Part I: Registered Hawala Providers and Licensed Financial Institutions

1 Introduction

1.1 Purpose

Article 44.11 of the Cabinet Decision No. (10) of 2019 Concerning the Implementing Regulation of Decree Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations charges Supervisory Authorities with "providing Financial Institutions...with guidelines and feedback to enhance the effectiveness of implementation of the Crime-combatting measures.''

The purpose of this Guidance is to assist the understanding and effective performance by the United Arab Emirates Central Bank's ("CBUAE'') licensed financial institutions ("LFIs'') of their statutory obligations under the legal and regulatory framework in force in the UAE. It should be read in conjunction with the CBUAE's Procedures for Anti-Money Laundering and Combating the Financing of Terrorism and Illicit Organizations (issued by Notice No. 74/2019 dated 19/06/2019) and Guidelines on Anti-Money Laundering and Combating the Financing of Terrorism and Illicit Organizations for Financial Institutions (issued by Notice 79/2019 dated 27/06/2019) and any amendments or updates thereof.1 As such, while this Guidance neither constitutes additional legislation or regulation nor replaces or supersedes any legal or regulatory requirements or statutory obligations, it sets out the expectations of the CBUAE for LFIs to be able to demonstrate compliance with these requirements. In the event of a discrepancy between this Guidance and the legal or regulatory frameworks currently in force, the latter will prevail. This Guidance may be supplemented with additional separate guidance materials, such as outreach sessions and thematic reviews conducted by the CBUAE.

Furthermore, this Guidance takes into account standards and guidance issued by the Financial Action Task Force ("FATF''), industry best practices and red flag indicators. These are not exhaustive and do not set limitations on the measures to be taken by LFIs in order to meet their statutory obligations under the legal and regulatory framework currently in force. As such, LFIs should perform their own assessments of the manner in which they should meet their statutory obligations.

This Guidance comes into effect immediately upon its issuance by the CBUAE with LFIs expected to demonstrate compliance with its requirements within one month from its coming into effect.

1 Available at https://www.centralbank.ae/en/cbuae-amlcft.

1.2 Applicability

Unless otherwise noted, this Guidance applies to all natural and legal persons which are licensed and/or supervised by the CBUAE in the following categories:

• Registered Hawala Providers (``RHP''); • National banks, branches of foreign banks; and • Exchange houses.

Key Definitions and AcronymsAML/CFT: Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations.

Beneficial owner: The natural person who owns or exercises effective ultimate control, directly or indirectly, over a client; or the natural person on whose behalf a transaction is being conducted; or the natural person who exercises effective ultimate control over a legal person or legal arrangement.

Beneficiary Hawala Provider: The beneficiary's Hawala Provider, or receiving Hawala Provider, that receives the funds or equivalent value from the Originating Hawala Provider.

CBUAE Regulations: Any resolution, regulation, circular, rule, instruction, standard or notice issued by the CBUAE.

Hawala Activity: The arrangements for transfer and receipt of funds or equivalent value and settlement through trade and cash.

Hawala Provider Certificate: The Certificate issued by the CBUAE for carrying on Hawala activity in the UAE.

Legal person: Any entities other than natural persons that can establish in their own right a permanent customer relationship with a financial institution or otherwise own property. This can include companies, bodies corporate, foundations, partnerships, or associations, along with similar entities.

Money or Value Transfer Service (MVTS): financial services that involve the acceptance of cash, cheques, other monetary instruments or other stores of value and the payment of a corresponding sum in cash or other form to a beneficiary by means of a communication, message, transfer, or through a clearing network to which the MVTS provider belongs.

Originating Hawala Provider: The originator's Hawala Provider, or sending Hawala Provider, that initiates and carries out the transfer of funds or equivalent value to the Beneficiary Hawala Provider.

Registered Hawala Provider: Any natural person holding a valid residency visa or Legal Person, who is registered in the CBUAE's Hawala Providers Register in accordance with the provisions of its Circular No. 24/2019, including its agents or a network of agents.

Registered Hawala Provider Agent: Any natural or legal person carrying out activity outside the UAE on behalf of a Registered Hawala Provider.

1.3 Legal Basis

This Guidance builds upon the provisions of the following laws and regulations:

• Decree Federal Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations (``AML-CFT Law''). • Cabinet Decision No. (10) of 2019 concerning the Implementing Regulation of Decree Federal Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations (``AML-CFT Decision''). • Cabinet Decision No. (74) of 2020 Regarding Terrorism Lists Regulation and Implementation of United Nations Security Council (UNSC) Resolutions on the Suppression and Combating of Terrorism, Terrorists Financing & Proliferation of Weapons of Mass Destruction, and Related Resolutions (``Cabinet Decision 74''). • Registered Hawala Providers Regulation issued by the CBUAE (``Circular No. 24/2019'').

Under Articles 4 and 5 of Circular No. 24/2019, RHP and their customers and agents must strictly abide by all UAE laws, including civil laws, Commercial Companies' Law, federal laws on AML/CFT, and any Regulations and directions issued by the CBUAE (``the legal and regulatory framework in the UAE''). RHP may be guided by the FATF standards on AML/CFT and Proliferation and must abide by guidance issued by the CBUAE in this regard.

1.4 Organization of this Guidance

The FATF's Mutual Evaluation Report of the UAE issued in April 2020 stated that the MVTS sector, including the Hawala service providers, is weighted as highly important in terms of risk and materiality in the UAE. This Guidance is addressed to the i) RHP and ii) LFIs that provide accounts or financial services to RHP. Part I of this Guidance applies to both RHP and LFIs, whereas Part II applies specifically to RHP and Part III specifically to LFIs.

2 Overview of Hawala activity

The FATF defines hawala providers (and other similar service providers) as money transmitters, particularly with ties to specific geographic regions or ethnic communities, that arrange for transfer and receipt of funds or equivalent value and settle through trade, cash, and net settlement over a long period of time. While hawala providers-also known as hawaladars-often use banking channels to settle between them, what makes them distinct from other money transmitters is their use of other settlement methods, including trade, cash, and long-term net settlement.2 Hawala is an activity based on trust and was established to avoid high charges by people who cannot afford them, the ability to reach beneficiaries in remote places quickly where banks do not operate, and the existence of strict currency controls in some countries. Because communication is often by text message and there is no need for funds to clear, hawala transfers may also be available faster than the ones made using the formal financial system. Although hawala providers generally specialize in transferring money between certain jurisdictions, they are also part of larger networks that can arrange transfers to almost any part of the world. Such transfers are likely to be slower and more expensive than transfers within the corridors in which the provider specializes. Although the hawala system minimizes use of the formal financial system, including use of international wires, it is important to note that almost all hawaladars will ultimately seek to conduct transfers, particularly international transfers through LFIs, and possibly to use other financial services. In doing so, they could expose the LFI with which they do business with to the risks of their own business activities and customers.

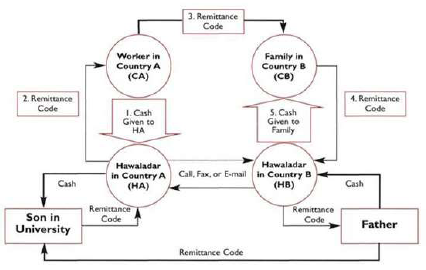

Common Attributes of Hawala Providers• Fees for funds transfers are less than other channels and funds are available faster. • Operates in communities in which the Hawala Provider is known, visible and accessible to the customers. • Operates in areas with high numbers of expatriates/migrant workers of a specific ethnic group by providing cultural convenience with absence of language barriers, trust among community members, and solidarity among migrants with limited education levels and literacy. • Operates with jurisdictions and regions underserved by other types of financial service providers, such as high-risk areas experiencing wars, civil unrest, conflicts, economic crisis, or weak or non-existent banking systems. • Operates as a hawala provider to facilitate remittance services as a side business to other business activities. • Provides one-off remittance services and communicates with the customer only as much as needed to conduct the transaction. Sample Hawala Transaction:3

2 See also the FATF report The Role of Hawala and Other Similar Service Providers in ML/TF (fatf-gafi.org)

3 Source: IMF III Features of the Informal Hawala System : Informal Funds Transfer Systems : An Analysis of the Informal Hawala System: (imf.org)3 Global risks of Hawala activity

Hawaladars' business model is built around satisfying customers' needs to move money rapidly across borders, a service that may also be misused by criminals as is to individuals seeking to conduct legitimate personal remittances. In recent years hawala providers have been repeatedly abused to transfer illicit funds, including funds involved in terrorist financing. Certain providers have been found to be fully complicit in these schemes, and even to operate as professional money launderers. In addition, hawala providers generally have the greatest competitive advantage in areas where more formal MVTS providers do not operate or have limited infrastructure, often because these jurisdictions are remote or classified as very high risk. Although this certainly does not mean that every transaction to those areas is illicit, it does suggest that the institutional risk profile of the average hawala provider is likely to be higher than that of other MVTS providers. In many jurisdictions, hawala providers operate underground, because they are providing an illegal service or because they and their customers don't want to be required to comply with rules related to taxes, currency controls, and AML/CFT compliance. This is especially common among hawala providers operating in jurisdictions where hawala is prohibited, unregulated, or illegal.

The inherent risk of hawala providers is influenced primarily by the regulatory environment and illicit finance risks in the jurisdictions in which they do business, the products and services they provide, and their customer base:

1. Regulatory Environment

The regulatory environment for hawala providers clearly varies across jurisdictions. In some jurisdictions, they are not able to maintain a license or registration and therefore operate entirely underground. While operating underground is generally prohibited under the laws of the country where the hawala provider operates, it does not necessarily mean that a provider is a money launderer. Still, underground providers will seek to conceal their activities from financial institutions, and are extremely unlikely to comply with any AML/CFT obligations. Such entities may present themselves to LFIs as ``general trading companies'' or describe other business types that can justify regular international transfers, including dealing in precious metals or stones, trading in used cars, or in high value carpets.

Even in jurisdictions where hawala is legal and regulated such as the UAE, hawala providers may have only a basic understanding of their financial crime risks and obligations, and may not use systems and technologies that support compliance with those obligations. Furthermore, because hawaladars may lack strong AML/CFT preventive measures, they may be sought out by customers specifically hoping to take advantage of this possible weakness. As a result, hawala providers are almost always found to be classified as very high-risk customers by banks. A hawala provider can strive to manage this risk by applying strong, targeted controls and maintaining an effective AML/CFT program that meets or exceeds UAE requirements and global standards (see Part II section 3 below).

2. Geography

Hawala providers, like all financial institutions, are heavily exposed to the risks prevalent in the geographies where they operate. The risk of a hawala provider, therefore, will depend in part on the illicit finance risks--including ML/TF and sanctions evasion--in the jurisdictions where it is established or has subsidiaries. In addition, a provider's risk will also be impacted by the jurisdictions with which it most frequently does business. For example, the risk of a hawaladar operating in the UAE and primarily executing transfers to and from Country X should be assessed based on the illicit finance risk in both the UAE and Country X.

3. Products, Services, and Delivery Channels

Hawala providers, by definition, all provide money or value transfer services using hawala networks, which is subject to higher risks. The risk of hawala transactions may be increased or decreased by the size and purpose of the transaction. Some hawaladars only carry out low-value personal remittances, while others service businesses by supporting commercial operations, which may involve relatively high-value transactions. Low-value personal remittances may be considered lower-risk, although low-value remittances to jurisdictions at high-risk for terrorist financing should be treated as equally high risk. RHP in the UAE may perform only limited services (listed in section 4.1 below), but hawala providers established elsewhere may not have such restrictions on their activity.

The risk involved in providing the hawala service is further impacted by the delivery channels through which it is offered. Channels that promote anonymity (accepting transaction orders by text or telephone; accepting cash; allowing agents or third parties to order transactions on behalf of the originator) increase the risk of the service. Some international law enforcement agencies have reported cases of hawala providers operating in virtual currencies; although still rare, such a delivery channel would be extremely high risk, as it would combine the general risks of hawala providers with those of virtual currencies, which offer illicit actors anonymity and access to a practically unregulated financial sector.

In addition, hawala services may not be the only financial product hawala providers offer. In many jurisdictions providers also offer small loans (often with pawned items as security) and sell stored value cards, or provide safekeeping services for cash. They may also engage in non-financial lines of business such as selling calling cards, mobile phones and SIM cards. All of these lines of business are cash intensive4 and high-risk, and are generally not subject to AML/CFT controls. Even in a jurisdiction where hawala providers are regulated, they may commingle cash proceeds of these other services with hawala funds. This means that a hawala provider with an account at an LFI could use that account to support all aspects of its business, not simply provision of hawala services.

4. Customer Base

Most hawala providers are likely to serve a customer base made up of lower-income individuals seeking to conduct or receive fairly low-value transfers. Such a customer base is not necessarily low-risk, especially when customers have ties to jurisdictions that are at high risk for terrorist financing. The risk of the provider's customer base, however, will be further increased if the provider conducts larger transfers on behalf of business entities (e.g. trade-based transactions), if it has a high proportion of legal person customers, or if its customers include politically exposed persons.

4 The CBUAE will issue Guidance for LFIs providing services to Cash Intensive Businesses.

4 Regulation and Supervision of RHP in the UAE

The CBUAE permits legitimate Hawala Activity as an important element of its continuous efforts to support financial inclusion and bring the unbanked population into the regulated financial system. To this end, Hawala is regulated by the Registered Hawala Providers Regulation issued by the CBUAE (``Circular No. 24/2019''). As per its articles 2.1 and 7.1 and Article 26 of the AML-CFT Decision, all providers carrying on Hawala Activity in the UAE must hold a Hawala Provider Certificate issued by the CBUAE; it is not permitted to carry on Hawala Activity without being registered with the CBUAE. RHP are supervised by the CBUAE, who has the right to examine the business of RHP and their agents and customers whenever it deems appropriate to ensure proper compliance with their statutory obligations under the legal and regulatory framework in the UAE, or impose supervisory action or administrative and financial sanctions for violations. Similar to its all LFIs, the CBUAE applies the principle of proportionality in its supervision and enforcement process, whereby small RHP may demonstrate to the CBUAE that the objectives are met without necessarily addressing all of the specifics cited in the legal and regulatory framework in the UAE.

4.1 Permitted and non-permitted services by RHP

RHP are only permitted to provide well-defined services, which include non-commercial personal remittances and money transfer services to support commercial operations (such as trade transactions with jurisdictional corridors serviced by the hawala community).

RHP are not permitted to engage in any of the following transactions:

• Take deposits, exchange currencies or sell and purchase travellers' cheques; • Provide any financial services other than money transfers (e.g. exchange of virtual assets/cryptocurrencies, loans, purchase of debts); or • Execute transactions involving or on behalf of any other hawala provider in the UAE (as they are required by Circular No. 24/2019 to manage their business personally and never assign such task to another person, also known as "nesting''). This excludes the agents of the RHP in a foreign country (see also Part II section 3.3.5 below).