposure (SNE) as the discounted counterparty exposure minus the discounted value of eligible single-name CVA hedges. With a single netting set and single hedge instrument, this calculation is:

11.With multiple netting sets for the counterparty (for EAD) or multiple-single name hedge instruments (for H), the corresponding terms in the SNE calculation would be the summations for the given counterparty as required above.

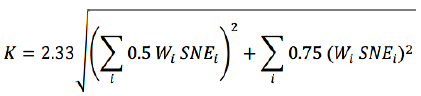

12.If the bank uses single-name hedging only, the bank must use SNE for its counterparties to calculate CVA capital using the following formula:

where Wi is the risk weight applicable to counterparty "i" from Table 1.

13.Each counterparty must be assigned to one of the seven rating categories in Table 1, based on the external credit rating of the counterparty. When a counterparty does not have an external rating, the bank should follow the approach used in the CCR Standard for credit derivatives that reference unrated entities. A bank should map alternative rating scales to the ratings in Table 1 based on an analysis of historical loss experience for each rating grade.

Table 1: Risk Weights for CVA Capital Calculation

Rating Risk Weight AAA 0.7% AA 0.7% A 0.8% BBB 1.0% BB 2.0% B 3.0% CCC 10.0% 14.If the bank also uses index hedges for CVA risk management, the CVA capital calculation is modified to include an additional reduction in systematic risk according to the following formula:

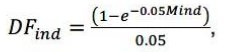

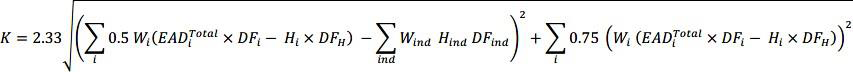

where

Hind is the notional of an eligible index hedge instrument used to hedge CVA risk,

Mind is the maturity of that index hedge, and

other variables are as defined above in this Standard.

The summation is taken across all index hedges. To determine the applicable risk weight for any index hedge, the bank should determine the risk weight from Table 1 that would apply to each component of the index, and use the weighted-average of these risk weights as Wind, with weights based on the notional composition of the index.

15.An alternative version of the full calculation (including index hedges) that gives the same result, but without the intermediate step of calculating SNE, is the following:

16.For any counterparty that is also a constituent of an index referenced by a CDS used for hedging CVA risk, the bank may, with supervisory approval, subtract the notional amount attributable to that single name within the index CDS (as based on its reference entity weight) from the index CDS notional amount (Hind), and treat that amount within the CVA capital calculation as a single-name hedge (Hi) of the individual counterparty with maturity equal to the maturity of the index.

D. Risk-Weighted Assets

17.A bank must determine the RWA for CVA by multiplying K as calculated above by the factor 12.5:

E. Simple Alternative Approach

18.Any bank with aggregate notional amount of covered transactions less than or equal to AED 400 billion may choose to set the bank's CVA RWA equal to its RWA for counterparty credit risk as computed under the CCR Standard. If the bank chooses this approach, it must be applied to all of the bank's covered transactions. In addition, a bank adopting this simple approach may not recognize the risk-reducing effects of CVA hedges. A bank meeting the requirements for using the Simple Alternative may choose to use either the Simple Alternative or the general CVA requirements, and may change that choice at any time with the approval of the Central Bank.

IV. Review Requirements

19.Bank calculations for CVA risk under these Standard and associated bank processes must be subject to appropriate levels of independent review and challenge. Reviews must cover material aspects of the calculations under these Standards, including but not limited to determination of eligible hedges, determination of maturities and amounts, mapping of counterparties to risk weights based on credit rating, and the CVA capital calculation.

V. Shari’ah Implementation

20.Banks offering Islamic financial services that use Shari’ah Compliant alternatives to derivatives and Securities financing transactions (SFTs) approved by their internal Shari’ah control committees should calculate the risk weighted asset (RWA) for Credit Valuation Adjustment (CVA) of these Shari’ah compliant alternatives in accordance with provisions set out in this standard/guidance and in the manner acceptable by Shari’ah. This is applicable until relevant standards and/or guidance in respect of these transactions are issued specifically for banks offering Islamic financial services