Book traversal links for C. Liquidity Coverage Ratio (LCR)

C. Liquidity Coverage Ratio (LCR)

C 33/2015 GUI Effective from 1/12/2015- 90) The LCR ratio comes directly from the BCBS recommendations mentioned at the beginning of this manual. It is therefore recommended that banks familiarize themselves with the BCBS final recommendations on liquidity titled “Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools' issued January 2013. This guidance manual concentrates on the more common factors that affect the liquidity of banks in the UAE. There will undoubtedly be some specific issues that will affect individual banks but are not detailed in this manual. The manual also attempts to simplify some of these factors for the sake of brevity as well as exercise national discretion where warranted and the possibility for such discretion exists. In the event that any confusion is created as a result then the BCBS document referred to above takes precedence.

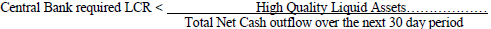

- 91) LCR is a coverage ratio of liquid assets to net cash outflows. It represents a 30 days stress scenario with combined assumptions covering both bank specific and market wide stresses. Therefore, the LCR aims to promote short-term resilience of a bank’s liquidity risk profile by ensuring that it has sufficient high-quality liquid assets to survive a significant stress scenario lasting for one month.

- 92) The LCR assumptions are applied to contractual data representing the main liquidity risk drivers (liabilities and contingent liabilities) at banks to determine the total cash outflows within the 30 days stress period.

- 93) Total cash inflow is also calculated based on assumptions applied to contractual inflows during the 30 day period. The total cash outflow is then reduced by the total cash inflow to arrive at the net cash outflow in 30 days. A cap on the amount of inflows that can be used to offset outflows is set at 75% of the outflows2.

- Total net cash outflows over the next 30 calendar days = Outflows – Inflows (restricted to 75% of outflows)

- 94) Banks should always be able to cover the net cash outflow with high quality liquid assets at the minimum LCR determined by the Central Bank.

2 The 75% max reduction limit is to ensure that the banks always have a net cash outflow of at least 25% which they are required to hold liquid assets against.