4 LGD Models

4.1 Scope

4.1.1

For risk management purpose and to comply with accounting and regulatory requirements, the majority of institutions develop models to estimate the potential loss arising in the event of the default of a facility or obligor. These are referred to as Loss Given Default models (“LGD”). These models serve several purposes including, but not limited to provision estimation, credit portfolio management, the economic capital estimation and capital allocation. For the purpose of the MMG, and to ensure appropriate model management, the following components are considered as separate models:

(i) TTC LGD models, and (ii) PIT LGD models.

The definitions of through-the-cycle (“TTC”) and point-in-time (“PIT”) are similar to those used under the section on PD models.

4.1.2

Institutions should develop and manage these models through a complete life-cycle process in line with the requirements articulated in the MMS. In particular, the development, ownership and validation process should be clearly managed and documented.

4.1.3

Institutions are expected to meet minimum expected practices for the development of LGD models. For that purpose, the construction of LGD models should include, at a minimum, the following steps:

(i) Regular and comprehensive collection of data, (ii) Accurate computation of realised historical LGD, (iii) Analysis of the LGD drivers and identification of the most relevant segmentation, (iv) Development of TTC LGD model(s), and (v)

Development of PIT LGD model(s).

4.1.4

This section elaborates on the concepts and methods that institutions should incorporate in their modelling practice. In particular, institutions should pay attention to the appropriate estimation of recovery and losses arising from restructured facilities. Restructuring should not always be considered as a zero-sum game leading to no financial impact. In some cases the present value (“PV”) mechanics can lead to limited impact; however, restructuring events generate execution costs, delays and uncertainty that should be fully identified and incorporated into LGD modelling.

4.1.5

Institutions are strongly recommended to apply floors on TTC LGD and PIT LGD across all portfolios for several reasons. There is limited evidence that default events lead to zero realised losses. An LGD of zero leads to zero expected loss and zero capital consumption, thereby creating a biased perception of risk and misguided portfolio allocation. LGD floors contribute to sound decision making for risk management and lead to more realistic provisioning. The value of the floor should be five percent (5%) for all facilities, except in the following circumstances:

(i)

The facility is fully secured by cash collateral, bank guarantees or government guarantees, and/or (ii) The institution provides robust evidence that historical LGDs are lower than 5%.

In all circumstances, LGD should not be lower than one percent (1%).

4.2 Data Collection

4.2.1

A robust data collection process should be put in place in order to support the estimation of LGD parameters. This process should follow the requirements pertaining to the Data Management Framework articulated in the MMS. If the data listed below is not currently available in the institution’s data bases, a formal project should be put in place in order to collect and store this data from the date of the MMG issuance.

4.2.2

Governance: The data types to be collected for the estimation of LGD are often spread across several teams and departments within institution. Consequently, close collaboration is expected between departments to (i) fully retrieve historical default cases, (ii) understand the reasons and the context for default and (iii) reconstruct long recovery processes that can last several years. In particular, close collaboration is expected between the risk analytics department in charge of model development and the department in charge of managing non-performing credit facilities.

4.2.3

Default definition: Institutions should ensure consistency between (i) the default definition used to collect data for LGD estimation and (ii) the default definition used to estimate PD for the same segment. PD and LGD are necessarily linked to each other and their estimation should be coherent. This is particularly relevant in the context of facility restructuring. If restructured facilities are included in the estimation of LGD, they should also be included in the estimation of PD.

4.2.4

Data types: The collection of data should cover all the elements necessary to estimate recoveries and historical LGDs, following each default event. At a minimum, the data collection process should include the following elements:

(i)

Default events: An exhaustive list of default events should be collected to support a robust estimation of LGD. They should be consistent with the default events employed for PD modelling. Institutions are expected to collect as many default events as possible covering at least one economic cycle. (ii)

Exposure At Default: As per the definition section. For non-contingent facilities, the EAD should be the outstanding amount at the date of default. For contingent facilities, the EAD should be the outstanding amount at the date of default plus any other amounts that become due during the recovery process. This should include any additional drawings that occurred after default and before foreclosure or cure. It should also include any part of the original exposure that had been written-off before the default event was recorded. (iii)

Outcome categorisation: Each default event should be linked to the categories presented in the next article, depending on the outcome of the recovery process, namely (i) cured & not restructured, (ii) cured & restructured, (iii) not cured & secured, and (iv) not cured & not secured. (iv)

Obligor information: For each default event, client related information should be collected including, at a minimum, client segment, industry and geography. (v)

Facility details: This should include the type of facility and the key elements of the facility terms such as the tenor, the seniority ranking and the effective interest rate. (vi)

Restructuring: Each restructuring and rescheduling event should be identified and used in the categorisation of outcomes presented in the next articles. (vii)

Collateral: For each default event related to collateralised facilities, institutions should collect all relevant collateral information, including, but not limited to, the type of collateral, the last valuation prior to the default event and the associated valuation date, the liquidation value after default and the associated liquidation date, the currencies of collateral values and unfunded credit protections. If several valuations are available, institutions have a method to estimate a single value. (viii)

Historical asset prices: In order to estimate collateral haircut, historical time series should be collected, including amongst others, real estate prices, traded securities and commodity prices. (ix)

Collected cash flows: For each default event, the data set should include the cash flow profile received through time, related to this specific default event. Provided that collected cash inflows are related to the specific default event, they can arise from any party, including the obligor itself, any guarantor or government entities. (x)

Direct costs: These costs are directly linked to the collection of the recovery cash flows. They should include outsourced collection costs, legal fees and any other fees charged by third parties. If the facility is secured, the data set should include costs associated with the sale of collateral, including auction proceedings and any other fees charges by third party during the collateral recovery process. (xi)

Indirect costs: Institutions are encourage to collect internal and external costs that cannot be directly attributed to the recovery process of a specific facility. Internal costs relate to the institution’s recovery process, i.e. mostly the team that manages non-performing credit facilities and obligors. External costs relate mostly to overall costs of outsourced collection services.

4.2.5

Categorisation: The outcome of default events should be clearly categorised. Institutions are free to define these categories, provided that these include, at a minimum, the below concepts.

Table 3: Typical outcomes of default events

Outcome Description Detailed outcome Category Cured The obligor has returned to a performing situation after a cure period-as defined in the CBUAE Credit Risk regulation. No restructuring / rescheduling Cured & not restructured Restructuring / rescheduling Cured & restructured Not cured The obligor has not returned to a performing status after defaulting. The facility is secured by collateral Not cured & secured The facility is not secured Not cured & unsecured Unresolved The outcome remains uncertain until a maximum recovery period beyond which all cases should be considered closed for LGD estimation. Unresolved 4.3 Historical Realised LGD

4.3.1

The next step in the modelling process involves the computation of historical realised LGD based on the data previously collected. The objective is to estimate the recovery and loss through a ‘workout’ approach for each of the identified default event.

4.3.2

The computation of LGD relies on the appropriate identification and quantification of the total recoveries and expenses linked to each default event. Institutions should implement a robust process to perform the necessary computation to estimate LGD at the lowest possible granularity level.

4.3.3

Institutions can develop their own methodologies for the estimation of historical realised LGD. However, their approach should incorporate, at a minimum, the components listed in this section and the corresponding categories of workout outcomes.

4.3.4

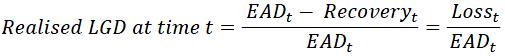

Institutions are expected to compute LGD at the time default (t) as the ratio of the total loss incurred divided by the Exposure At Default. When modelling LGD time series, the time of reference should be the date of default. We note LGD as a function of time t, as LGDt, then t is the date of default, which is different from the time at which the recovery cash flows where collected. The total recovery is noted Recoveryt and the total loss is noted Losst. Institutions should therefore estimate realised LGD for each default event with the following formula:

4.3.5

The recovery is derived from all cash inflows and expenses occurring at future times after the default event and discounted back to the default date. The recovery cash flows should not be higher than the amount of recoveries that can legally be obtained by the institution. The discount rates should reflect the time-value of money plus the uncertainty surrounding the cash flows. Additional considerations for restructured facilities are presented at the end of this section. If several facilities are secured by one or several collaterals, institutions should implement a clear collateral allocation mechanism from the obligor level to each facility. The computations of Recoveryt and Losst depend on the workout outcome. The estimation method should incorporate the following components.

Table 4: Recovery and costs per type of outcome

Outcome Components of recovery and costs (1) Cured & not restructured (a)

Indirect costs, as defined in the data collection section.

(2) Cured & restructured (a) Potential reduction in present value upon restructuring the facility. (b) Direct costs, as defined in the data collection section. (c)

Indirect costs, as defined in the data collection section.

(3) Not cured & secured (a) When applicable, present value of discounted collateral proceedings back to the default date (b) Direct costs, as defined in the data collection section. (c) Indirect costs, as defined in the data collection section. (d)

Cash flows received but not associated with collateral liquidation.

(4) Not cured & unsecured (a) Recovered cash flows. Effect of discounting these cash flows back to the default date, function of the time to recovery. (b)

Indirect costs, as defined in the data collection section.

(5) Unresolved These should be treated as per the following article. 4.3.6

The treatment of unresolved default cases (incomplete workouts) creates a material bias in the estimation of LGD. Consequently, institutions should establish a clear process for the treatment of these cases and understand their impact on the estimation of historical realised LGD.

(i)

Institutions should define criteria to decide on whether the recovery process of a default case should be considered closed. A degree of conservativeness should be included in this estimation to reflect the uncertainty of the recovery process. This means that if doubts persist regarding the possibility of future cash inflows, the recovery process should be considered closed. (ii)

Institutions should put in place clear criteria to include or exclude unresolved cases in their estimation samples. For that purpose, a maximum length of resolution period (from the date of default) should be established by obligor segment. The objective is to choose a duration that is sufficiently short to maximise the number of recovery cases flagged as ‘closed’ and sufficiently long to capture a fair recovery period. (iii)

It is recommended that open default cases with a recovery period longer than four (4) years should be included in the LGD estimation process, irrespective of whether they are considered closed. For the avoidance of doubt, all closed cases with a shorter recovery period should, of course, be included. Banks are free to use a shorter maximum duration. Longer maximum duration, however, should be avoided and can only be used upon robust evidence provided by the institution. (iv)

Default cases that are still unresolved within the maximum length of the recovery process (i.e. shorter than 4 years) should preferably be excluded for the purpose of estimating historical LGDs. Institutions have the option to consider adjustments by extrapolating the remaining completion of the workout process up to the maximum resolution period. Such extrapolation should be based on documented analysis of the recovery pattern by obligor segment and/or product type observed for closed cases. This extrapolation should be conservative and incorporate the possibility of lower recovered cash-flows.

Table 5: Treatment of unresolved default cases

Recovery status Shorter recovery than the maximum recovery period Longer recovery than the maximum recovery period Closed cases Included. All discounted cash-flows taken into account. Included. All discounted cash-flows taken into account. Open cases Excluded. Possible inclusion if cash-flows are extrapolated. Included. All discounted cash-flows taken into account. 4.3.7

Institutions should not assume that restructuring and rescheduling events necessarily lead to zero economic loss. For restructuring associated with material exposures, an estimation of their associated present value impact should be performed. If no PV impact is readily available, then the terms of the new and old facilities should be collected in order to estimate a PV impact, according to the methodology outlined in the dedicated section of the MMG. In particular, if the PV impact of the cash flow adjustment is compensated for by a capitalisation of interest, institutions should include an incremental credit spread in discounting to reflect the uncertainty arising from postponing principal repayments at future dates. Such credit spread should then lead to a negative PV impact.

4.3.8

For low default portfolios, institutions may not have enough data to estimate robust historical recovery patterns. In this case, institutions should be in a position to demonstrate that data collection efforts have taken place. They should also justify subsequent modelling choices based on alternative data sources and/or comparables. Furthermore, portfolios with high frequency of cure via restructuring should not be considered as portfolios with low default frequency. Restructured facilities could be recognised as defaults depending on circumstances and in compliance with the CBUAE Credit Risk Regulation.

4.4 Analysis of Realised LGD

4.4.1

Once institutions have estimated and categorised realised LGD, they should analyse and understand the drivers of realised LGD in order to inform modelling choices in the subsequent step.

4.4.2

At a minimum, institutions should analyse and understand the impact of the following drivers on LGD:

(i)

The time at which LGD was observed in the economic cycle. The profile of the recovery pattern and the effect of the economic cycle on this pattern. (ii)

The effect of collateral on the final LGD including the time to realise the collateral, the impact of the type of collateral, the difference between the last valuation and the liquidation value. (iii)

The link between LGD and the obligor’s credit worthiness at the time of default captured by its rating or its PD. (iv) The type of facility and its seniority ranking, where applicable. (v) The obligor segments expressed by size, industry, and/or geography. (vi)

Any change in the bankruptcy legal framework of the jurisdiction of exposure.

4.4.3

Institutions should identify the most appropriate segmentation of historical realised LGD, because this choice will subsequently inform model segmentation. Portfolio segmentation should be based upon the characteristics of the obligors, its facilities and its collateral types, if any.

4.4.4

Institutions should be cautious when using ‘Secured LGD’ and ‘Unsecured LGDs’ as portfolio segments. A secured LGD is a loss obtained from a facility secured by a collateral. It is based upon the estimation of a collateral coverage (defined as the ratio of the collateral value to the exposure). The loss resulting from such coverage can spread across a large range: from low values in the case of over-collateralization, up to high values in the case of small collateral amounts. An average (referred as Secured LGD) across such large range of values is likely to suffer from a lack of accuracy. Thus, it is preferable to employ collateral as a direct continuous driver of LGD, rather than use it to split a population of obligors.

4.4.5

Once segments have been identified, institutions should produce three types of LGD per segment to support the estimation of ECL as per accounting principles. These estimates should be used to calibrate the TTC LGD and PIT LGD models in subsequent modelling steps. The estimation of averages can be exposure-weighted or count-weighted. This choice depends on each portfolio and thus each institution.

(i)

The long run average by segment, through time across business cycles, estimated as the average of realised LGDs over the observation period. (ii) The LGD during economic downturns. (iii)

The LGD during periods of economic growth.

4.4.6

When analysing the effect of collateral on LGD outcomes, institutions should consider, at a minimum, the following collateral types. Note that personal guarantees should not be considered as eligible collateral for the purpose of modelling LGD. This list may evolve with the CBUAE regulation.

Table 6: Types of eligible collateral

Collateral types Cash (or cash equivalent) Federal Government (security or guarantee) Local Government (security or guarantee) Foreign sovereign government bonds rated BBB- or above UAE licensed Bank (security or guarantee) Foreign bank rated AA- or above (security or guarantee) Foreign bank rated BBB- but below AA- (security or guarantee) Listed Shares on a recognized stock exchange Bonds or guarantees from corporations rated above BBB- Residential Real Estate Commercial Real Estate All other banks bonds or guarantees Cars, Boats, Machinery and other movables All other corporate bonds or guarantees (not including cross or personal guarantees) 4.5 TTC LGD Modelling

4.5.1

The objective of TTC LGD models is to estimate LGD, independently of the macroeconomic circumstances at the time of default. Therefore, these models should not depend on macroeconomic variables. These models can take several forms depending on the data available and the type of portfolio. Institutions are free to choose the most suitable approach, provided that it meets the minimum expectations articulated in this section.

4.5.2

Defaulted vs. non-defaulted cases: LGD should be modelled and estimated separately between defaulted obligors (or facilities) and non-defaulted obligors. Whilst the methodology should be similar between these two cases, several differences exist:

(i)

Upon a default event, the estimation of recovery relies on assumptions and on a live process with regular information updates. Therefore, for defaulted obligors (or facilities), as the recovery process unfolds, institutions should collect additional information to estimate recovery rates with further accuracy and thus obtain more specific LGD estimation. (ii)

For defaulted obligors (or facilities), particular attention should be given to PV modelling as per the dedicated section of the MMG. Discount factors should reflect the circumstances of default and the uncertainty surrounding the recovery process. (iii)

One of the major differences between LGD from defaulted vs. non-default exposures is that the former is estimated only as of the date of default, while the latter is estimated at several point in time, depending on the needs of risk management and financial reporting.

4.5.3

Properties: At a minimum, LGD models should meet the following properties.

(i)

The modelled LGD should be based upon the historical realised LGD observations previously estimated. (ii)

The methodology should avoid excessive and unreasonable generalisations to compensate for a lack of data. (iii)

The model performance should be validated based on clear performance measurement criteria. For instance, model predictions should be compared against individual observations and also against segment average. (iv)

There should be enough evidence to demonstrate that in-sample fit and out-of-sample performance are reasonable. (v) The choice of parameters should be justified and documented. (vi)

The model inputs should be granular and specify enough to generate a LGD distribution that is a fair and accurate reflection of the observed LGDs.

4.5.4

Functional form: Institutions are free to use LGD models with any functional form provided that the model output is an accurate reflection of the observed LGD. Institutions should aim to build LGD models that incorporate the suitable drivers enabling the model to reflect the main possible outcomes of the workout process.

4.5.5

Parameters: Institutions should aim to incorporate the following drivers in their LGD models. This means that any model using less granular inputs should be considered as a first generation model that requires improvement as further data becomes available.

(i) The probability of cure without restructuring, (ii) The probability of cure through restructuring, (iii) The collateral coverage, (iv) Direct and indirect recovery costs, (v) Collateral liquidation values including haircuts, and (vi)

Recovered cash flows

The quantitative drivers above should be analysed (segmented) by qualitative drivers, including but not limited to:

(vii) Industry or obligor type, (viii) Facility type, and (ix)

Seniority ranking.

4.5.6

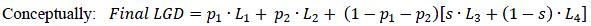

The parameters listed above should drive the estimation of LGD. The mathematical construction of the LGD model can take several forms, that institutions are free to choose. The form presented below serves as illustration. Institutions are not expected to use this expression literally; rather, they should ensure that their final LGD model respects the principles of this expression with a suitable estimation of each component. If institutions employ a different functional form, they are encouraged to use the following expression as a challenger model.

Table 7: Typical components of LGD models

Component Definition P1 Probability of cure without restructuring P2 Probability of cure through restructuring S Collateral coverage defined as 𝐶𝑜𝑙𝑙𝑎𝑡𝑒𝑟𝑎𝑙 𝑉𝑎𝑙𝑢𝑒 ⁄𝐸𝐴D L1 Loss (cost) from managing delinquent clients that were cured without restructuring L2 Loss from managing delinquent clients through restructuring or rescheduling, including direct and indirect costs plus NPV impacts. L3 Loss from the realisation of collateral including haircuts, direct and indirect costs plus NPV impact. Estimated across all collateral types. L4 Loss arising from the incomplete recovery of the portion of exposure not covered by collateral, also including indirect management costs and NPV impacts. (Referred to as unsecured LGD.)

The loss arising from the unsecured portion (L4) is often called "unsecured LGD". The final LGD after taking collateral into accounts is often referred to as the "secured LGD". Irrespective of the semantic employed, LGD models should reconcile conceptually against the expression above.

4.5.7

Granularity: Institutions should aim to develop TTC LGD models to estimate LGD at a low level of granularity. The following minimum expected practices apply:

(i)

Institutions should aim to model LGD at facility level, i.e. the LGD should incorporate facility characteristics. If this is not possible for practical reasons, LGD should be computed at obligor level. This means that LGD should be driven by parameters specific to each obligor and the associated collaterals if any. (ii)

If several facilities are secured by one or several collaterals, institutions should implement a clear collateral allocation mechanism from the obligor to each facility. (iii)

If institutions do not have the required data to build such granular models, they should put in place a formal project in order to collect the necessary data as a stepping stone towards accurate LGD modelling.

4.5.8

Segmentation: The portfolio segmentation employed to estimate LGDs should be justified and documented. In theory, LGD segments do not have to be identical to those employed for PD modelling. However, in practice, it is recommended to use similar portfolio segmentation across PD and LGD models, where possible, in order to ease the interpretation of LGD and subsequent usage in provision and capital estimation.

4.5.9

Collateral haircuts: The last valuation of an asset is unlikely to reflect the resale value of a repossessed asset. Consequently, institutions should estimate appropriate haircuts based on the assumption that they intend to sell the repossessed asset as soon as reasonably possible. Haircuts should be estimated based on historical data by type of collateral.

4.5.10

Bimodal distribution: Institutions should identify whether the distribution of observed LGD is bimodal, i.e. a distribution with two peaks of high frequency. In this case, specific modelling constraints apply. Institutions should be cautious when using an average value between these two peaks. Such average can be misleading and should not be employed to assign LGD at facility level since it does not correspond to an observable LGD at facility level.

4.5.11

Logical features: Following on from the conceptual framework presented above, some logical characteristics should be respected: (i) the final LGD should be equal or smaller than the unsecured LGD, (ii) the LGD should decrease with the presence of collateral, all other parameters being kept constant, and (iii) the longer the recovery period, the higher the recovery, the lower the LGD. The logical features should be tested as part of the model validation process.

4.6 PIT LGD Modelling

4.6.1

There is general evidence that LGD levels tend to be higher during economic downturns. This intuitive relationship is supported by numerous publications from academics and practitioners based on data from the US and European markets. In the UAE, whilst this relationship is more difficult to prove, there are objective reasons to believe it exists. In any case, this should be investigated as part of current accounting requirements. Consequently, institutions should implement a process to analyse the relationship between LGD and macro factors. This should be done at a relevant level of granularity.

4.6.2

This analysis should drive the modelling strategy of PIT LGD. Several modelling options can be envisaged and institutions should articulate explicitly their approach based on their preliminary analysis. While making a strategic decision, institutions should remain conservative. A portfolio may not be large enough to capture this relationship despite the existence of such relationship at larger scale. In doubt, it is preferable to include some degree of correlation between LGD and macro factors for the estimation of ECL. Once a mechanism is in place, the strength of the relationship can be adjusted in calibration exercises, upon further evidence proving or refuting it.

4.6.3

The objective of PIT LGD models is to estimate LGD as a function of the economic circumstances at the time of default and during the recovery process. Therefore, these models should depend on macroeconomic variables. Institutions are free to choose the most suitable methodology, provided that it meets the minimum expected practices articulated in this section.

4.6.4

PIT LGD models can be constructed by (i) adjusting TTC LGD or (ii) developing models independently from TTC LGD. For consistency purpose, the former is recommended over the latter. If institutions chose the second approach, they should ensure that both PIT LGD output and TTC LGD outputs are coherent.

4.6.5

The properties of the PIT LGD models should be similar to that of TTC LGD models. At a minimum, these models should meet the following:.

(i)

The modelled LGD should be based upon the historical realised LGD observations previously estimated. (ii)

The methodology should avoid excessive and unreasonable generalisations to compensate for a lack of data. (iii)

The model performance should be validated based on clear performance measurement criteria. For instance, model predictions should be compared against individual observations (or relevant groups) and also against segment average. (iv) The choice of parameters should be justified and documented. (v)

There should be enough evidence to demonstrate that in-sample fit and out-of-sample performance are reasonable. (vi)

The model inputs should be granular and specify enough to generate a PIT LGD distribution that is a fair and accurate reflection of the observed LGDs.

4.6.6

PIT LGD models can take several forms depending on the data available and the type of portfolio. Several broad categories of models can be defined as follows, ranked by increasing granularity and accuracy:

(i)

Option 1: Most granular approach. The LGD parameters are directly linked to the macro forecasts and used as inputs to compute the losses (L1,L2,L3,L4). The final LGD is subsequently computed based on these losses, as defined in the TTC LGD section. For instance, collateral values at facility level can be directly linked to the macro forecasts, then secured LGDs are derived. (ii)

Option 2: Intermediate granular approach. The losses (L1,L2,L3,L4) are linked to the macro forecasts and used as input to estimate the final LGD, as defined in the TTC LGD section. For instance, the segment level secured and unsecured LGDs can be linked to the macro forecasts. (iii)

Option 3: Non-granular approach. The final LGD is directly linked to the macro forecasts. In this case the PIT LGD models does not use the LGD parameters. (iv)

Option 4: Alternative approach. The final LGD is linked to the obligor's PD, itself linked to macro forecasts. In this case, the LGD response to macroeconomic shocks is constructed as a second order effect through correlation rather than structural causation.

4.6.7

Institutions should articulate and document explicitly their preferred modelling option. All these options are acceptable; however institutions should be aware of their theoretical and practical limitations, in particular the potential accuracy issues arising from options 3 and 4. Institutions should aim to model PIT LGD via option 1. Consequently, institutions should understand and assess the financial implications of their modelling choice. This choice should be approved by the Model Oversight Committee.

4.6.8

If the PIT LGD model uses PIT PD as a sole driver of macro adjustment, then the model segmentation should be identical between PIT LGD and PIT PD. If institutions decide to develop dedicated PIT LGD-macro models, those should follow the minimum expectations articulated in the section of the MMG dedicated to macro models.

4.7 Validation of LGD Models

4.7.1

Institutions should validate all LGD models according to the validation principles articulated in the MMS. Both qualitative and quantitative assessments should be conducted for an appropriate validation.

4.7.2

Institutions should ensure that segment-level LGD values represent the risk profile of their books. Statistical tests alone are not sufficient to conduct appropriate validation of LGD at segment level. Consequently, institutions should combine statistical tests, judgement and checks across comparable metrics to ensure that the calibration of these metrics are meaningful and accurate.

4.7.3

The scope of the validation should be comprehensive. If the validation is performed by a third party consultant, institutions should ensure that the validation effort is comprehensive in scope and substance.

4.7.4

The validation scope should include, at a minimum, the following components:

(i)

The data quality, comprehensiveness and collection process. This should cover the analysis of unusual features observed in historical data and their subsequent treatment for modelling. (ii)

The definition of default. This should cover the treatment of technical defaults and restructured accounts. (iii)

The methodology employed to compute historical LGD. This should cover in particular the possible outcomes as described earlier in this section. Partial replication of the historical LGD for a sample of facilities should be performed. (iv)

The methodology employed to estimate TTC LGD and subsequent PIT adjustments. This should cover the model fit, functional form, robustness, properties and sensitivities. (v)

The treatment of collateral. The treatment of LGD segmentation granularity. The quality of the model output in terms of economic and business meaning. This can rely on comparables based on data available outside of the institution. (vi)

The existence of spurious accuracy and excessive generalisation. In particular, the validation process should report the excessive usage of average LGD employed across a large population of heterogeneous obligors. (vii)

Back-testing of modelled LGD, estimated separately for defaulted and non-defaulted obligors.