I. Tier Capital Supply

Introduction

This guidance explains how banks can comply with the Tier Capital Supply Standard. It must be read in conjunction with the Capital Regulation and Standards for Capital Adequacy of Banks in the UAE. Guidance regarding Minimum Capital Requirement and Capital buffer as stated in the document have to be followed by all banks for the purpose of regulatory compliance.

1.To help and ensure a consistent and transparent implementation of Capital supply standards, Central Bank will review and update this guidance document periodically.

2.The guidance document has structured into six main sections

- 1. Scope of Application

- 2. Eligible capital

- 3. Regulatory adjustments

- 4. Threshold deductions

- 5. Significant investment in commercial entities

- 6. Frequently Asked Questions

1. Scope of Application

3.“Financial activities” do not include insurance activities and “financial entities” do not include insurance entities.

4.Examples of the types of activities that financial entities might be involved in include financial leasing, issuing credit cards, portfolio management, investment advisory, custodial and safekeeping services and other similar activities that are ancillary to the business of banking

Treatment of investment in Insurance Entities

5.Insurance subsidiaries are to be deconsolidated for regulatory capital purposes (i.e. all equity, assets, liabilities and third-party capital investments in such insurance entities are to be removed from the bank’s balance sheet) and the book value of the investment in the subsidiary is to be included in the aggregate investments.

6.Investments in the capital of insurance entities where the bank owns more than 10% of the insurance entity’s common share capital will be subject to the “Threshold deductions” treatment. Amounts below the threshold that are not deducted are to be risk weighted at 250 %.

(Investments in insurance entities wherein ownership is greater than 10% will also include insurance subsidiaries)

2. Eligible Capital

Accumulated Other Comprehensive Income and Other Disclosed Reserve

7.For unrealized fair value reserves relating to financial instruments to be included in CET1 capital banks and their auditor must only recognize such gains or losses that are prudently valued and independently verifiable (e.g. by reference to market prices). Prior prudent valuations, and the independent verification thereof, are mandatory.

8.The amount of cumulative unrealized losses arising from the changes in fair value of financial instruments, including loans/financing and receivables, classified as “available-for-sale” shall be fully deducted in the calculation of CET1 Capital.

9.Revaluation reserves or cumulative unrealized gains shall be added to CET 1 with a haircut of 55%.

10.The amount of cumulative unrealized gains arising from the changes in the fair value or revaluation of bank’s own premises and real estate investment are not allowed to be included as part of Asset Revaluation reserve for regulatory purposes.

11.IFRS9 will be implemented during 2018. Banks that are impacted significantly from the implementation of IFRS9 may approach the Central Bank to apply for a transition period for the IFRS9 impact. Such applications will be analysed and considered on a case-by-case basis.

Retained Earnings

12. The amount reported under accumulated retained earnings (5.1.4.1) should be as per the audited financial statement at year end and should remain the same for the entire financial year.

13. Current financial year’s/quarter’s profits can only be taken into account after they are properly audited/ reviewed by the external auditors of the bank. Current financial years /quarter’s loss if incurred have to be deducted from the capital.

14. Dividend expected/ proposed for the financial year should be reported under (5.1.4.3) and will be deducted from Retained Earnings/ (Loss) (5.1.4). Expected dividend applies only for Q4 until dividend is actually paid.

15. The dividend deduction must be updated based on each of the following events, if the amount changes, after Annual General meeting, or the approval from the Central Bank, or the release of the Financial Statements by the auditors.

16. Other adjustments to the Retained Earnings includes: a. Prudential filter: Partial addback of ECL in accordance with the Regulation Regarding Accounting Provisions and Capital Requirements - Transitional Arrangements should be reported under (5.1.4.4) IFRS transitional arrangement.

b. CBUAE Regulatory deductions: i. Amount exceeding Large Exposure threshold: Any amount that is in violation of Large Exposure regulation of notice 300/2013 shall be deducted from the capital. Any amount deducted from CET1 under 5.1.4.5 of the BRF 95 due to a Large Exposure violation of notice no.226/2018 may be excluded for the calculation of risk weighted assets. However, amounts that are not deducted must be included in risk weighted assets. Furthermore, any counterparty credit risk (under CR2a) associated with such exposure must remain included in the calculation of risk weighted asset.

ii. Loans to directors: The circular 83/2019 on Corporate Governance regulations for Banks, under the article (6) “Transaction with Related parties” requires if the transaction with the related parties are not provided on arm’s length basis, then on general or case by case basis, deduct such exposure from capital. The deduction should be reported under 5.1.4.5 of the BRF 95. Capital Buffers - Countercyclical Buffer

17.The buffer for internationally active banks will be a weighted average of the buffers deployed across all the jurisdictions to which it has credit exposures. The buffer that will apply to each bank will reflect the geographic composition of its portfolio of credit exposures. When considering the jurisdiction to which a private sector credit exposure relates, banks should use, where possible, an ultimate risk basis; i.e. it should use the country where the guarantor of the exposure resides, not where the exposure has been booked.

18.Banks will have to look at the geographic location of their private sector credit exposures (including non-bank financial sector exposures) and calculate their countercyclical capital buffer requirement as a weighted average of the buffers that are being applied in jurisdictions to which they have an exposure. Credit exposures in this case include all private sector credit exposures that attract a credit risk capital charge or the risk weighted equivalent trading book capital charges for specific risk and securitisation.

19.The weighting applied to the buffer in place in each jurisdiction will be the bank’s total credit risk charge that relates to private sector credit exposures in that jurisdiction, divided by the bank’s total credit risk charge that relates to private sector credit exposures across all jurisdictions. Banks must determine whether the ultimate counterparty is a private sector exposure, as well as the location of the “ultimate risk”, to the extent possible.

20.The charge for the relevant portfolio should be allocated to the geographic regions of the constituents of the portfolio by calculating the proportion of the portfolio’s total credit exposure arising from credit exposure to counterparties in each geographic region.

Please refer to Question 15 of the FAQs below for further guidance and examples of countercyclical buffers.

3. Regulatory Adjustments

Goodwill and Other Intangibles

21.Intangible assets typically do not generate any cash flows and hence their value, when a bank is in need of immediate additional capital to absorb losses, is uncertain. For this reason, all intangible assets are deducted from CET1 (5.1.8.1).

22.From regulatory perspective, goodwill and intangible assets have the same meaning as under IFRS.

23.Capitalized software costs that is not “integral to hardware” is to be treated as an intangible asset and software that is “integral to hardware” is to be treated as property, plant and equipment (i.e. as a fixed asset).

24.The amount of intangible assets to be deducted should be net of any associated deferred tax liability (DTL) that would be extinguished if the asset became impaired or derecognised under the applicable accounting standards.

25.Goodwill and intangible assets that are deducted from CET1, they are excluded from the calculation of RWA for credit risk exposure value.

Deferred Tax Assets

26. Deferred tax assets (DTAs) typically arise when a bank:

- suffers a net loss in a financial year and is permitted to carry forward this loss to offset future profits when calculating its tax bill (net losses carried forward)

- has to reduce the value of an asset on the balance sheet, but this 'loss in value' is not recognised by the tax authorities until a future period (temporary timing difference)

27. DTAs arising from net losses carried forward have to be deducted in full from a bank's CET1 (5.1.8.2). This recognises that their value can only be derived through the existence of future taxable income. On the other hand, a DTA relying on future profitability and arising from temporary timing differences is subject to the 'threshold deduction rule' (5.1.9.2).

- suffers a net loss in a financial year and is permitted to carry forward this loss to offset future profits when calculating its tax bill (net losses carried forward)

4. Threshold Deduction

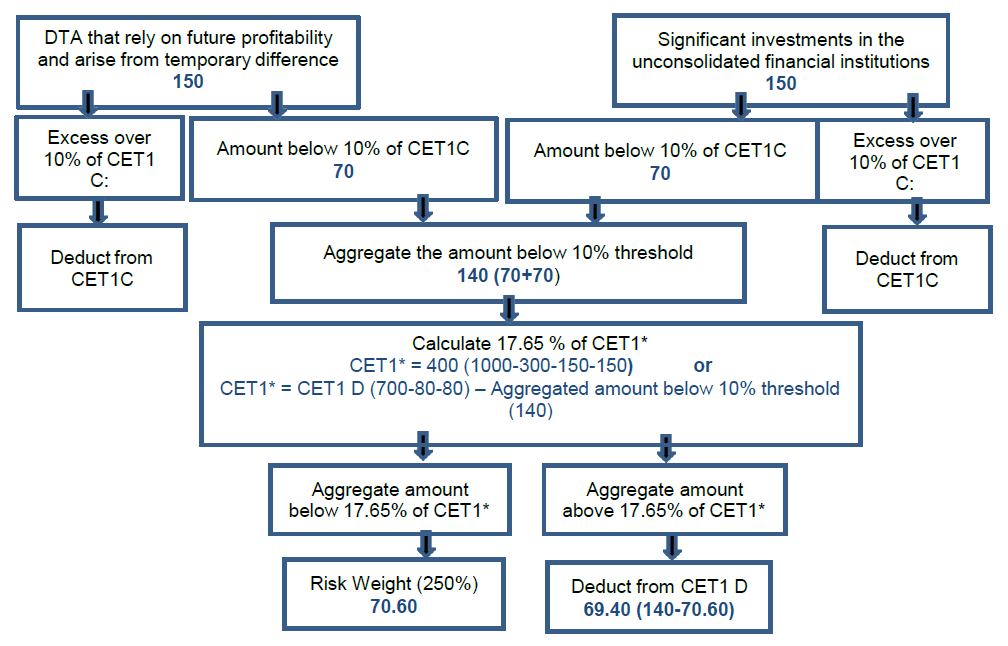

28.The purpose of calculating the threshold is to limit the significant investments in the common shares of unconsolidated financial institutions (banks, insurance and other financial entities) and deferred tax assets (arising from temporary differences) to 15% of the CET1 after all deduction (Deduction includes regulatory deductions and the amount of significant investments in the common shares of unconsolidated financial institutions and deferred tax assets in full).

29.Therefore, significant investments in the common shares of unconsolidated financial institutions and deferred tax assets may receive limited recognition of 10% CET1 individually (CET after regulatory adjustment outlined in section 3 of the Tier Capital Supply Standard).

30.The amount that is recognised will receive risk weight of 250% and the remaining amount will be deducted.

See Appendix 5 for an example.

5. Significant Investment in Commercial Entities

31. For purposes of this section, 'significant investments' in a commercial entity is defined as any investment in the capital instruments of a commercial entity by a bank which is equivalent to or more than 10% of CET 1 of the bank (after application of regulatory and threshold deduction). See Appendix 3 for an example.

6. Frequently Asked Questions

Question 1: When will the Standards, Guidance and Template with regards to Solo reporting be issued by the Central Bank?

The Central Bank will issue all related material regarding Solo reporting during 2020. Formal communication will be issued in advance.Question 2: What is meant by the book value of an investment?

The book value of an investment shall be in accordance with the applicable accounting framework (IFRS). This valuation must be accepted by an external auditor.Question 3: Are capital shortfalls of non-consolidated insurance companies to be deducted from CET1?

Yes, any capital shortfall on a company has to be deducted.Question 4: If the Bank meets minimum CET1 ratios can the excess CET1 also be counted to meet AT1 and Total CAR?

Yes.Question 5: Please clarify whether minority interest related to any other regulated financial entity (which is not a bank) should be included or not.

Only minority interest of the subsidiary that are subject to the same minimum prudential standards and level of supervision as a bank be eligible for inclusion in the capital.Question 6: Is the bank able to include the profit & loss in the year-end CAR calculation before the issuance of the audited financial statements?

Bank may include interim profit/ yearend profit in CET1 capital only if reviewed or audited by external auditors. Furthermore, the expected dividend should be deducted in Q4.Question 7: Is subordinated Debt currently considered Tier 2 as per Basel III, hence no amortization is required?

Grandfathering rule plus amortization in last 5 years - refer to Standards for Capital Adequacy of banks in UAE, Tier Capital Supply Standard- paragraph 27 (iv)(b) . Reference should also be made to the Tier Capital Instruments Standards.Question 8: Do dividends need to be deducted from CET1 after the proposal from the Board or after Central Bank approval or after approval from shareholders at the Annual General Meeting?

Please refer to Question 6Question 9: How do you treat goodwill and intangible assets arising on an insurance subsidiary? Should it be considered since the standards mentions insurance subsidiaries are to be completely deconsolidated and hence there will be no goodwill?

Goodwill and other intangible must be deducted in the calculation of CET1. In particular deduction is also applied to any goodwill included in the valuation of significant investments in the capital of banking, financial and insurance entities that are outside the scope of consolidation.Question 10: Subsidiaries which are used for providing manpower services at cost, should these be classified as commercial entities or financial entities?

A non-financial sector entity is an entity that is not:- a)a financial sector entity; or

- b)a direct extension of banking; or

- c)ancillary to banking; or

- d)leasing, factoring, the management of unit trusts, the management of data processing services or any other similar services"

Question 11: Obtain an understanding to the timeline by when the Central Bank may advise specific Banks of specific countercyclical buffers?*

The underlying process for the implementation of countercyclical buffers will be set and communicated during 2018Question 12: Criterion 4 for Additional Tier 1 capital. Can the Central Bank give additional guidance on what will be considered to be an incentive to redeem?

The following list provides some examples of what would be considered to be an incentive to redeem:A call option combined with an increase in the credit spread of the instrument if the call is not exercised.

A call option combined with a requirement or an investor option to convert the instrument into shares if the call is not exercised.

A call option combined with a change in reference rate where the credit spread over the second reference rate is greater than the initial payment rate less the swap rate (ie the fixed rate paid to the call date to receive the second reference rate). For example, if the initial reference rate is 0.9%, the credit spread over the initial reference rate is 2% (ie the initial payment rate is 2.9%), and the swap rate to the call date is 1.2%, a credit spread over the second reference rate greater than 1.7% (2.9-1.2%) would be considered an incentive to redeem.

Conversion from a fixed rate to a floating rate (or vice versa) in combination with a call option without any increase in credit spread will not in itself be viewed as an incentive to redeem. However, as required by criteria 5, the bank must not do anything that creates an expectation that the call will be exercised.

The above is not an exhaustive list of what is considered an incentive to redeem and so banks should seek guidance from Central Bank on specific features and instruments. Banks must not expect Central Bank to approve the exercise of a call option for the purpose of satisfying investor expectations that a call will be exercised.

Question 13: Criteria 4 and 5 for Additional Tier 1 capital. An instrument is structured with a first call date after 5 years but thereafter is callable quarterly at every interest payment due date (subject to supervisory approval). The instrument does not have a step-up. Does instrument meet criteria 4 and 5 in terms of being perpetual with no incentive to redeem?

Criterion 5 allows an instrument to be called by an issuer after a minimum period of 5 years. It does not preclude calling at times after that date or preclude multiple dates on which a call may be exercised. However, the specification of multiple dates upon which a call might be exercised must not be used to create an expectation that the instrument will be redeemed at the first call date, as this is prohibited by criterion.Question 14: Can an option to call the instrument after five years but prior to the start of the amortisation period viewed as an incentive to redeem?

No, it can’t be viewed as an incentive to redeem.Question 15: With regards to countercyclical buffer, what are “private sector credit exposures”? What does “geographic location” mean? How should the geographic location of exposures on the banking book and the trading book be identified? What is the difference between (the jurisdiction of) “ultimate risk” and (the jurisdiction of) “immediate counterparty” exposures?*

“Private sector credit exposures” refers to exposures to private sector counterparties which attract a credit risk capital charge in the banking book, and the risk weighted equivalent trading book capital charges for specific risk, the incremental risk charge, and securitisation. Interbank exposures and exposures to the public sector are excluded, but non-bank financial sector exposures are included. The geographic location of a bank’s private sector credit exposures is determined by the location of the counterparties that make up the capital charge, irrespective of the bank’s own physical location or its country of incorporation. The location is identified according to the concept of “ultimate risk”. The geographic location identifies the jurisdiction that has announced countercyclical capital buffer add-on rate is to be applied by the bank to the corresponding credit exposure, appropriately weightedThe concepts of “ultimate risk” and “immediate risk” are those used by the BIS' International Banking Statistics. The jurisdiction of “immediate counterparty” refers to the jurisdiction of residence of immediate counterparties, while the jurisdiction of “ultimate risk” is where the final risk lies. For the purpose of the countercyclical capital buffer, banks should use, where possible, exposures on an “ultimate risk” basis.

For example, a bank could face the situation where the exposures to a borrower is in one jurisdiction (country A), and the risk mitigant (e.g. guarantee) is in another jurisdiction (country B). In this case, the “immediate counterparty” is in country A, but the “ultimate risk” is in country B. This means that if the bank has a debt claim on an investment vehicle, the ultimate risk exposure should be allocated to the jurisdiction where the vehicle (or if applicable, its parent/guarantor) resides. If the bank has an equity claim, the ultimate risk exposure should be allocated proportionately to the jurisdictions where the ultimate risk exposures of the vehicle resides.

*See current Countercyclical Capital Buffer on Credit Exposures in the UAE.

Appendix

Appendix 1: Banking, Securities, Insurance and Other Financial Entities - Significant Investment (Ownership in the Entity More Than 10%)

Significant investment (ownership in the entity more than 10% ) Entity Entity activity Investment Classification Listed/Unlisted Bank's ownership in the entity (% of Holding) Investment Amount A Banking Banking Book Listed 40% 60 B Insurance Banking Book Listed 18% 35 C Securities Banking Book Unlisted 16% 28 D Banking Trading Book Listed 11% 18 a. Total significant investment (Banking, Securities, insurance and other financial entities) 141 b. Bank's CET1 (after applying all the regulatory deduction except section 3.9 and 3.10 of the Tier Capital Supply Standard) 1000 c. Limit (10 % of bank's CET1) 100 d. Amount to be deducted from bank's CET1 41 e. Amount not deducted to considered for aggregate threshold deduction 100 The remaining amount of 100 is to be distributed amongst the investments on a pro rata / proportionate basis and risk weighted at 250% (assuming no threshold deduction apply).The total of 250 RWA (100 *250%) will be distributed as follows.

Entity Investment Classification Investment Amount as a % of all such investment Calculation of amount not deducted to be risk weighted Risk weight RWA Section A Banking Book 60 42% 43 (100 x 43%) 250% 106.38 Credit Risk B Banking Book 35 25% 25 (100 x 25%) 250% 62.06 Credit Risk C Banking Book 28 20% 20 (100 x 20%) 250% 49.65 Credit Risk D Trading Book 18 13% 13 (100 x 13%) Equity Risk - Market risk section 141 100% 100 Appendix 2: Banking, Securities, Insurance and Other Financial Entities - Investment with Ownership Not More Than 10%

Investment (ownership not more than 10%) Entity Entity activity Investment Classification Listed/Unlisted Bank's ownership in the entity (% of Holding) Investment Amount E Banking Banking Book Listed 10% 50 F Banking Trading Book Listed 3% 11 G Securities Banking Book Unlisted 8% 40 H Insurance Banking Book Listed 2% 9 a.Total investment (Banking, Securities, insurance and other financial entities) 110 b. Bank's CET1 (after applying all the regulatory deduction except section 3.9 and 3.10 of the Tier Capital Supply Standards) 1000 c. Limit (10% of bank's CET1) 100 d. Amount to be deducted from bank's CET1 (a-c) 10 e. Amount not deducted to be risk weighted (Remaining amount) (a-d) 100 The remaining amount of 75 is to be distributed amongst the investments on a pro rata / proportionate basis and risk weighted as stated below

Entity Investment Classification Investment Amount as a % of all such investment Calculation of amount not deducted to be risk weighted Listed/ Unlisted Risk weight RWA Section E Banking Book 50 45.5% 45.50 (100 x 45.5 %) Listed 100% 34.50 Credit Risk F Trading Book 11 10.0% 10 (100 x 10.00%) Listed Equity Risk - Market risk section G Banking Book 40 36.4% 36.4 (100 x 36.4%) Unlisted 150% 40.50 Credit Risk H Banking Book 9 8.2% 8.2 (100 x 8.2%) Listed 100% 6.00 Credit Risk 110 100% 100 Appendix 3: Significant Investments in Commercial Entities.

Individual Investment Limit Check and its treatment Bank's CET1 (after applying all the regulatory and threshold deduction) 1000 Individual Limit (10% of bank's CET1D) 100 Step 1: Individual Limit check

Significant investments in commercial entities Entity Entity activity Investment Classification Listed/ Unlisted Investment Amount Amount as a % of bank's CET1 Significant Investment Amount to RW at 952% Remaining amount I Commercial Banking Book Listed 140 14% Yes 40 100 J Commercial Banking Book Listed 120 12% Yes 20 100 K Commercial Banking Book Unlisted 110 11% Yes 10 100 L Commercial Banking Book Listed 115 12% Yes 15 100 M Commercial Banking Book Listed 75 8% No 75 N Commercial Banking Book Listed 45 5% No 45 O Commercial Banking Book Listed 50 5% No 50 655 85 570 Risk weighting at 952% on account of 10% threshold on individual basis is 85.

Step 2: Aggregate Limit check

Aggregate of remaining amount of investments after 10% deduction (entity I,J,K,L,M,N & O) 570 Aggregate Limit (25% of bank's CET1) 250 The amount to be risk-weighted at 952% based on the 25% threshold on aggregate basis 250 Remaining amount of investments to be risk-weighted under the applicable risk weighting rules (100% RW for listed and 150% unlisted) 320 Total amount to be risk weighted at 952%: 335 (85 + 250)

Appendix 4: Minority Interest Illustrative Example

This Appendix illustrates the treatment of minority interest and other capital issued out of subsidiaries to third parties, which is set out in section 2.7 of the Tier Capital Supply Standard (Paragraph 35 to 41).

A banking group consists of two legal entities that are both banks. Bank P is the parent, Bank S is the subsidiary, and their unconsolidated balance sheets are set out below

Bank P Balance sheet Amount (AED) Bank S Balance sheet Amount (AED) Assets Assets Loan to customers 100 Loan to customers 150 Investment in CET 1 of Bank S 7 Investment in AT1 of Bank S 4 Investment in T2 of Bank S 2 Total Assets 113 Total Assets 150 Liabilities and Equities Liabilities and Equities Depositors 70 Depositors 127 Common Equity (CET1) 26 Common Equity (CET1) 10 Additional Tier1 (AT1) 7 Additional Tier1 (AT1) 5 Tier 2 10 Tier 2 8 Total Liabilities and Equities 113 Total Liabilities and Equities 150 The balance sheet of Bank P shows that in addition to its loans to customers, it owns 70% of the common shares of Bank S, 80% of the Additional Tier 1 of Bank S and 25% of the Tier 2 capital of Bank S. The ownership of the capital of Bank S is therefore as follows:

Capital issued by Bank S Amount Issued to Parent Amount Issued to third party Total Common Equity (CET1) 7 3 10 Additional Tier1 (AT1) 4 1 5 Tier 1 11 4 15 Tier 2 2 6 8 Total Capital (TC) 13 10 23 The consolidated balance sheet of the banking group is set out below:

Consolidated Balance sheet of Bank P Assets Amount (AED) Loan to customers 250 Total Assets 250 Liabilities and Equities Depositors 197 Common Equity (CET1) 26 Additional Tier1 (AT1) 7 Tier 2 10 Minority Interest Common Equity (CET1) 3 Additional Tier1 (AT1) 1 Tier 2 6 Liabilities and Equities 250 For illustrative purposes, Bank S is assumed to have risk-weighted assets of 100. In this example, the minimum capital requirements of Bank S and the subsidiary’s contribution to the consolidated requirements are the same since Bank S does not have any loans to Bank P. This means that it is subject to the following minimum plus capital conservation buffer requirements and has the following surplus capital:

Minimum and surplus capital of Bank S Capital Minimum plus Capital conservation Buffer Surplus CET1 (7% + 2.5%) of 100 = 9.5 0.50

(10- 9.5)T1 (8.5%+ 2.5%) of 100 = 11 4.00

(10+5-11)TC (10.5% +2.5%) of 100 = 13 10

(10+5+8 -13)The following table illustrates how to calculate the amount of capital issued by Bank S to include in consolidated capital, following the calculation procedure set out in paragraphs 35 to 41 of the Tier Capital Supply Standards.

Bank S: amount of capital issued to third parties included in the consolidated capital. Capital Total Amount Issued (A) Total Amount Issued to third party (B) Surplus (C) Surplus attributable to third parties (i.e. amount excluded from consolidated capital) (D) = (C) * (B/A) Amount Included in the consolidated capital (E) = (B)-(D) CET1 10 3 0.5 0.15 2.85 T1 15 4 4 1.07 2.93 TC 23 10 10 4.35 5.65 The following table summarizes the components of capital for the consolidated group based on the amounts calculated in the table above. Additional Tier 1 is calculated as the difference between Common Equity Tier 1 and Tier 1 and Tier 2 is the difference between Total Capital and Tier 1.

Bank S: amount of capital issued to third parties included in the consolidated capital. Capital Total amount issued by Parent (all of which is to be included in consolidated capital) Amount issued by subsidiaries to third parties to be included in the consolidated capital Total amount of capital issued by parent and subsidiary to be included in the consolidated capital CET1 26 2.85 28.85 AT1 7 0.08 7.08 T1 33 2.93 35.93 T2 10 2.72 12.72 TC 43 5.65 48.65 Appendix 5: Threshold Deduction

This Appendix is meant to clarify the reporting of threshold deduction and calculation of the 10% limit on significant investments in the common shares of unconsolidated financial institutions (banks, insurance and other financial entities); and the 10% limit on deferred tax assets arising from temporary differences.

CET1 Capital (prior to regulatory deductions) 1000 Regulatory deductions: 300 Total CET1 after the regulatory adjustments above (CET1C) 700 Total amount of significant investments in the common share of banking, financial and insurance entities 150 Total amount of Deferred tax assets arising from temporary differences 150

*This is a “hypothetical” amount of CET1 that is used only for the purpose of determining the deduction of above two items for the aggregate limit. Amount of CET1 = Total CET1 (prior to deduction) – All the deduction except the threshold deduction (i.e. all deduction outlined in para 44 to 68 of the Tier Capital Supply Standards) minus the total amount of both DTA that rely on future profitability and arise from temporary difference and significant investments in the unconsolidated financial institutions.

Appendix 6: Effective Countercyclical Buffer

Assume a bank has the following capital ratios

Capital Base Minimum Capital Requirements Bank's Capital Ratio Common Equity Tier 1 Capital Ratio 7.00% 9.50% Tier 1 Capital Ratio 8.50% 0.00% Tier 2 Capital Ratio 2.00% 4.00% Total Capital Ratio 10.50% 13.50% From the above table, the bank has fulfilled all minimum capital requirements. In addition, the bank has to meet the additional capital buffers:

Capital Conservation Buffer (CCB) 2.50% Countercyclical Buffer* 0.00% D- SIB 1.00% Aggregated Buffer requirement (effective CCB) 3.50% The table below shows the adjusted quartiles accordingly:

Freely available

CET 1 RatioMinimum Capital Conservation Ratios (expressed as a percentage of earnings) Within 1st quartile of buffer: 0.0 % - 0.875% 100 % Within 2nd quartile of buffer: > 0.875% - 1.75% 80 % Within 3rd quartile of buffer: > 1.75% - 2.625% 60 % Within 4th quartile of buffer: > 2.625% - 3.5% 40 % Above top of the buffer: > 3.5% 0 % As the bank does not have Additional Tier 1, the bank has to use 8.5% of its available CET1 to fulfill the minimum Tier 1 requirement of 8.5%. Only the proportion of CET1 that is not allocated to fulfill the minimum capital requirements is freely available to fulfill the buffer requirement. For this bank, 1% CET1 is freely available, because the bank already used 8.5% of its CET1 to fulfill the Tier 1 ratio. (9.5% available CET1 - 8.5% CET1 required to fulfill the Tier 1 minimum requirement of 8.5%).

Impact: The bank breaches the effective CCB with 1% freely available CET1. Capital conservation is required by at least 80% of the bank’s earnings. Distributions to shareholders is limited to maximal 20% of the bank’s earnings (Central Bank approval of dividends still required).

*See current Countercyclical Capital Buffer on Credit Exposures in the UAE.