VI. Equity Investments in Funds

I. Introduction

1.In December 2013, the Basel Committee on Banking Supervision (BCBS) published a revised framework for calculating the capital requirements for banks’ equity investments in funds held in the banking book. This followed a BCBS review of the risk-based capital requirements for banks’ exposures to funds, undertaken as part of the work of the Financial Stability Board (FSB) to strengthen the oversight and regulation of shadow banking. The BCBS review was undertaken to clarify the existing treatment of such exposures in the Basel II capital adequacy framework and to achieve a more internationally consistent and risk-sensitive capital treatment for banks’ investments in the equity of funds, reflecting both the risk of the fund’s underlying investments and its leverage.

2.Following the approach developed by the BCBS in Capital requirements for banks’ equity investments in funds, (BCBS 266, published December 2013), the Central Bank Standards for minimum required capital for banks’ equity investments in funds relies on a hierarchy of three successive approaches to risk weighting of fund assets, with varying degrees of risk sensitivity and conservatism:

- •The “look-through approach” (LTA): The LTA is the most granular approach. Subject to meeting the conditions set out for its use, banks employing the LTA must apply the risk weight of the fund’s underlying exposures as if the exposures were held directly by the bank;

- •The “mandate-based approach” (MBA): The MBA provides a degree of risk sensitivity, and can be used when banks do not meet the conditions for applying the LTA. Banks employing the MBA assign risk weights on the basis of the information contained in a fund’s mandate or in relevant regulations, national legislation, or other similar rules under which the fund is required to operate; and

- •The “fall-back approach” (FBA): When neither of the above approaches is feasible, the FBA must be used. The FBA applies a 1250 percent risk weight to a bank’s equity investment in the fund.

To ensure that banks have appropriate incentives to enhance the risk management of their exposures, the degree of conservatism increases with each successive approach.

3.The capital framework for banks’ equity investments in funds also incorporates a leverage adjustment to the risk-weighted assets derived from the above approaches to appropriately reflect a fund’s leverage.

II. Clarifications

A. Scope

4.The Standards covers banks’ equity investments held in the banking book. Note that equity positions within the trading book are covered by the market risk capital requirements that apply to trading book positions.

5.The Central Bank has chosen not to use the national discretion provided within the BCBS framework to exclude from the standard equity positions in entities whose debt obligations qualify for a zero risk weight. The Central Bank also has chosen not to use the national discretion provided within the BCBS framework to exclude from the scope of the standard equity investments made under identified official programs that support specified sectors of the economy

B. General Design of the Capital Requirement

6.At a high level, the framework is designed such that the risk-weight for a bank’s equity investment in a fund depends on the average risk weight that would be applicable to the assets of the fund, and on the extent of use of leverage by the fund. The approach to the average risk weight for any fund will reflect one or more of the three approaches described briefly above (and described more fully in the Standards).

7.The illustration below gives a general overview of how the average risk weight and leverage are combined, subject to a cap of 1250%, and then applied to the bank’s equity investment in the funds.

8.For example, if the average risk weight of the assets held by the fund is 80%, and the fund is financed through half debt and half equity, then the ratio of assets to equity would be 2.0 and the risk weight applied to a bank’s investment in the fund would be:

80% x 2.0 = 160%

If instead the same fund is financed 90% by debt, then the ratio of assets to equity would be 10, and the risk weight applied to the bank’s investment in the fund would be 800% (80% x 10).

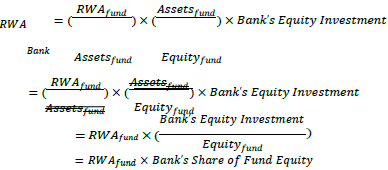

9.Another way to view the capital requirement for equity investments in funds is that a bank generally must count a proportional amount of the risk-weighted assets (RWA) of the fund as the bank’s own RWA for capital purposes, in proportion to the bank’s share of the equity of the fund. Ignoring the 1250% limit for simplicity, the RWA calculation can be written as:

The rearrangement of the terms in the equation highlights that the bank’s RWA from the EIF is the bank’s proportional share of the fund’s RWA – if the bank holds a 5% share of the equity in the fund, then the bank’s RWA is 5% of the total RWA of the fund. This is a logical treatment – if a bank effectively owns 5% of a fund, the bank must hold capital as if it owns 5% of the fund’s risk-weighted assets.

C. Look-Through Approach

10.The LTA requires a bank to assign the same risk weights to the underlying exposures of a fund as would be assigned if the bank held the exposures directly. The information used for to determine the risk weights must meet the requirements stated in the Standards, including sufficiency, frequency, and third party review. However, that information is not required to be derived from sources that are subject to an external audit.

11.RWA and assets of investment funds should, to the extent possible, be evaluated using the same accounting standards the bank would apply if the assets were held directly. However, where this is not possible due to constraints on available information, the evaluation can be based on the accounting standards applied by the investment fund, provided the treatment of the numerator (RWA) and the denominator (total unweighted assets) is consistent.

12.If a bank relies on third-party calculations for determining the underlying risk weights of the exposures of the fund, the risk weights should be increased by a factor of 1.2 times to compensate for the fact that the bank cannot be certain about the accuracy of third-party information. For instance, any exposure that is ordinarily subject to a 20% risk weight under the risk-based capital standards would be weighted at 24% (1.2×20%) when the look-through is performed by a third party.

D. Mandate-Based Approach

13.Under the MBA, banks may use the information contained in a fund’s mandate, or in the rules or regulations governing such investment funds in the relevant jurisdiction. Information used for this purpose is not strictly limited to a fund’s mandate or to national regulations or other requirements that govern such funds. For example, a bank could obtain information from the fund’s prospectus or from other disclosures of the fund.

14.To ensure that all underlying risks are taken into account (including CCR) and that the MBA renders capital requirements no less than the LTA, the Standards requires that risk-weighted assets for funds’ exposures be calculated as the sum of three items:

- •On-balance-sheet exposures;

- •Off-balance-sheet exposures including notional value of derivatives exposures; and

- •CCR exposure for derivatives.

15.As with the LTA, for purposes of the MBA the RWA and assets of investment funds should, to the extent possible, be evaluated using the same accounting standards the bank would apply if the assets were held directly. However, where this is not possible due to constraints on available information, the evaluation can be based on the accounting standards applied by the investment fund, provided the treatment of the numerator (RWA) and the denominator (total unweighted assets) is consistent.

16.In general, the MBA aims to take a conservative approach by calculating the highest risk-weighted assets the fund could achieve under the terms of its mandate or governing laws and regulations. Under the MBA, the bank should assume that the fund’s assets are first invested to the maximum extent allowable in assets that would attract the highest risk weight, and then to the maximum extent allowable in the next riskiest type of asset, and so on until all of the fund’s balance sheet assets have been assigned to a risk-weight category. If more than one risk weight could be applied to a given exposure, the bank must use the maximum applicable risk weight. For example, if the mandate does not place restrictions on the rating quality of the fund’s investments in corporate bonds, the bank should apply a risk weight of 150% to the fund’s corporate bond positions.

17.For derivatives, when the replacement cost is unknown, the Standards takes a conservative approach by setting replacement cost equal to the notional amount of the derivatives contracts. When the notional amount of a fund’s derivative exposure is unknown, the approach again is conservative: the bank should use the maximum notional amount of derivatives allowed under the fund’s mandate. When the PFE for derivatives is unknown, the PFE add-on should be set at 15% of the notional value. Thus, if the replacement cost and PFE add-on both are unknown, a total multiplication factor of 1.15 must be applied to the notional amount to reflect the CCR exposure.

18.Instead of determining a CVA charge associated with the fund’s derivative exposures, the Standards allows banks to multiply the CCR exposure by a factor of 1.5 before applying the risk weight associated with the counterparty. However, a bank is not required to apply the 1.5 factor for situations in which the CVA capital charge would not otherwise be applicable. Notably, this includes derivative transactions for which the direct counterparty is a qualifying central counterparty.

E. Leverage Adjustment

19.A leverage adjustment is applied to the average risk weight of the fund under either the LTA or the MBA. A similar leverage adjustment is not necessary for the FBA, because the risk weight of 1250% applied under the FBA to equity investments in funds is fixed at that maximum value.

20.When determining the leverage adjustment under the MBA, banks are required to make conservative assumptions using information from the fund’s mandate. Specifically, the Standards requires that banks assume the fund will use financial leverage up to the maximum amount permitted under the fund’s mandate, or up to the maximum permitted under the regulations governing that fund. This maximum may be significantly greater than the actual leverage for the fund at any point in time.

III. Frequently Asked Questions

Question 1: BCBS 266 states “Equity holdings in entities whose debt obligations qualify for a zero risk weight can be excluded from the LTA, MBA and FBA approaches (including those publicly sponsored entities where a zero risk weight can be applied), at the discretion of the national supervisor.” Are such equity holdings excluded under the Central Bank’s Standards?

No, the Central Bank of the UAE has chosen not to adopt this point of national discretion. Bank investments in such funds are subject to the requirements of the Standards.Question 2: If a bank makes a “seed capital investment” in a fund that is out of scope of consolidation, and is considered a significant investment in the common shares of a banking, financial, or insurance entity, is it within scope as an equity investment in a fund?

If the investment is one that the bank would be required to deduct from capital, then the investment is not in scope for this Standards.Question 3: If a bank makes a “seed capital investment” in a fund, and that fund is managed by a Fund Manager hired by the bank, is the investment considered to be a direct investment in the fund, or indirect?

Assuming that the fund in question is not consolidated into the bank under accounting rules for financial reporting, such an investment is considered a direct investment under the Standards.Question 4: Under the Standards, what methodology should a bank use to compute counterparty credit risk exposure for funds in which the bank has an equity investment?

The Standards states that banks must risk weight all exposures as if the bank held those exposures directly. Thus, the risk weights and the exposure amounts for counterparty credit risk should be determined using the standards that would apply to the bank. For banks in the UAE, the applicable standards for counterparty credit risk is the Central Bank’s Standards for Counterparty Credit Risk Capital, which reflects the Standardised Approach to Counterparty Credit Risk (SA-CCR).Question 5: If a bank relies on a third-party information provider for information used to calculate the leverage adjustment for a fund, does the 1.2 multiplication factor apply?

No, as the Standards states, the factor of 1.2 applies when the bank relies on a third party for the risk weights of the underlying exposures. This is a conservative adjustment to recognize the uncertainty associated with such information about risk weights. It does not apply to the leverage ratio calculation.Question 6: The FBA applies a risk weight of 1250%, which is significantly higher than the current risk weights of 100% or 150% that apply to equity investments in funds under previous capital requirements. Should this risk weight be lower?

The risk weight of 1250% is aligned with international capital standards as developed by the Basel Committee, and is being adopted by the Central Bank under this Standards. Considering the higher minimum capital requirements in the UAE (10.5% vs 8%), the final risk weight is capped at 952%.Question 7: What happens when the bank has mandated intermediaries to invest in fixed income? Would this investment be included or excluded in the calculation of Equity Investments?

Banks having mandated Intermediaries have to go through same framework approach. This means that if the bank has information for these intermediaries, the bank may use the LTA approach. If the bank does not have information, then it has to use the MBA or FBA approach.Question 8: The EIF standards allows for partial use of approaches for reporting EIF and the RWA calculations from each applied approach are summed, and then divided by total fund assets to compute “Avg RWfund”. Should the leverage of the fund be proportioned according to use of approach?

No, the leverage ratio is a single number that applies to the entire fund. When a bank uses more than one approach to determine the risk weight (that is, LTA, MBA, and/or FBA), the bank should report the amounts on separate lines in the reporting template.IV. Example Calculations

A. Example of Calculation of Risk-Weighted Assets Using the LTA

21.Consider a fund that aims to replicate an equity index using a strategy based on forward contracts. Assume the fund holds short-term forward contracts for this purpose with a notional amount of 100 that are cleared through a qualifying central counterparty. Further, assume that the fund’s financial position can be represented by the following T-account balance sheet:

Assets Liabilities and Equity Cash 20 Notes payable 5 Government bonds (AAA) 30 Variation margin receivable on forward contracts 50 Equity 95 100 100 Finally, assume that the bank’s equity investment in the fund comprises 20% of the shares of the fund, and therefore is 20% × 95 = 19.

Using the LTA, the fund’s balance sheet exposures of 100 are risk weighted according to the risk weights that would be applied to these assets by the bank. For cash, the risk weight is 0%; for the government bonds, the risk weight is also 0%. The margin receivable is an exposure to a qualifying CCP, which has 2% risk weight. The underlying risk weight for equity exposures (100%) is applied to the notional amount of the forward contracts.

Assume that the bank is able to determine that the amount of the CCR exposure to the CCP is 10, which then receives the 2% risk weight for exposures to a qualifying CCP. Note that there is no CVA charge because the forward contracts are cleared through the qualifying CCP.

The total RWA for the fund is:

20×0% + 30×0% + 50×2% + 100×100% + 10×2% = 101.2

Given the total assets of the fund of 100, the average risk-weight for the fund is:

Avg RWfund = 101.2 / 100 = 101.2%

With fund assets of 100 and fund equity of 95, leverage is calculated as the assets-to-equity ratio, or 100/95≈1.05. Therefore, the risk-weight for the bank’s equity investment in the fund is:

Risk Weight = 101.2% × (100/95) = 106.5%

Applying this risk weight to the bank’s equity investment in the fund of 19, the bank’s RWA on the position for the purpose of calculating minimum required capital is 106.5% × 19 = 20.24.

B. Example of Calculation of Risk-Weighted Assets Using the MBA

22.Consider a fund with current balance-sheet assets of 100, and assume that the bank is unable to apply the LTA due to a lack of adequate information. Suppose that the fund’s mandate states that the fund’s investment objective is to replicate an equity index. In addition to being permitted to invest in equities directly as assets and to hold cash balances, the mandate allows the fund to take long positions in equity index futures up to a maximum notional amount equivalent to 80% of the fund’s balance sheet. Since this means that with 100 in assets the fund could have futures with a notional value of 80, the total on-balance-sheet and off-balance-sheet exposures of the fund could reach 180.

Suppose that the fund’s mandate also places a restriction on leverage, allowing the fund to issue debt up to a maximum of 10% of the total value of the fund’s assets. This debt constraint implies that with 100 in assets, the fund’s maximum financial leverage would be at a mixture of 10 debt and 90 equity, for a maximum assets-to-equity ratio of 100/90≈1.11.

Finally, assume that the value of the bank’s investment in the fund is 20.

For the computation of RWA, the on-balance-sheet assets are assumed to be invested to the maximum extent possible in the riskiest type of asset permitted under the mandate. The mandate allows either cash (which has a zero risk weight) or equities, so the full 100 is assumed to be in equities, with a 100% risk weight.

Next, the fund is assumed to enter into derivatives contracts to the maximum extent allowable under its mandate – stated as 80% of total assets – implying a maximum derivatives notional of 80. This amount receives the risk weight associated with the underlying of the derivatives position, which in this example is 100% for publicly traded equity holdings.

The calculation of RWA must include an amount for the counterparty credit risk associated with derivatives. If the bank cannot determine the replacement cost associated with the futures contracts, then the replacement cost must be approximated by the maximum notional amount of 80. If the PFE is similarly indeterminate, an additional 15% of the notional amount must be added for PFE. Thus, the CCR exposure is 1.4 x (80×1.15) = 129. Assuming the futures contracts clear through a qualifying CCP, a risk weight of 2% applies to the CCR exposure, and no CVA charge is assessed for the CCP.

The total RWA for the fund is the sum of the components for on-balance-sheet assets, off-balance-sheet exposures, and CCR:

100×100% + 80×100% + 129×2% = 182.58

Given the total assets of the fund of 100, the average risk-weight for the fund is:

Avg RWfund = 182.58 / 100 = 182.58%

As noted above, the fund’s maximum leverage is approximately 1.11 at an assets-to-equity ratio of 100/90. Therefore, the risk-weight for the bank’s equity investment in the fund is:

Risk Weight = 182.58% × (100/90) = 202.87%

Applying this risk weight of 202.87% to the bank’s equity investment in the fund of 20, the bank’s RWA on the position for the purpose of calculating minimum required capital is 202.87% × 20 = 40.57.