4.1 Risk-Based Approach (RBA)

A risk-based approach (RBA) is central to the effective implementation of the AML/CFT legislation. It means that FIs identify, assess, and understand the ML/TF risks to which they are exposed, and implement the most appropriate mitigation measures. An RBA requires financial institutions to have systems and controls that are commensurate with the specific risks of money laundering and terrorist financing facing them. Assessing this risk is, therefore, one of the most important steps in creating a good AML/CFT compliance program and will enable FIs to focus their resources where the risks are higher. In this regard, FIs can take into account their business nature, size and complexity.

(AML-CFT Law Article 16.1; AML-CFT Decision Article 4.1-3)

Implicit in both the AML-CFT Law and the AML-CFT Decision is the well-established concept of a risk-based approach (RBA) to the identification and assessment of ML/FT risks. Specifically, the AML-CFT Law states that FIs should “identify crime risks within (their) scope of work” and should update their risk assessments on the basis of the various risk factors set out in the AML-CFT Decision. Likewise, the AML-CFT Decision states that FIs’ identification, assessment and understanding of the risks should be carried out “in concert with their business nature and size,” and that various risk factors should be considered in determining the level of mitigation required. The AML-CFT Decision further provides that enhanced due diligence should be performed in cases where high risks are identified, while simplified due diligence may be performed in certain cases where low risk is identified, unless there is a suspicion of ML/FT.

An RBA to AML/CFT means that FIs should identify, assess and understand the ML/TF risks to which they are exposed and take AML/CFT measures commensurate to those risks in order to mitigate them effectively. This will require an understanding of the ML/TF risk faced by UAE (national risks), risks by the sector and the FI as well as specific products and services, customer base, the capacity in which customers are operating, jurisdictions in which they operate , the delivery channel and the effectiveness of risk controls put in place.

The use of an RBA thus allows FIs to allocate their resources more efficiently and effectively, within the scope of the national AML/CFT legislative and regulatory framework, by adopting and applying preventative measures that are targeted at and commensurate with the nature of risks they face.

While there are limits to any risk-management approach, and no RBA can be considered as completely failsafe; there may be occasions where an FI has taken all reasonable measures to identify and mitigate ML/TF risks, but it is still used for ML/TF in isolated instances. FIs should nevertheless understand that a risk-based approach is not a justification for ignoring certain ML/FT risks, nor does it exempt them from taking reasonable and proportionate mitigation measures, even for risks that are assessed as low. Their statutory obligations require them to identify, assess and understand the level of (inherent) risks presented by their (types of) customers, products and services, transactions, geographic areas and delivery channels, and to be in a position to apply sufficient AML/CFT mitigation measures on a risk-appropriate basis at all times.

In order to do so, they should identify and assess their exposure to ML/FT risks on the basis of a variety of risk factors (see Section 4.1, Risk Factors), some of which are related to the nature, size, complexity and operational environment of their businesses, and others of which are customer- or relationship-specific. Furthermore, they should take reasonable and proportionate risk mitigation measures based on the severity of the risks identified.

Conducting an ML/TF business risk assessments can assist FIs to understand their risk exposure and the areas they should give priority in combating ML/FT. The extent of business-wide risks to which an FI is exposed may require different levels of AML/CFT resources and mitigation strategies.

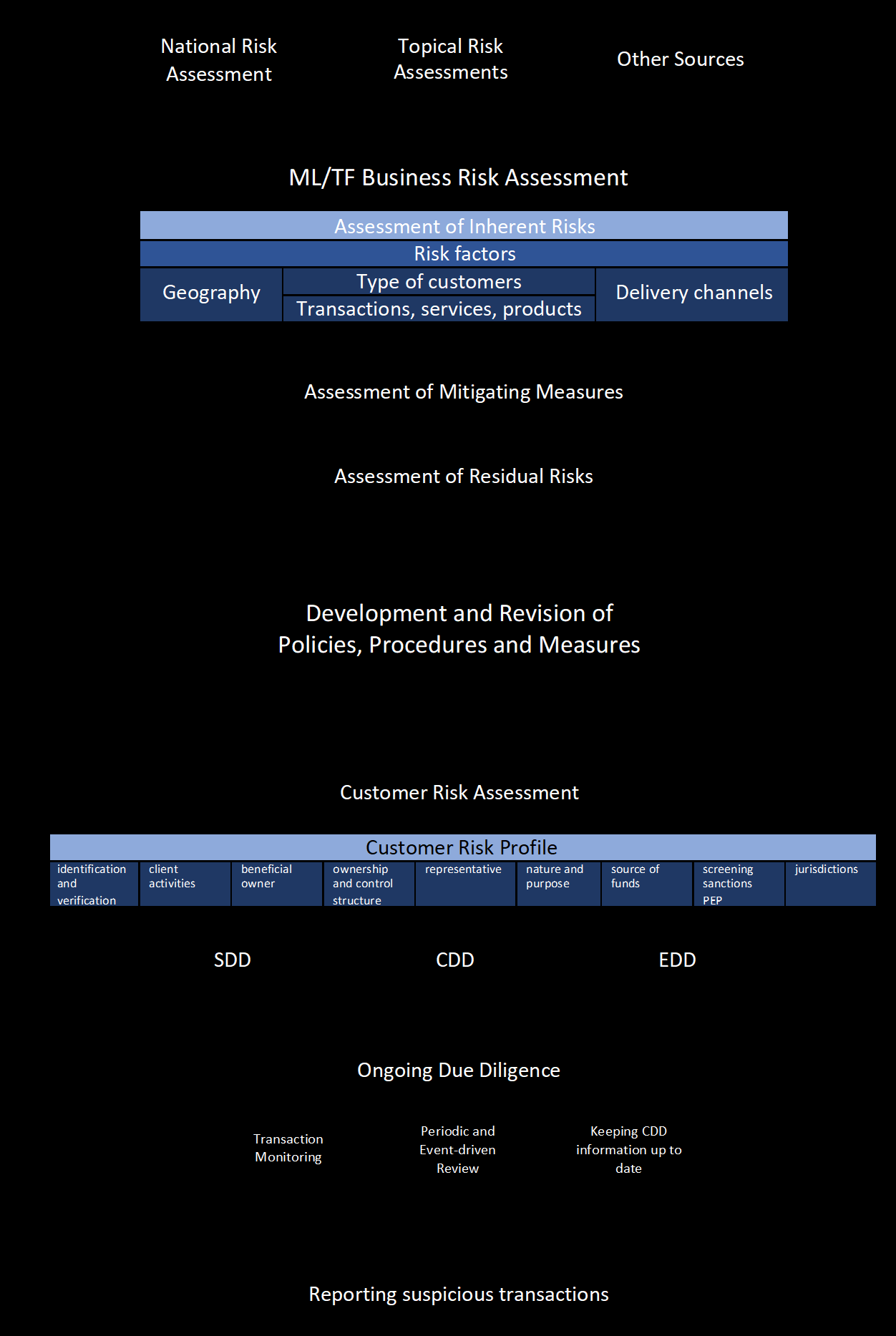

The following picture is a schematic overview of the RBA process from an ML/TF business risk assessments to developing policies, procedures and measures to CDD and the reporting of suspicious transactions.

4.1.1 Assessing Business-wide Risks

(AML-CFT Law Article 16.1; AML-CFT Decision Article 4.1)

An important first step in applying an RBA is to identify, assess and understand the ML/FT risks by way of an ML/FT risk assessment of the entire business. The purpose of such an ML/FT business risk assessment is to improve the effectiveness of ML/FT risk management, by identifying the inherent ML/FT risks faced by the enterprise as a whole, determining how these risks are effectively mitigated through internal policies, procedures and controls, and establishing the residual ML/FT risks and any gaps in the controls that should be addressed.

Thus, an effective ML/TF business risk assessment can allow FIs to identify gaps and opportunities for improvement in their framework of internal AML/CFT policies, procedures and controls, as well as to make informed management decisions about risk appetite, allocation of AML/CFT resources, and ML/FT risk-mitigation strategies that are appropriately aligned with residual risks.

The first step of conducting an ML/TF business risk assessment for FIs is to identify, assess and understand the inherent ML/FT risks (i.e., the risks that an FI is exposed to if there were no control measures in place to mitigate them) across all business lines and processes with respect to the following risk factors: customers, products, services and transactions, delivery channels, geographic locations, and any other risk factors.

With the inherent risks as a basis, the FI can determine the nature and intensity of risk mitigating controls to apply to the inherent risks. The level of inherent ML/FT risks influence the kinds and levels of AML/CFT resources and mitigation strategies which FIs require to put in place. The assessment of inherent ML/FT risks and of the effectiveness of the risk mitigation measures will result in a residual risk assessment, i.e., the risks that remain when effective control measures are in place. In case the residual risk falls outside the risk appetite of the FI, additional control measures will need to be implemented to ensure that the level of ML/FT risk is acceptable to the FI.

FIs may utilise a variety of models or methodologies to analyse their risks, in keeping with the nature and size of their businesses. FIs should decide on both the frequency and methodology of an ML/FT business risk assessment, including baseline and follow-up assessments, that are appropriate to their particular circumstances, taking into consideration the nature of the inherent and residual ML/FT risks to which they are exposed, as well as the results of the NRA and Topical Risk Assessments. In most cases, FIs should consider performing the ML/FT business risk assessment at least annually; however assessments that are more frequent or less frequent may be justified, depending on the particular circumstances. They should also decide on policies and procedures related to the periodic review of their ML/TF business risk assessment methodology, taking into consideration changes in internal or external factors. These decisions should be documented, approved by senior management, and communicated to the appropriate levels of the organisation.

As part of the model or methodology, FIs should consider including in their ML/FT risk assessment the following elements:

• Likelihood or probability of occurrence of identified inherent risks;

• Timing of identified inherent risks;

• Impact on the organisation of identified inherent risks.

The result of an effective ML/FT business risk assessment will be the classification of identified risks into different categories, such as high, medium, low, or some combination of those categories (such as medium-high, medium-low). Such classifications may assist FIs to prioritise their ML/FT risk exposures more effectively, so that they may determine the appropriate types and levels of AML/CFT resources needed, and adopt and apply reasonable and risk-proportionate mitigation measures.

4.1.2 Risk Factors

As part of the business-wide ML/TF risk assessment, a proper identification of risk factors is crucial to the effective assessment of ML/FT risk. Risks will often occur as combinations of these risk factors. A risk can for instance occur because of the interrelationship between a customer and the jurisdictions where the customer is from or is active, or because of the connection between a product and the delivery channel.

Identified risk factors are used for the accurate categorisation of inherent risks, as well as for the application of appropriate mitigation measures. At the enterprise level, this includes adopting and applying adequate policies, procedures, and controls to business processes (see Section 5.1, Internal Policies, Controls and Procedures). The policies, procedures, and controls will in turn address the risks at the individual customer level, including assigning appropriate risk classifications to customers and applying due diligence measures that are commensurate with the identified risks (see Section 6, Customer Due Diligence).

The AML-CFT Decision outlines several risk factors which FIs must consider, when identifying and assessing their ML/FT risk exposure. FIs may also consider a wide array of additional risk factors, utilising various sources, such as:

• ML/FT red-flag indicators;

• Input and information from relevant internal sources, including the designated AML/CFT compliance officer;

• Information from national sources, including the results of the NRA or any Topical Risk Assessment with regard to ML/FT trends and sectoral threats and notices or circulars from the relevant Supervisory Authorities;

• Information from publications of relevant international organisations, such as FATF, MENAFATF and other FSRBs, the Egmont Group, UNODC, and others. (Links to some of these sources may be found in Appendix 11.2.)

In keeping with the ever-evolving nature of ML/FT risks, and in order to ensure that FIs implement a model for conducting the ML/TF business risk assessment that is appropriate to the nature and size of their businesses, FIs should continuously update the risk factors which they consider, in order to reflect new and emerging ML/FT risks and typologies.

A good practice to assess the inherent risk factors, is for FIs to formulate risk scenarios and assess the likelihood that a scenario occurs and the impact should a scenario materialize. The likelihood can be assessed based on the number of times per year that a risk scenario can occur. The impact can be assessed based on the possible financial and reputational effects that can result if a scenario indeed occurs. In this way, the FI can determine the inherent risks of a risk factor.

When assessing the inherent risks, an FI should make an inventory of the customers it services, the products and services it offers, define the scope of business areas to assess, including business units, legal entities, divisions, countries and regions. For this, an FI should make use of up-to-date quantitative and qualitative information on for instance, the types and number of customers, the volume of operations for the types of customers, volume of business per product and services and geographic locations.

Examples with regard to some of the major risk factors that should be taken into account by FIs when conducting the ML/TF business risk assessment are provided in the sections below. Even though some of these risk factors will also be relevant for the risk assessment of an individual Customer or Business Relationship, for the ML/TF business risk assessment, FIs are reminded that they should take a holistic view when evaluating exposure to these categories of customers.

4.1.3 Customer Risk

The customer risk factors relate to types or categories of customers. Certain customer or business relationship categories pose a risk that should be taken into account when assessing the overall level of inherent customer risk. When identifying certain categories of customers as inherently high risk, FIs should also consider the results of the NRA or any Topical Risk Assessment, as well as information from official sources, including the Supervisory Authorities, the FIU, the FATF, MENAFATF and other FSRBs, the Egmont Group, etc.

When assessing the customer risk factors with respect to the business-wide ML/FT risk assessment, an FI can take into account:

• Type of customers: The risks related to retail customers in combination with their product/service needs may be different from those related to high net worth or corporate customers and their respective product/service needs. Likewise, the risks associated with resident customers may be different from those associated with non-resident customers.

• Customer base. FIs with small, homogenous customer bases may face different risks from those with larger, more diverse customer bases. Similarly, FIs targeting growing or emerging markets may face different customer risks than those with more established customer bases.

• Maturity of relationship. FIs that rely on more transactional, occasional, or one-off interactions with their customers may be exposed to different risks from institutions with more repetitive or long-term business relationships.

The specific customer risk factors that FIs should consider, include:

• Categories of business relationships with complex legal, ownership, or direct or indirect group or network structures, or with less transparency with regard to Beneficial Ownership, effective control, or tax residency, may pose different ML/FT risks than those with simpler legal/ownership structures or with greater transparency.

• Categories of Customers involved in highly regulated and supervised activities and those involved in activities that are unregulated.

• Customers associated with higher-risk persons or professions (for example, foreign PEPs and/or their companies), or those linked to sectors associated with higher ML/FT risks.

• Non-resident entities particularly those with connections to offshore and high risk jurisdictions.

• Professionals (e.g., lawyers, accountants and TCSPs) acting as introducer or intermediary on behalf of customers or groups of customers (whereby there is no direct contact with the customer).

• High net worth individuals.

• Respondent banks from high risk countries.

Some of these customer risk factors are also relevant when determining the customer risk classification of an individual customer and the type and extent of customer due diligence to be performed (see Section 6, Customer Due Diligence).

4.1.4 Geographic Risk

FIs should consider geographic ML/FT risk factors both from domestically and cross-border sources. These risks arise from: (i) the locations where the FI has offices, branches and subsidiaries and (ii) locations in which the customers reside or conduct their activities. Examples of some of these factors include:

• Regulatory/supervisory framework. Countries with stronger AML/CFT controls present a different level of risk than countries with weaker regulatory and supervisory frameworks, for instance countries identified by the FATF as jurisdictions with weak AML/CFT measures.

• International Sanctions. FIs should consider whether the countries or jurisdictions they deal with are the subject of international sanctions, such as targeted financial sanctions (TFS), UAE, OFAC, UN and EU restrictive measures, that could impact their ML/FT risk exposure and mitigation requirements.

• Reputation. FIs should consider whether the countries or jurisdictions they deal with are associated with higher or lower levels of ML/FT, corruption, and (lack of) transparency (particularly as regards financial and fiscal reporting, criminal and legal matters, and Beneficial Ownership, but also including such factors as freedom of information and the press).

• Combination with customers’ inherent risk factors. FIs should consider the countries risk in combination with customers risks, including principal residential or operating locations of customers.

4.1.5 Product-, Service-, Transaction-Related Risk

When assessing the inherent ML/FT risks associated with product, service, and transaction types, an FI should take stock of its lines of business, products and services that are more vulnerable to ML/FT abuse. FIs should assess the inherent ML/FT risks of abuse of the products and services by their customers taking into account a number of factors such as their ease for holding and transferring value or their complexity and transparency. Some of the risk factors that FIs should consider, among others, are:

• Typology. FIs should consider whether the product, service, or transaction type is associated with any established ML/FT typologies (see Section 3.10, ML/FT Typologies).

• Complexity. Products, services, or transaction types that favour complexity, especially when that complexity is excessive or unnecessary, can often be exploited for the purpose of money laundering and/or the financing of terrorism or illegal organisations. FIs should consider the conceptual, operational, legal, technological and other complexities of the product, service, or transaction type. Those with higher complexity or greater dependencies on the interactions between multiple systems and/or market participants may expose FIs to different types and levels of ML/FT risk than those with lower complexity or with fewer dependencies on multiple systems and/or market participants.

• Transparency and transferability. Situations that favour anonymity can often be exploited for the purpose of ML/FT. FIs should consider the level of transparency and transferability of ownership or control of products, services, or transaction types, particularly in respect of the ability to monitor the identities and the roles/responsibilities of all parties involved at each stage. Special attention should be given to products, services, or transaction types in which funds can be pooled or co-mingled, or in which multiple or anonymous parties can have authority over the disposition of funds, or for which the transferability of Beneficial Ownership or control can be accomplished with relative ease and/or with limited disclosure of information.

• Size/value. Products, services, or transaction types with different size or value parameters or limits may pose different levels of ML/FT risk.

4.1.6 Delivery Channel-Related Risk

Different delivery channels for the acquisition and management of customers and business relationships, as well as for the delivery of products and services, entail different types and levels of ML/FT risk.

When evaluating delivery channel-related risk, FIs should pay particular attention to those channels, whether related to customer acquisition and/or relationship management, or to product or service delivery, which have the potential to favour anonymity. Among others, these may include non-face-to-face channels (especially in cases where there are no safeguards in place such as electronic identification means), such as internet-, phone-, or other remote-access services or technologies; the use of third-party business introducers, intermediaries, agents or distributors; and the use of third-party payment, or other transaction intermediaries.

4.1.7 Other Risk Factors

Given the ever-evolving nature of ML/FT risks, new risks are constantly emerging, while existing ones may change in their relative importance due to legal or regulatory developments, changes in the marketplace, or as a result of new or disruptive products or technologies. For this reason, no list of risks can ever be considered as exhaustive.

Nevertheless, additional factors that may present specific risks are, e.g., the introduction of new products or services, new technologies or delivery processes or the establishment of new branches and subsidiaries locally and abroad.

In order to ensure, therefore, that FIs are in a position to review and update the ML/TF business risk assessment as well as mitigation measures, FIs should take into consideration the results of the NRA or any Topical Risk Assessment. They should also consult publications from official sources on a regular basis, including those of the relevant Supervisory Authorities, the FIU, the FATF, MENAFATF and other FSRBs, the Egmont Group, and others. Links to some of these sources may be found in Appendix 11.2.

Examples of some of the types of additional risk factors which FIs may consider in identifying and assessing their ML/FT risk exposure include:

• Novelty/innovation. FIs should consider the depth of experience with and knowledge of the product, service, transaction, or channel type. Products, services, transaction, or delivery channel types that are new to the market or to the enterprise may not be as well understood as, and may therefore pose a different level of ML/FT risk than, more established ones. Likewise, products, services, transaction, or delivery channel types which are unexpected or unusual with respect to a particular type of customer may indicate a different level of potential ML/FT risk exposure than would more traditional or expected product, service, transaction, or channel types in regard to that same type of customer.

• Cyber security/distributed networks. FIs may consider evaluating the degree to which their operational processes and/or their customers expose them to the risk of exploitation for the purpose of professional third-party money laundering and/or the financing of terrorism or of illegal organisations, through cyber-attacks or through other means, such as the use of distributed technology or social networks. An example of such a risk is the recent dramatic increase in the global incidence of so-called CEO fraud, in which fraudsters troll companies with phishing e-mails that are purportedly from the CEO or other senior executives, and attempt to conduct fraudulent transactions or obtain sensitive data that can be used for criminal purposes.

4.1.8 Assessing New Product and New Technologies Risks

As part of their obligation to update their ML/FT risk assessments on an ongoing basis, the AML-CFT Decision specifically requires FIs to “identify and assess the risks of money laundering and terrorism financing that may arise when developing new products and new professional practices, including means of providing new services and using new or under-development techniques for both new and existing products.”

FIs must complete the assessment of such risks, and take the appropriate risk management measures, prior to launching new products and services, practices or techniques, or technologies. In general, they should integrate these ML/FT risk assessment and mitigation requirements into their new product, service, channel, or technology development processes.

For the purpose of assessing the ML/FT risks associated with new products, services, practices, techniques, or technologies, FIs may consider utilising the same or similar risk assessment models or methodologies as those utilised for their ML/FT business risk assessments, updated as necessary for the particular circumstances. They should also document the new product, service, practice, technique, or technology risk assessments, in keeping with the nature and size of their businesses (see Section 4.6.1, Documentation, Updating and Analysis).