Book traversal links for VI. Illustrations of Replacement Cost Calculations with Margining

VI. Illustrations of Replacement Cost Calculations with Margining

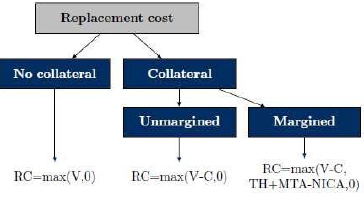

C 52/2017 GUI Effective from 1/4/2021Calculation of Replacement Cost (RC) depends whether or not a trade is collateralized, as illustrated below and in the summary table.

| Transaction Characteristics | Replacement Cost (RC) |

| No collateral | Value of the derivative transactions in the netting set, if that value is positive (else RC=0) |

| Collateralized, no margin | Value of the derivative transactions in the netting set minus the value of the collateral after applicable haircuts, if positive (else RC=0) |

| Collateralized and margined | Same as the no margin case, unless TH+MTA-NICA (see definitions below) is greater than the resulting RC |

- •TH = positive threshold before the counterparty must send collateral to the bank

- •MTA = minimum transfer amount applicable to the counterparty

- •NICA = net independent collateral amount other than variation margin (unsegregated or segregated) posted to the bank, minus the unsegregated collateral posted by the bank. The quantity TH + MTA – NICA represents the largest net exposure, including all collateral held or posted under the margin agreement that would not trigger a collateral call.