III. Approaches

7. The calculation of the operational risk capital charge is covered under the Standards for Capital Adequacy of banks in the UAE.

8. The approaches represent a continuum of increasing sophistication and risk sensitivity. The charge is to be calculated using one of the following two approaches:

a. Basic Indicator Approach (BIA)

9. The Basic Indicator Approach (BIA) is a simple approach for calculating the capital charge for operational risk. It can be used by banks that are not internationally active, as well as by banks that are internationally active but may not yet have risk management systems in place for using the more advanced approaches for measuring operational risk.

10. While the approach is available for all banks as a 'point of entry', irrespective of their level of sophistication, Central Bank expects internationally active banks and banks with significant operational risk to discontinue indefinitely with the Basic Indicator Approach.

The Basic Indicator Approach Components

11. The operational risk capital charge under the BIA is based on two components:

- 1.The exposure indicator, represented by the Gross Income (GI) of a bank as a whole.

- 2.The fixed factor, alpha (α), set by the Basel Committee.

The formula for calculating the capital charge for operational risk under the BIA is as follows:

Where:

KBIA = The capital charge under the BIA;

GI = Annual gross income, where positive, over the previous three years;

n = Number of the previous three years for which gross income is positive; and

α =15%, relating the industry wide level of required capital to the industry wide level of the indicator.

1.Gross Income of the Bank

12. Gross income is a broad indicator that serves as a proxy for the likely exposure of a bank to operational risk. It is the total of net interest income plus net non-interest income of a bank as a whole. Net interest income is defined as interest income of a bank (for example, from loans and advances) minus the interest expenses (for example, interest paid on deposits). Net non-interest income is defined as fees and commissions earned minus the non-interest expenses (that is, fees and commissions paid) and other income.

13. Gross income used in the calculation of the capital charge for operational risk should be:

- -Gross of any provisions, for example, for unpaid interest. This is because such amounts should have normally formed part of a bank's income but have been set aside for likely credit losses.

- -Gross of operating expenses, including fees paid to outsourcing service providers. This is because outsourcing of activities does not fully transfer operational risk to the service provider. Outsourcing is the strategic use of outside resources to perform business functions that are traditionally managed by internal staff. Outsourcing offers the advantage of access to specialised and experienced personnel that may not be available internally, and enables banks to concentrate on their core business and reduce costs.

14. Only sustainable, renewable and recurrent sources of income are to be used as the basis for calculating the operational risk capital charge. Banks should perform a reconciliation between the gross income reported on the capital adequacy return and the audited financial statements. This information should be available to the Central Bank upon request. As such, gross income should exclude:

- -realised profits/losses from the sale of securities classified as 'held to maturity' and 'available for sale', which typically constitute items of the banking book under certain accounting standards. The intention is to hold such securities for some time or up to their full term and not for trading purposes. Their sale does not represent sustainable income from normal business.

- -Held to maturity securities are those that the bank intends to hold indefinitely or until the security reaches its maturity. Available for sale securities includes securities that are neither held for trading purposes nor intended to be held till maturity. These are securities that the bank intends to hold in the short or medium term, but may ultimately sell. Banking book relates to positions that are held to maturity with no trading intent associated with them. Most loans and advances are included in the banking book as they are intended to be held until maturity. At times, there may also be liquid positions assigned to the banking book if they are intended to be held over a longer term or to maturity.

- -Extraordinary or irregular items as well as income derived from insurance claims. Again, these items are to be excluded, as they are not sustainable sources of income for a bank.

15. Banks sometimes outsource certain activities, such as processing and maintaining data on loan collection services to external service providers. Alternatively, banks may act as service providers to other banks. This results in the payment or receipt of a fee for the outsourced service.

16. Basel provides the following guidance for the treatment of outsourcing fees paid or received, while calculating the gross income for the purpose of calculating the operational risk capital charge:

- -Outsourcing fees paid by a bank to a service provider do not reduce the gross income of the bank.

- -Outsourcing fees received by a bank for providing outsourcing services are included in the definition of gross income.

2.Alpha

17. Alpha is a fixed factor, set by the Basel Committee. It serves as a proxy for the industry-wide relationship between operational risk loss experience of a bank and the aggregate level of the operational risk exposure as reflected in its gross income.

Treatment of Negative Gross Income

18. The operational risk capital charge under the BIA is assumed that a bank has positive gross income for all of the previous three years. However, some banks may have negative gross income for some year(s), for example, resulting from poor financial performance. Figures for any year in which annual gross income is negative or zero shall be excluded from both the numerator and denominator when calculating the gross income average.

19. On this basis, the figures presented in the 3 years' calculations should reconcile (or be reconcilable) with the bank’s audited financial statements.

b. Standardised Approach (SA)

20.The Standardised Approach (SA) represents a refinement along the continuum of approaches for calculating the operational risk capital charge. While this approach also relies on fixed factors as a percentage of gross income, it allows banks to use up to eight such factors, called betas, depending upon their business lines.

21.The calculation of the operational risk charge under this approach is more risk sensitive than the BIA.

The Standardised Approach Capital Charge

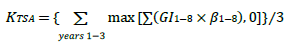

22.Under the Standardised Approach (SA), the operational risk capital charge is based on the operational risk capital charges for individual business lines in a bank. The formula for calculating the operational risk capital charge under the SA is as follows:

Where:

KTSA = the capital charge under the Standardised Approach

GI1-8 = the annual gross income in a given year, as defined in the Basic Indicator Approach (BIA), for each of the eight business lines

β 1-8 = a fixed percentage, set by the committee, relating the level of required capital to the level of the gross income for each of the eight business lines

The Standardised Approach Components

23.The Standardised Approach identifies two main components to be used in calculating the operational risk capital charge:

1.Gross Income of Eight Business Lines

24.Eight business lines are recommended for use by the Basel Committee in calculating the operational risk charge under the SA. These business lines are considered as being representative of the various kinds of businesses undertaken by banks. The identified business lines briefed below are:

- 1.Corporate finance: banking arrangements and facilities provided to large commercial enterprises, multinational companies, non-bank financial institutions, government departments etc.

- 2.Trading and sales: treasury operations, buying and selling of securities, currencies and commodities for proprietary and client accounts.

- 3.Retail banking: financing arrangements for private individuals, retail clients and small businesses such as personal loans, credit cards, auto loans, etc. as well as other facilities such as trust and estates and investment advice.

- 4.Commercial banking: financing arrangements for commercial enterprises, including project finance, real estate, trade finance, factoring, leasing, guarantees, bills of exchange etc.

- 5.Payment and settlement: activities relating to payments and collections, interbank funds transfer, clearing and settlement.

- 6.Agency services: acting as issuing and paying agents for corporate clients, providing custodial services etc.

- 7.Asset management: managing funds of clients on a pooled, segregated, retail, institutional, open or closed basis under a mandate.

- 8.Retail brokerage: broking services provided to customers that are retail investors rather than institutional investors.

25.Under the SA, the gross income is calculated for each of the eight business lines. It serves as a proxy for the likely scale of exposure of that business line of the bank to operational risk. Since all income has to be allocated to a business line, the sum of the gross income of the eight business lines should equal the gross income for the bank as a whole

26. Just like in the Basic Indicator Approach, gross income for SA comprises net interest income plus net non-interest income as defined in the Operational Risk section of the Standards re Capital Adequacy.

2.Beta

27.Beta serves as a proxy for the industry-wide relationship between the operational risk loss experience and the level of operational risk exposure as reflected in the gross income for a business line. It is representative of the amount of loss that can be incurred by a bank given that level of exposure (represented by gross income) in a business line.

28.The beta factors for the eight business lines as set by the Basel Committee are as follows:

Beta Business line Beta factor β 1 Corporate finance 18% β 2 Trading and sales 18% β 3 Retail banking 12% β 4 Commercial banking 15% β 5 Payment and settlement 18% β 6 Agency services 15% β 7 Asset management 12% β 8 Retail brokerage 12% 29.The beta factors have been set within a range of 12-18% depending upon the degree of operational risk perceived in a business line. Thus, a 12% beta factor for retail banking indicates that, in general, the operational risk in retail banking is lower than the operational risk in commercial banking. The latter, which has a beta of 15%, carries a lower operational risk than, for example, payment and settlement, which carries a beta factor of 18%.

Treatment of Negative Gross Income from Business lines

30.Some banks may have negative gross income for some years in some business lines. This will result in a negative capital charge for the business line for that year. If the gross income and the resulting capital charge of a specific business line is negative, the aggregate of the capital charges across business lines for that year could still be positive, so long as the gross income from other business lines is positive.

31.The following guidance applies for treatment of negative capital charges under the Standardised Approach:

- -In any given year, negative charges in business lines may offset positive capital charges in other business lines without any limit.

- -If the total capital charge, after offsetting negative and positive capital charges of business lines, is negative for a given year, then the numerator for that year will be set to zero.

- -If negative gross income distorts the operational risk capital charge calculated under the SA, the Central Bank will consider appropriate supervisory action under Pillar 2.

Calculating the Operational risk capital charge under the Standardised Approach (SA)

The calculation of the capital charge for operational risk under the SA follows the following steps:

Step 1: Calculate the capital charge for each business line using its gross income and applicable beta factor in year 1.

If the gross income from a business line is negative, the capital charge for that business line in year 1 will be negative.

Step 2: Sum the eight capital charges of business lines for Year 1.

In a year, negative capital charges in some business lines may offset positive capital charges for other business lines without any limit.

Steps 3 and 4: Follow steps 1 and 2 for the other two years.

Step 5: Calculate the 3-year average of the aggregated capital charges. Where the aggregate capital charge across all business lines in a given year is negative, then the input to the numerator for that year will be zero. The denominator will remain 3, representing the three years included in the calculation.

Central Bank supports the use of the Beta given in the Standards re Capital Adequacy as well as here in this guidance above as the basis for the capital calculations under SA.

c. Alternative Standardised Approach (ASA) Capital Charge

32.The Alternative Standardised Approach provides a different exposure indicator for two of the eight business lines, retail banking and commercial banking. These activities essentially comprise traditional banking business and still represent the main business of banks in several jurisdictions.

Calculation of Operational Risk Capital Charge under Alternative Standardised Approach (ASA)

33.Using the ASA, the operational risk capital charge for retail banking and commercial banking will be based on the following formulas:

Where:

Krb = is the capital charge for retail banking

m = 0.035

β rb = is the beta factor for retail banking (12%)

LArb = is the total outstanding retail loans and advances (non-risk weighted and gross of provisions), averaged over the past three years

Where:

KCB = is the capital charge for commercial banking

m = 0.035

βCB= is the beta factor for commercial banking (15%)

LACB = is the total outstanding commercial loans and advances (non-risk weighted and gross of provisions), averaged over the past three years

For the other six business lines, the calculation of the operational risk capital charge will be based on the gross income and beta factor of that business line, as prescribed under the SA.

Further Options under the Alternative Standardised Approach (ASA)

34.Further options are available at under the ASA for calculating the operational risk capital charge to address problems in disaggregation of the exposure indicator among business lines by banks. However, the greater the disaggregation, the better will be the alignment of the capital charge with a bank's operational risk profile.

35.Available options relate to using loans and advances in commercial and retail banking business lines and gross income in the other six business lines as the exposure indicators with different beta factor combinations:

- -Option 1 – using a common beta factor of 15% for commercial loans and retail loans, and the SA beta factors for the other six business lines

- -Option 2 – using the SA beta factors of 15% and 12%, respectively, for commercial loans and retail loans and a common beta factor of 18% for the other six business lines

- -Option 3 – using a common beta of 15% for commercial loans and retail loans and a common beta factor of 18% for the other six business lines

For further details, kindly refer to the Appendix below.