Appendix

Appendix 1: Banking, Securities, Insurance and Other Financial Entities - Significant Investment (Ownership in the Entity More Than 10%)

Significant investment (ownership in the entity more than 10% ) Entity Entity activity Investment Classification Listed/Unlisted Bank's ownership in the entity (% of Holding) Investment Amount A Banking Banking Book Listed 40% 60 B Insurance Banking Book Listed 18% 35 C Securities Banking Book Unlisted 16% 28 D Banking Trading Book Listed 11% 18 a. Total significant investment (Banking, Securities, insurance and other financial entities) 141 b. Bank's CET1 (after applying all the regulatory deduction except section 3.9 and 3.10 of the Tier Capital Supply Standard) 1000 c. Limit (10 % of bank's CET1) 100 d. Amount to be deducted from bank's CET1 41 e. Amount not deducted to considered for aggregate threshold deduction 100 The remaining amount of 100 is to be distributed amongst the investments on a pro rata / proportionate basis and risk weighted at 250% (assuming no threshold deduction apply).The total of 250 RWA (100 *250%) will be distributed as follows.

Entity Investment Classification Investment Amount as a % of all such investment Calculation of amount not deducted to be risk weighted Risk weight RWA Section A Banking Book 60 42% 43 (100 x 43%) 250% 106.38 Credit Risk B Banking Book 35 25% 25 (100 x 25%) 250% 62.06 Credit Risk C Banking Book 28 20% 20 (100 x 20%) 250% 49.65 Credit Risk D Trading Book 18 13% 13 (100 x 13%) Equity Risk - Market risk section 141 100% 100 Appendix 2: Banking, Securities, Insurance and Other Financial Entities - Investment with Ownership Not More Than 10%

Investment (ownership not more than 10%) Entity Entity activity Investment Classification Listed/Unlisted Bank's ownership in the entity (% of Holding) Investment Amount E Banking Banking Book Listed 10% 50 F Banking Trading Book Listed 3% 11 G Securities Banking Book Unlisted 8% 40 H Insurance Banking Book Listed 2% 9 a.Total investment (Banking, Securities, insurance and other financial entities) 110 b. Bank's CET1 (after applying all the regulatory deduction except section 3.9 and 3.10 of the Tier Capital Supply Standards) 1000 c. Limit (10% of bank's CET1) 100 d. Amount to be deducted from bank's CET1 (a-c) 10 e. Amount not deducted to be risk weighted (Remaining amount) (a-d) 100 The remaining amount of 75 is to be distributed amongst the investments on a pro rata / proportionate basis and risk weighted as stated below

Entity Investment Classification Investment Amount as a % of all such investment Calculation of amount not deducted to be risk weighted Listed/ Unlisted Risk weight RWA Section E Banking Book 50 45.5% 45.50 (100 x 45.5 %) Listed 100% 34.50 Credit Risk F Trading Book 11 10.0% 10 (100 x 10.00%) Listed Equity Risk - Market risk section G Banking Book 40 36.4% 36.4 (100 x 36.4%) Unlisted 150% 40.50 Credit Risk H Banking Book 9 8.2% 8.2 (100 x 8.2%) Listed 100% 6.00 Credit Risk 110 100% 100 Appendix 3: Significant Investments in Commercial Entities.

Individual Investment Limit Check and its treatment Bank's CET1 (after applying all the regulatory and threshold deduction) 1000 Individual Limit (10% of bank's CET1D) 100 Step 1: Individual Limit check

Significant investments in commercial entities Entity Entity activity Investment Classification Listed/ Unlisted Investment Amount Amount as a % of bank's CET1 Significant Investment Amount to RW at 952% Remaining amount I Commercial Banking Book Listed 140 14% Yes 40 100 J Commercial Banking Book Listed 120 12% Yes 20 100 K Commercial Banking Book Unlisted 110 11% Yes 10 100 L Commercial Banking Book Listed 115 12% Yes 15 100 M Commercial Banking Book Listed 75 8% No 75 N Commercial Banking Book Listed 45 5% No 45 O Commercial Banking Book Listed 50 5% No 50 655 85 570 Risk weighting at 952% on account of 10% threshold on individual basis is 85.

Step 2: Aggregate Limit check

Aggregate of remaining amount of investments after 10% deduction (entity I,J,K,L,M,N & O) 570 Aggregate Limit (25% of bank's CET1) 250 The amount to be risk-weighted at 952% based on the 25% threshold on aggregate basis 250 Remaining amount of investments to be risk-weighted under the applicable risk weighting rules (100% RW for listed and 150% unlisted) 320 Total amount to be risk weighted at 952%: 335 (85 + 250)

Appendix 4: Minority Interest Illustrative Example

This Appendix illustrates the treatment of minority interest and other capital issued out of subsidiaries to third parties, which is set out in section 2.7 of the Tier Capital Supply Standard (Paragraph 35 to 41).

A banking group consists of two legal entities that are both banks. Bank P is the parent, Bank S is the subsidiary, and their unconsolidated balance sheets are set out below

Bank P Balance sheet Amount (AED) Bank S Balance sheet Amount (AED) Assets Assets Loan to customers 100 Loan to customers 150 Investment in CET 1 of Bank S 7 Investment in AT1 of Bank S 4 Investment in T2 of Bank S 2 Total Assets 113 Total Assets 150 Liabilities and Equities Liabilities and Equities Depositors 70 Depositors 127 Common Equity (CET1) 26 Common Equity (CET1) 10 Additional Tier1 (AT1) 7 Additional Tier1 (AT1) 5 Tier 2 10 Tier 2 8 Total Liabilities and Equities 113 Total Liabilities and Equities 150 The balance sheet of Bank P shows that in addition to its loans to customers, it owns 70% of the common shares of Bank S, 80% of the Additional Tier 1 of Bank S and 25% of the Tier 2 capital of Bank S. The ownership of the capital of Bank S is therefore as follows:

Capital issued by Bank S Amount Issued to Parent Amount Issued to third party Total Common Equity (CET1) 7 3 10 Additional Tier1 (AT1) 4 1 5 Tier 1 11 4 15 Tier 2 2 6 8 Total Capital (TC) 13 10 23 The consolidated balance sheet of the banking group is set out below:

Consolidated Balance sheet of Bank P Assets Amount (AED) Loan to customers 250 Total Assets 250 Liabilities and Equities Depositors 197 Common Equity (CET1) 26 Additional Tier1 (AT1) 7 Tier 2 10 Minority Interest Common Equity (CET1) 3 Additional Tier1 (AT1) 1 Tier 2 6 Liabilities and Equities 250 For illustrative purposes, Bank S is assumed to have risk-weighted assets of 100. In this example, the minimum capital requirements of Bank S and the subsidiary’s contribution to the consolidated requirements are the same since Bank S does not have any loans to Bank P. This means that it is subject to the following minimum plus capital conservation buffer requirements and has the following surplus capital:

Minimum and surplus capital of Bank S Capital Minimum plus Capital conservation Buffer Surplus CET1 (7% + 2.5%) of 100 = 9.5 0.50

(10- 9.5)T1 (8.5%+ 2.5%) of 100 = 11 4.00

(10+5-11)TC (10.5% +2.5%) of 100 = 13 10

(10+5+8 -13)The following table illustrates how to calculate the amount of capital issued by Bank S to include in consolidated capital, following the calculation procedure set out in paragraphs 35 to 41 of the Tier Capital Supply Standards.

Bank S: amount of capital issued to third parties included in the consolidated capital. Capital Total Amount Issued (A) Total Amount Issued to third party (B) Surplus (C) Surplus attributable to third parties (i.e. amount excluded from consolidated capital) (D) = (C) * (B/A) Amount Included in the consolidated capital (E) = (B)-(D) CET1 10 3 0.5 0.15 2.85 T1 15 4 4 1.07 2.93 TC 23 10 10 4.35 5.65 The following table summarizes the components of capital for the consolidated group based on the amounts calculated in the table above. Additional Tier 1 is calculated as the difference between Common Equity Tier 1 and Tier 1 and Tier 2 is the difference between Total Capital and Tier 1.

Bank S: amount of capital issued to third parties included in the consolidated capital. Capital Total amount issued by Parent (all of which is to be included in consolidated capital) Amount issued by subsidiaries to third parties to be included in the consolidated capital Total amount of capital issued by parent and subsidiary to be included in the consolidated capital CET1 26 2.85 28.85 AT1 7 0.08 7.08 T1 33 2.93 35.93 T2 10 2.72 12.72 TC 43 5.65 48.65 Appendix 5: Threshold Deduction

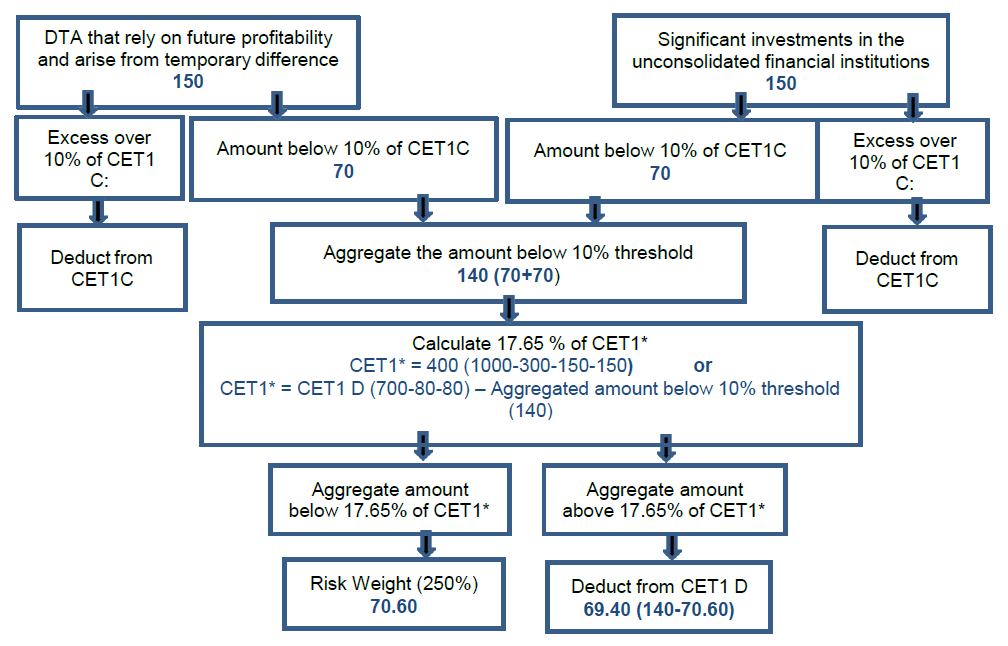

This Appendix is meant to clarify the reporting of threshold deduction and calculation of the 10% limit on significant investments in the common shares of unconsolidated financial institutions (banks, insurance and other financial entities); and the 10% limit on deferred tax assets arising from temporary differences.

CET1 Capital (prior to regulatory deductions) 1000 Regulatory deductions: 300 Total CET1 after the regulatory adjustments above (CET1C) 700 Total amount of significant investments in the common share of banking, financial and insurance entities 150 Total amount of Deferred tax assets arising from temporary differences 150

*This is a “hypothetical” amount of CET1 that is used only for the purpose of determining the deduction of above two items for the aggregate limit. Amount of CET1 = Total CET1 (prior to deduction) – All the deduction except the threshold deduction (i.e. all deduction outlined in para 44 to 68 of the Tier Capital Supply Standards) minus the total amount of both DTA that rely on future profitability and arise from temporary difference and significant investments in the unconsolidated financial institutions.

Appendix 6: Effective Countercyclical Buffer

Assume a bank has the following capital ratios

Capital Base Minimum Capital Requirements Bank's Capital Ratio Common Equity Tier 1 Capital Ratio 7.00% 9.50% Tier 1 Capital Ratio 8.50% 0.00% Tier 2 Capital Ratio 2.00% 4.00% Total Capital Ratio 10.50% 13.50% From the above table, the bank has fulfilled all minimum capital requirements. In addition, the bank has to meet the additional capital buffers:

Capital Conservation Buffer (CCB) 2.50% Countercyclical Buffer* 0.00% D- SIB 1.00% Aggregated Buffer requirement (effective CCB) 3.50% The table below shows the adjusted quartiles accordingly:

Freely available

CET 1 RatioMinimum Capital Conservation Ratios (expressed as a percentage of earnings) Within 1st quartile of buffer: 0.0 % - 0.875% 100 % Within 2nd quartile of buffer: > 0.875% - 1.75% 80 % Within 3rd quartile of buffer: > 1.75% - 2.625% 60 % Within 4th quartile of buffer: > 2.625% - 3.5% 40 % Above top of the buffer: > 3.5% 0 % As the bank does not have Additional Tier 1, the bank has to use 8.5% of its available CET1 to fulfill the minimum Tier 1 requirement of 8.5%. Only the proportion of CET1 that is not allocated to fulfill the minimum capital requirements is freely available to fulfill the buffer requirement. For this bank, 1% CET1 is freely available, because the bank already used 8.5% of its CET1 to fulfill the Tier 1 ratio. (9.5% available CET1 - 8.5% CET1 required to fulfill the Tier 1 minimum requirement of 8.5%).

Impact: The bank breaches the effective CCB with 1% freely available CET1. Capital conservation is required by at least 80% of the bank’s earnings. Distributions to shareholders is limited to maximal 20% of the bank’s earnings (Central Bank approval of dividends still required).

*See current Countercyclical Capital Buffer on Credit Exposures in the UAE.