Capital Adequacy

Regulations Re Capital Adequacy

C 52/2017 Effective from 23/2/2017Introduction

The Central Bank seeks to promote the effective and efficient development and functioning of the banking system. To this end, banks are required to manage their capital in a prudent manner. It is important that banks’ risk exposures are backed by a strong capital base of high quality in order to contribute to the stability of the financial system of the UAE.

In introducing these Capital Adequacy Regulations, the Central Bank intends to ensure that banks’ capital adequacy is in line with revised rules outlined by the Basel Committee on Banking Supervision in ‘Basel III: A global regulatory framework for more resilient banks and banking systems’, commonly referred to as ‘Basel III’. These Regulations are supported by accompanying Standards, which elaborate on the supervisory expectations of the Central Bank with respect to capital adequacy requirements.

These Regulations and the accompanying Standards are issued pursuant to the powers vested in the Central Bank under the Central Bank Law.

Where these Regulations, or their accompanying Standards, include a requirement to provide information or to take certain measures, or to address certain items listed at a minimum, the Central Bank may impose requirements, which are additional to the listing provided in the relevant article.

Objective

The objective of these Regulations is to establish minimum capital adequacy requirements for banks with a view to:

- i. Ensuring the soundness of banks; and

- ii. Enhancing financial stability.

- i. Ensuring the soundness of banks; and

Scope of Application

These Regulations and the accompanying Standards apply to all banks. Banks must ensure that these Regulations and Standards are adhered to on the following two levels:

i. The solo level capital adequacy ratio requirements, which measure the capital adequacy of an individual bank based on its standalone capital strength; and

ii. The group level capital adequacy ratio requirements, which measure the capital adequacy of a bank based on its capital strength and risk profile after regulatory consolidation of assets and liabilities of its subsidiaries.

Article (1): Definitions

- Bank: A financial institution which is authorized by the Central Bank to accept deposits as a bank.

- Central Bank: The Central Bank of the United Arab Emirates.

- Central Bank Law: Union Law No (10) of 1980 concerning the Central Bank, the Monetary System and Organization of Banking as amended or replaced from time to time.

- Terminology used in these Regulations: As defined in the Basel III capital framework, for example ‘Basel III: A global regulatory framework for more resilient banks and banking systems’ published by the Basel Committee for Banking Supervision in December 2010 and revised in June 2011.

- Bank: A financial institution which is authorized by the Central Bank to accept deposits as a bank.

Article (2): Quantitative Requirements

- Total regulatory capital comprises the sum of the following items:

- Tier 1 capital, composed of

- Common Equity Tier 1 (CET1) and

- Additional Tier 1 (AT1);

- Common Equity Tier 1 (CET1) and

- Tier 2 capital.

- Tier 1 capital, composed of

- All regulatory capital components referred to in Article 2.1 are net of regulatory adjustments. A bank must comply with the following minimum requirements, at all times:

- CET1 must be at least 7.0% of risk weighted assets (RWA);

- Tier 1 Capital must be at least 8.5% of RWA;

- Total Capital, calculated as the sum of Tier 1 Capital and Tier 2 Capital, must be at least 10.5% of RWA.

- CET1 must be at least 7.0% of risk weighted assets (RWA);

- Based on the outcome of the Supervisory Review and Evaluation Process conducted by the Central Bank, a bank may be subject to an additional capital add-on, also referred to as individual supervisory capital guidance requirement (SCG). Banks concerned must comply with the individual SCG requirement, set by the Central Bank

- Total regulatory capital comprises the sum of the following items:

Article (3): Capital Components

- CET1 capital comprises the sum of the following items:

- Common shares issued by a bank which are eligible for inclusion in CET1;

- Share premium resulting from the issue of instruments included in CET1;

- Retained earnings;

- Legal reserves;

- Statutory reserves;

- Accumulated other comprehensive income and other disclosed reserves;

- Common shares issued by consolidated subsidiaries of a bank and held by third parties, also referred to as minority interest, which are eligible for inclusion in CET1;

- Regulatory adjustments applied in the calculation of CET1.

- Common shares issued by a bank which are eligible for inclusion in CET1;

- AT1 capital comprises the sum of the following items:

- Instruments issued by a bank which are eligible for inclusion in AT1 and are not included in CET1;

- Stock surplus, or share premium, resulting from the issue of instruments included in AT1;

- Instruments issued by consolidated subsidiaries of the bank and held by third parties which are eligible for inclusion in AT1 and are not included in CET1;

- Regulatory adjustments applied in the calculation of AT1.

- Instruments issued by a bank which are eligible for inclusion in AT1 and are not included in CET1;

- Tier 2 capital comprises the sum of the following items:

- Banks using the standardized approach for credit risk: general provisions/general loan loss reserves up to a maximum of 1.25 % of credit RWA;

- Perpetual equity instruments, not included in Tier 1 capital;

- Share premium resulting from the issue of instruments included in Tier 2 capital;

- Instruments which are eligible for inclusion of Tier 2;

- Perpetual instruments issued by consolidated subsidiaries, not included in Tier 1 capital;

- Regulatory adjustments applied in the calculation of Tier 2.

- Banks using the standardized approach for credit risk: general provisions/general loan loss reserves up to a maximum of 1.25 % of credit RWA;

- Profit-sharing investment accounts must not be classified as part of an Islamic bank’s regulatory capital as referred to in Article 2 of these Regulations.

- Investment risk reserves and a portion of the profit equalization reserve (PER), if any, belong to the equity of investment account holders, and thus must not be used in the calculation of an Islamic bank’s regulatory capital. As the purpose of a PER is to smooth the profit payouts and not to cover losses, any portion of a PER that is part of the Islamic bank’s reserves must not be treated as regulatory capital as referred to in Article 2 of these Regulations.

- CET1 capital comprises the sum of the following items:

Article (4): Regulatory Adjustments

- The following regulatory adjustments must be applied to CET1 capital:

- Goodwill and other intangibles;

- Deferred tax assets;

- Cash Flow hedge reserve;

- Gain on sale related to securitization transactions;

- Cumulative gains and losses due to changes in own credit risk on fair valued financial liabilities;

- Defined benefit pension fund assets and liabilities;

- Investments in own shares, or treasury stock;

- Reciprocal cross holdings in the capital of banking, financial and insurance entities;

- Investments in the capital of banking, financial and insurance entities, that are outside the scope of regulatory consolidation and where the bank does not own more than 10% of the issued common share capital of the entity;

- Significant investments in capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation;

- Threshold deductions.

- Goodwill and other intangibles;

- For the following items, which under Basel II were deducted 50% from Tier 1 and 50% from Tier 2, or had the option of being deducted or risk weighted, banks must apply a risk weight, which is calculated as the reciprocal of the minimum requirement of the Total Capital.

- Certain securitization exposures;

- Non-payment/delivery on non-Delivery-versus-Payment and non-Payment-versus-Payment transactions;

- Significant investments in commercial entities.

- Certain securitization exposures;

- The following regulatory adjustments must be applied to CET1 capital:

Article (5): Capital Conservation Buffer

- In addition to the minimum CET1 capital of 7.0% of RWA, banks must maintain a capital conservation buffer (CCB) of 2.5% of RWAs in the form of CET1 capital

- Outside of periods of stress, banks are encouraged to hold buffers of capital above the capital adequacy requirements

- A bank that does not comply with the buffer requirement:

- Must restrict its dividends pay out to its shareholders in accordance with table 1;

- Must have a definite plan to replenish the buffer as part of its internal capital adequacy assessment process;

- Must bring the buffer to the required level within a time limit agreed with the Central Bank; and

- Will be monitored closely by the Central Bank.

- Must restrict its dividends pay out to its shareholders in accordance with table 1;

Table 1

Individual Bank Minimum Capital Conservation StandardsCET 1 Ratio Minimum Capital Conservation Ratios (expressed as a percentage of earnings) 7.0% - 7.625% 100% > 7.625% - 8.25% 80% > 8.25% - 8.875% 60% > 8.875% - 9.5% 40% > 9.5% 0% - In addition to the minimum CET1 capital of 7.0% of RWA, banks must maintain a capital conservation buffer (CCB) of 2.5% of RWAs in the form of CET1 capital

Article (6): Countercyclical Buffer

To achieve the broader macro-prudential goal of protecting the banking sector from periods of excess aggregate credit growth and in addition to the CCB requirements, banks may be required to implement the countercyclical buffer (CCyB). Banks must meet the CCyB requirements by using CET1 capital. The level of the CCyB requirements will vary between 0% - 2.5% of RWA and be communicated by the Central Bank with an adequate notice period.

See current Countercyclical Capital Buffer on Credit Exposures in the UAE.

Article (7): Domestic Systemically Important Banks

Banks classified as domestically systemically important banks will be required to hold additional capital buffers applied to CET1. Banks concerned will be notified by the Central Bank.

Article (8): Disclosure Requirements

- To help improve transparency of regulatory capital and market discipline, banks will be required, at a minimum, to disclose the following items:

- Full reconciliation of all regulatory capital elements back to the balance sheet in the audited financial statements;

- Separate disclosure of all regulatory adjustments and the items not deducted from Common Equity Tier 1 according to paragraphs 87 and 88 of Basel III;

- Description of all limits and minima, identifying the positive and negative elements of capital to which the limits and minima apply;

- Description of the main features of capital instruments issued;

- Banks, which disclose ratios involving components of regulatory capital, for example ‘Equity Tier 1’, ‘Core Tier 1’ or ‘Tangible Common Equity’ ratios, must accompany such disclosures with a comprehensive explanation of how these ratios are calculated;

- Full terms and conditions of all instruments included in the regulatory capital. Issuances that fall under a grandfathering rule are exempted.

- Full reconciliation of all regulatory capital elements back to the balance sheet in the audited financial statements;

- To help improve transparency of regulatory capital and market discipline, banks will be required, at a minimum, to disclose the following items:

Article (9): Transitional Arrangements

For the purpose of the value calculation of the following items:

- Regulatory adjustments referred to in Article 4.1 of these Regulations; and

- Capital issued from a subsidiary, also referred to as minority interest;

banks must apply the following percentages:

- a) 80% for the time period from 1st January 2017 to 31st December 2017;

- b) 100% for the time period starting from 1st January 2018.

- Capital instruments that no longer qualify as non-common equity Tier 1 capital or Tier 2 capital will be phased out over a time horizon of 10 years, starting from 1st January 2017. The detailed phasing out rules of such capital instruments will be set out in the Standards.

- Capital instruments included in CET1 that do not meet the requirements of these Regulations will be excluded from CET1 starting from 31st December 2017.

- Table 2: Minimum Transitional Arrangements:

Table 2: Minimum Transitional Arrangements Capital Element Basel II 2016 Basel III 2017 Basel III 2018 Basel III 2019 Minimum Common Equity Tier 1 Ratio - 7.0% 7.0% 7.0% Minimum Tier 1 Capital Ratio 8.0% 8.5% 8.5% 8.5% Minimum Capital Adequacy Ratio 12.0% 10.5% 10.5% 10.5% Capital Conservation Buffer - 1.25% 1.875% 2.5% Domestic Systemically Important Banks Buffer; in percentage of individual capital surcharge - 50% 75% 100% Countercyclical buffer* - -0% 1.25% -0% 1.875% 2.5%-0% *See current Countercyclical Capital Buffer on Credit Exposures in the UAE.

Article (10): Reporting

- Banks must report to the Central Bank on their capital position in the format and frequency prescribed in the Standards.

- A bank must provide upon request any specific information with respect to its capital positions.

- Banks must report to the Central Bank on their capital position in the format and frequency prescribed in the Standards.

Article (11): Interpretation

The Regulatory Development Division of the Central Bank shall be the reference for interpretation of the provisions of these Regulations.

Article (12): Publication and Application

These Regulations shall be published in the Official Gazette and become effective from 1 February 2017.

Standards for Capital Adequacy of Banks in the UAE

C 52/2017 STA Effective from 1/12/2022I. Introduction and Scope

I. Introduction

1.The Central Bank seeks to promote the effective and efficient development and functioning of the banking system. To this end, banks are required to manage their capital in a prudent and sustainable manner. It is important that banks’ risk exposures are backed by a strong capital base of high quality in order to contribute to the stability of the financial system of the UAE.

2.In introducing these Standards, the Central Bank intends to ensure that banks’ capital adequacy is in line with the minimum standards as published by the Basel Committee on Banking Supervision, i.e. the Basel II: International Convergence of Capital Measurement and Capital Standards, June 2006, which was implemented in the UAE in 2009 (Capital Adequacy Standards, Standardised Approach), and the ‘Basel III: A global regulatory framework for more resilient banks and banking systems’, commonly referred to as ‘Basel III’.

3.These Standards support the regulations and elaborate on the supervisory expectations of the Central Bank with respect to capital adequacy requirements. These standards are issued pursuant to the powers vested in the Central Bank under the Central Bank Law.

4.Where these standards, include a requirement to provide information or to take certain measures, or to address certain items listed at a minimum, the Central Bank may impose requirements, which are additional to the listing provided in the relevant article.

5.The Standards follow the calibration developed by the Basel Committee, which includes a maximum risk weight of 1250%, calibrated on a total capital adequacy requirement of 8%. The UAE instituted a higher minimum capital requirement of 10.5% (excluding capital buffers), applicable to all licensed banks. Consequently, the maximum capital charge for a single exposure will be the lesser of the value of the exposure after applying valid credit risk mitigation, netting and haircuts, and the capital resulting from applying a risk weight of 952% (reciprocal of 10.5%) to this exposure.

II. Scope of Application

6.These Standards apply to all banks. Banks must ensure that these Standards are adhered to on a consolidated basis. The group level capital adequacy ratio requirements must measure the capital adequacy of a bank based on its capital strength and risk profile after regulatory consolidation of assets and liabilities of its subsidiaries as specified herein.

7.Note that the solo-level capital adequacy ratio requirements, which measure the capital adequacy of an individual bank based on its stand-alone capital strength, will be issued at a later stage

8.These Standards should be read in conjunction with the associated guidance issued by the Central Bank (Guidance for Capital Adequacy of Banks in the UAE – September 2020).

III. Domestic Systemically Important Banks (D-SIBs)

9.Banks designated by the Central Bank as domestic systemically important banks are required to hold additional risk-based capital ratio buffers, applied to Common Equity Tier 1 (CET1). Banks are notified individually by the Central Bank with regard to the additional requirements.

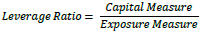

10.All banks must maintain a leverage ratio of at least 3.0%. Designated domestic systemically important banks must maintain a leverage ratio of at least 3.5%.

IV. Reporting

11.Banks must report to the Central Bank on their capital position in the format and frequency determined by the Central Bank.

12.A bank must provide the Central Bank with any specific information with respect to its capital positions upon request.

V. Independent Review

13.An Independent review of the Central Bank’s Capital framework implementation by internal audit is required every year. However, if the Central Bank is not satisfied with the internal audit, Central Bank may require an external review.

14.For D-SIBs, in addition, an independent external review is required every 3 years.

VI. Interpretation

15.The Regulatory Development Division of the Central Bank shall be the reference for interpretation of the provisions of these Standards.

VII. Application

16.The following Standards are already in effect as follows:

- •The Tier Capital Supply Standard

- •Tier Capital Instruments Standard

- •Pillar 2 Standard

17.The remaining Standards will be effective from Q2 2021 onwards.

18.Banks must continue to submit the existing Basel Capital reports (live reporting (production) for BRF 95, CAR Returns workbook and Pillar 3).

Pillar 1

II. Tier Capital Supply

1. Scope of Application

1.This Standard formulates capital adequacy requirements that need to be applied to all banks in UAE on a consolidated basis. The consolidated entity includes all worldwide banking subsidiaries, however it excludes insurance companies and non-financial commercial entities that are subsidiaries of the entity licensed in the UAE.

2.Banks are required to deduct, from CET1, the full amount of any capital shortfall of subsidiaries that are regulated and are subject to capital requirements on a worldwide basis. Additionally, any shortfall in the capital requirement of unconsolidated subsidiary (e.g. insurance, commercial entity) must be fully deducted from the CET1 capital (at stand-alone as well as consolidated level)

3.The amount of the capital requirement and capital shortfall for this deduction is to be based on the regulations issued by the subsidiary’s regulator (i.e. based on the host regulator’s capital adequacy requirements).

4.The Standards follow the international calibration as developed by the Basel Committee, imposing risk weights up to 1250% for assets. The UAE adopted a higher minimum capital requirement of 10.5% minimum CAR (without the capital conservation buffer). Taking into consideration the higher minimum capital requirements of 10.5% in the UAE, the risk weight shall be capped at 952% (reciprocal of 10.5%).

1.1 Investments in the Capital of Banking Subsidiaries

5.Majority-owned or controlled banking entities, securities entities (where subject to broadly similar regulation or where securities activities are deemed banking activities) and other financial entities should generally be fully consolidated. Notwithstanding the banks decision on exercising control over an entity and the subsequent consolidation of that entity, the Central Bank reserves the right to determine whether the bank exercises control over an entity and hence may require banks to consolidate/deconsolidate entities.

6.In instances where it is not feasible to consolidate certain majority-owned banking, securities or other regulated financial entities1, banks may, subject to prior Central Bank approval, opt for non-consolidation of such entities for regulatory capital purposes.

7.For group level reporting, if any majority-owned financial subsidiaries are not consolidated for capital purposes, all assets, liabilities and third-party capital investments in the subsidiaries will be removed from the bank’s balance sheet. All equity and other investments in regulatory capital instruments in those entities attributable to the bank / banking group will be deducted.

8.Banks are required to deduct from CET1 the full amount of any capital shortfalls of subsidiaries excluded from regulatory consolidation, that are regulated entities and are subject to capital requirements. The amount of the capital requirement and capital shortfall for this deduction is to be based on the regulations issued by the subsidiary’s regulator (i.e. based on the host regulator’s local capital adequacy requirements).

1 Examples of the types of activities that financial entities might be involved in include financial leasing, issuing credit cards, portfolio management, investment advisory, custodial and safekeeping services and other similar activities that are ancillary to the business of banking.

1.2 Investments in the Capital of Banking, Securities, Financial and Insurance Entities

Banking, securities, financial and insurance entities – (ownership in entity does not exceed 10%)

9.A bank’s equity interests in banking, securities, insurance and other financial entities are defined as investments in the capital of banking, securities, insurance and other financial entities if the bank owns up to 10% of the investee’s common share capital.

For detailed treatment of investments in such entities, refer to Section 3.9 - Regulatory Adjustments.

Banking, securities, financial and insurance entities – Significant investments (ownership in entity exceeds 10%)

10.Significant investments in banking, securities and other financial entities are defined as investments in the capital of banking, securities and other financial entities (that are outside the scope of regulatory consolidation) wherein the bank owns more than 10% of the investee’s common share capital. Such investments will be subject to the treatment outlined in Section 3.10 - Regulatory Adjustments.

1.3 Investments in Commercial Entities

11.Significant investments in commercial entities are subject to the treatment outlined in section 5. Subsidiaries that are commercial entities are not to be consolidated for regulatory capital purposes. In cases where a subsidiary that is a commercial entity has been consolidated for accounting purposes, the entity is to be deconsolidated for regulatory purposes (i.e. all assets, liabilities and equity will be removed from the bank’s balance sheet) and the book value of the investment will be subject to the treatment.

For detailed treatment of investments in such entities, refer to Section 5.

2. Eligible Capital

2.1 Component of Capital

12.Total regulatory capital will consist of the sum of the following items:

- i.Tier 1 capital, composed of

- a.Common Equity Tier 1 (“CET1”)

- b.Additional Tier 1 (“AT1”)

- ii.Tier 2 capital.

These regulatory capital components are net of regulatory adjustments.

13.Article (2.2) of Capital Adequacy Regulation requires banks to apply the following minimum requirement, at all times:

- i.CET1 capital must be at least 7.0% of risk-weighted assets (RWA).

- ii.Tier 1 capital must be at least 8.5% of RWA.

- iii.Total capital, calculated as sum of Tier 1 capital and Tier 2 capital, must be at least 10.5% of RWA.

- i.Tier 1 capital, composed of

2.2 Capital Buffers:

14.Article (5.1) of Capital Adequacy Regulation requires banks to maintain a capital conservation buffer (CCB) of 2.5% of total risk weighted assets, in the form of CET1 capital.

15.Article (6) of Capital Adequacy Regulation requires banks to implement a countercyclical buffer (CCyB). Banks must meet the CCyB requirements by using CET1 capital exclusively. Banks will be subject to a countercyclical buffer that varies between zero and 2.5% of total risk weighted assets*. The buffer that will apply to each bank will reflect the geographic composition of its portfolio of credit exposures. The CCyB buffer extends the capital conservation buffer (CCB).

16.Domestic Systemically Important Banks (D-SIBs) are required to comply with article (7) of the Capital Adequacy Regulation. The additional requirements for identified D-SIBs will be communicated individually by the Central Bank to each relevant bank. Banks must meet the D-SIB buffer requirements by using CET1 capital. The D-SIB buffer extends the capital conservation buffer (CCB).

17.Based on the outcome of the Supervisory Review and Evaluation Process (SREP) conducted by the Central Bank, a bank may be subject to an additional capital add-on, also referred to as individual Supervisory Capital Guidance requirement (SCG). Banks notified must apply the individual SCG requirement, as set by the Central Bank. The Individual SCG increases the minimum capital requirement.

18.The aggregation of all the capital buffers (CCB, CCyB and D-SIB) form an effective capital conservation buffer. Any breach of the capital conservation buffers will lead to the following additional supervisory requirements and constraints on distributions:

- i.The relevant bank must immediately inform the Central Bank of the breach.

- ii.The relevant bank shall submit an approved plan to restore its regulatory capital to meet the buffer level requirement.

- iii.The relevant bank will be subjected to more intense supervision.

- iv.Capital conservation restrictions will immediately become effective in the form of restriction of dividends as prescribed by the Central Bank.

*See current Countercyclical Capital Buffer on Credit Exposures in the UAE.

2.3 Common Equity Tier 1

19.As per Article 3.1 of the Capital Adequacy Regulation, CET1 capital consists of the sum of the following elements:

- i.Common shares issued by a bank which are eligible for inclusion in CET1 (or the equivalent for non-joint stock companies);

- ii.Share premium resulting from the issue of instruments included in CET1;

- iii.Retained earnings;

- iv.Legal reserves;

- v.Statutory reserves;

- vi.Accumulated other comprehensive income and other disclosed reserves;

- vii.Common shares issued by consolidated subsidiaries of a bank and held by third parties, also referred to as minority interest, which are eligible for inclusion in CET1;

- viii.Regulatory adjustments applied in the calculation of CET1.

20.Retained earnings and other comprehensive income include audited/reviewed interim profit or loss. Expected dividend payments are excluded from CET1.

Common shares issued by the bank

21.For an instrument to be included in CET1 capital, it must meet all of the following criteria stated below. In cases where banks issue non-voting common shares, they must be identical to voting common shares of the issuing bank in all respects except the absence of voting rights for inclusion in CET1.

- i.Represents the most subordinated claim in liquidation of the bank.

- ii.The investor is entitled to a claim on the residual assets that is proportional to its share of issued capital, after all senior claims have been paid in liquidation (i.e. has an unlimited and variable claim, not a fixed or capped claim).

- iii.The principal is perpetual and never repaid outside of liquidation (setting aside discretionary repurchases or other means of effectively reducing capital in a discretionary manner that is allowable under relevant law and subject to the prior approval of the Central Bank).

- iv.The bank does nothing to create an expectation at issuance that the instrument will be bought back, redeemed or cancelled, nor do the statutory or contractual terms provide any feature that might give rise to such an expectation.

- v.Distributions are paid out of distributable items, including retained earnings. The level of distributions is not in any way tied or linked to the amount paid in at issuance and is not subject to a contractual cap (except to the extent that a bank is unable to pay distributions that exceed the level of distributable items).

- vi.There are no circumstances under which the distributions are obligatory. Non-payment is, therefore, not an event of default.

- vii.Distributions are paid only after all legal and contractual obligations have been met and payments on more senior capital instruments have been made. This means that there are no preferential distributions, including in respect of other elements classified as the highest quality issued capital.

- viii.The issued capital takes the first and proportionately greatest share of any losses as they occur. Within the highest quality capital, each instrument absorbs losses on a going concern basis proportionately and pari passu with all the others.

- ix.The paid-in amount is recognized as equity capital (i.e. not recognized as a liability) for determining balance sheet insolvency.

- x.The paid-in amount is classified as equity under the relevant accounting standards.

- xi.It is directly issued and paid-in and the bank cannot directly or indirectly have funded the purchase of the instrument.

- xii.The paid-in amount is neither secured nor covered by a guarantee of the issuer or related entity or subject to any other arrangement that legally or economically enhances the seniority of the claim.

- xiii.It is either only issued with the approval of the owners of the issuing bank, given directly by the owners or, if permitted by applicable law, given by the Board of Directors or by other persons duly authorized by the owners.

- xiv.It is clearly and separately disclosed on the bank’s balance sheet.

2.4 Additional Tier 1 Capital

22.Articles 3.2 of the Capital Adequacy Regulation, AT1 capital consists of the sum of the following elements:

- i.Instruments issued by a bank which are eligible for inclusion in AT1 and are not included in CET1 (e.g. perpetual equity instruments, not included in CET1);

- ii.Stock surplus, or share premium, resulting from the issue of instruments included in AT1;

- iii.Instruments issued by consolidated subsidiaries of the bank and held by third parties which are eligible for inclusion in AT1 and are not included in CET1;

- iv.Regulatory adjustments applied in the calculation of AT1.

23.The treatment of instruments issued out of consolidated subsidiaries of the bank and the regulatory deductions applied in the calculation of AT1 capital are addressed in the Tier Capital Instruments Standard.

Instruments issued by the bank that meet the Additional Tier 1 criteria

24.The following is the minimum set of criteria for an instrument issued by the bank to meet or exceed in order for it to be included in Additional Tier 1 capital:

- i.Issued and paid-in

- ii.Subordinated to depositors, general creditors and subordinated debt of the bank

- iii.Is neither secured nor covered by a guarantee of the issuer or related entity or other arrangement that legally or economically enhances the seniority of the claim vis-à-vis bank creditors

- iv.Is perpetual, i.e. there is no maturity date and there are no step-ups or other incentives to redeem

- v.May be callable at the initiative of the issuer only after a minimum of five years:

- a.To exercise a call option a bank must receive prior Central Bank approval; and

- b.A bank must not do anything which creates an expectation that the call will be exercised; and

- c.Banks must not exercise a call unless:

- 1)They replace the called instrument with capital of the same or better quality and the replacement of this capital is done at conditions which are sustainable for the income capacity of the bank; or

- 2)The bank demonstrates that its capital position is well above the minimum capital requirements after the call option is exercised.

- vi.Any repayment of principal (e.g. through repurchase or redemption) must be with prior Central Bank’s approval and banks should not assume or create market expectations that Central Bank’s approval will be given.

- vii.Dividend/coupon discretion:

- a.the Central Bank and the bank must have full discretion at all times to cancel distributions/payments

- b.cancellation of discretionary payments must not be an event of default

- c.banks must have full access to cancelled payments to meet obligations as they fall due

- d.Cancellation of distributions/payments must not impose restrictions on the bank except in relation to distributions to common stockholders.

- viii.Dividends/coupons must be paid out of distributable items

- ix.The instrument cannot have a credit-sensitive dividend feature, that is a dividend/coupon that is reset periodically based in whole or in part on the banking organization’s credit standing.

- x.The instrument cannot contribute to liabilities exceeding assets in the required balance sheet test to determine insolvency.

- xi.Instruments classified as liabilities for accounting purposes must have principal loss absorption through a write-down mechanism which allocates losses to the instrument at a pre-specified trigger point. The loss absorption trigger must be set at a level of 7.625% of CET1. The write-down will have the following effects:

- 1.Reduce the claim of the instrument in liquidation;

- 2.Reduce the amount re-paid when a call is exercised; and

- 3.Partially or fully reduce coupon/dividend payments on the instrument.

- xii.Neither the bank nor a related party over which the bank exercises control or significant influence can have purchased the instrument or otherwise come into possession of the instrument, such as through receipt of collateral or a reverse repurchase agreement, nor can the bank directly or indirectly have funded the purchase of the instrument.

- xiii.The instrument cannot have any features that hinder recapitalization, such as provisions that require the issuer to compensate investors if a new instrument is issued at a lower price during a specified time frame.

- xiv.[Applicable for Islamic banks only] If the instrument is not issued out of an operating entity or the holding company in the consolidated group (e.g. a special purpose vehicle – “SPV”), proceeds must be immediately available without limitation to an operating entity or the holding company in the consolidated group in a form which meets or exceeds all of the other criteria for inclusion in AT1 capital (Refer to the Capital Instruments Standards).

- xv.In addition to the criteria outlined above, the instrument must meet criteria for minimum requirements to ensure loss absorbency at the point of non-viability. Please refer to the Capital Instruments Standards.

Share premium resulting from the issue of instruments included in Additional Tier 1 capital;

25.Share premium that is not eligible for inclusion in CET1, will only be permitted to be included in AT1 capital if the shares giving rise to the stock surplus are permitted to be included in AT1 capital.

2.5 Tier 2 Capital

26.Articles 3.3 of the Capital Adequacy Regulation, Tier 2 capital consists of the sum of the following elements:

- i.Banks using the standardized approach for credit risk: general provisions or general loan loss reserves, up to maximum of 1.25% of credit RWA;

- ii.Instruments issued by the bank that meet the criteria for inclusion in Tier 2 capital, and are not included in Tier 1 capital;

- iii.Share premium resulting from the issue of instruments included in Tier 2 capital;

- iv.Instruments which are eligible for inclusion of Tier 2 (refer to paragraph 27)

- v.Instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Tier 2 capital, and are not included in Tier 1 capital;

- vi.Regulatory adjustments applied in the calculation of Tier 2.

27.The treatment of instruments issued out of consolidated subsidiaries of the bank and the regulatory deductions applied in the calculation of Tier 2 capital are addressed in the Tier Capital Instrument Standard.

Instruments issued by the bank that meet the Tier 2 criteria

28.The objective of Tier 2 capital is to provide loss absorption on a gone-concern basis. Based on this objective, the minimum set of criteria for an instrument to meet or exceed in order for it to be included in Tier 2 capital are set out below.

Criteria for inclusion in Tier 2 Capital

- i.Issued and paid-in.

- ii.Subordinated to depositors and general creditors of the bank.

- iii.Is neither secured nor covered by a guarantee of the issuer or related entity or other arrangement that legally or economically enhances the seniority of the claim vis-à-vis depositors and general bank creditors

- iv.Maturity:

- a.minimum original maturity of at least five years

- b.recognition in regulatory capital in the remaining five years before maturity will be amortized on an annualized straight line basis (i.e. 20% incremental reduction in recognition every successive year in the last five years)

- c.there are no step-ups or other incentives to redeem

- v.May be callable at the initiative of the issuer only after a minimum of five years:

- a.To exercise a call option a bank must receive prior Central Bank’s approval;

- b.A bank must not do anything that creates an expectation that the call will be exercised; and

- c.Banks must not exercise a call unless:

- 1.They replace the called instrument with capital of the same or better quality and the replacement of this capital is done at conditions which are sustainable for the income capacity of the bank; or

- 2.The bank demonstrates that its capital position is well above the minimum capital requirements after the call option is exercised.

- vi.The investor must have no rights to accelerate the repayment of future scheduled payments (coupon or principal), except in bankruptcy and liquidation.

- vii.The instrument cannot have a credit-sensitive dividend feature, that is a dividend/coupon that is reset periodically based in whole or in part on the banking organization’s credit standing.

- viii.Neither the bank nor a related party over which the bank exercises control or significant influence can have purchased the instrument or otherwise come into possession of the instrument, such as through receipt of collateral or a reverse repurchase agreement, nor can the bank directly or indirectly have funded the purchase of the instrument.

- ix.[Applicable for Islamic banks only] If the instrument is not issued out of an operating entity or the holding company in the consolidated group (e.g. a special purpose vehicle – “SPV”), proceeds must be immediately available without limitation to an operating entity or the holding company in the consolidated group in a form which meets or exceeds all of the other criteria for inclusion in Tier 2 Capital (Refer to the Capital Instruments Standards).

29.In addition to the criteria outlined above, the instrument must meet the minimum requirements to ensure loss absorbency at the point of non-viability. Please refer to the Capital Instruments Standards.

Share premium resulting from the issue of instruments included in Tier 2 capital

30.Share premium that is not eligible for inclusion in Tier 1, will only be permitted to be included in Tier 2 capital if the shares giving rise to the stock surplus are permitted to be included in Tier 2 capital.

General provisions/General loan-loss reserves:

31.Provisions or loan-loss reserves held against future, presently unidentified losses are freely available to meet losses which subsequently materialize and therefore qualify for inclusion within Tier 2. Provisions ascribed to identified deterioration of particular assets or known liabilities, whether individual or grouped, should be excluded. Furthermore, general provisions or general reserves for loan losses will be limited to a maximum of 1.25% of credit risk weighted risk assets calculated under the standardised approach.

Capital component of Capital Adequacy Regulation

32.If a bank has complied with the minimum CET1 and Tier 1 capital ratios, the excess AT1 capital can be counted to meet the total capital ratio, also referred to as Capital Adequacy Ratio (CAR).

33.Profit-sharing investment accounts must not be classified as part of an Islamic bank’s regulatory capital as referred to in Article 2 of Capital Adequacy Regulation.

34.Investment risk reserves and a portion of the Profit Equalization Reserve (PER), if any, belong to the equity of investment account holders, and thus must not be used in the calculation of an Islamic bank’s regulatory capital. As the purpose of a PER is to smooth the profit pay-outs and not to cover losses, any portion of a PER that is part of the Islamic bank’s reserves must not be treated as regulatory capital as referred to in Article 2 of Capital Adequacy Regulations.

2.6 Additional Criteria for AT1 and Tier 2 Instruments: Minimum Requirements to Ensure Loss Absorbency at the Point of Non-Vability.

35. In order for an instrument issued by a bank to be included in AT1 or Tier 2 capital, it must also meet or exceed the minimum requirements defined in Capital Instruments Standards. These requirements are in addition to the criteria for AT1 and Tier 2 instruments stated above.

2.7 Minority Interest (i.e. Non-Controlling Interest) and Other Capital Issued Out of Consolidated Subsidiaries

Common shares issued by consolidated subsidiaries (that is within the scope of regulatory consolidation)

36.Minority interest arising from the issue of common shares by a fully consolidated subsidiary of the bank may receive recognition in CET1 only if:

- i.The instrument giving rise to the minority interest would, if issued by the bank, meet all of the criteria for classification as common shares for regulatory capital purposes; and

- ii.The subsidiary that issued the instrument is itself a bank. (It is noted that minority interest in a subsidiary that is a bank is strictly excluded from the parent bank’s common equity if the parent bank or affiliate has entered into any arrangements to fund directly or indirectly minority investment in the subsidiary whether through an SPV or through another vehicle or arrangement. The treatment outlined here, thus, is strictly available where all minority investments in the bank subsidiary solely represent genuine third party common equity contributions to the subsidiary.)

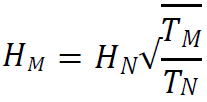

37.The amount of capital meeting the above criteria that will be recognized in consolidated CET1 is calculated as follows

Total minority interest meeting the two criteria above minus the amount of the surplus CET1 of the subsidiary attributable to the minority shareholders.

- i.Surplus CET1 of the subsidiary is calculated as the CET1 (after the application of regulatory deductions) of the subsidiary minus the lower of:

- a.the minimum CET1 requirement of the subsidiary plus the capital conservation buffer (i.e. 9.5% of risk weighted assets) and

- b.the portion of the parent’s consolidated minimum CET1 requirement plus the capital conservation buffer (i.e. 9.5% of consolidated risk weighted assets) that relates to the subsidiary.

- ii.The amount of the surplus CET1 that is attributable to the minority shareholders is calculated by multiplying the surplus CET1 by the percentage of CET1 that is held by minority shareholders.

Tier 1 qualifying capital issued by consolidated subsidiaries (that is within the scope of regulatory consolidation)

38.Tier 1 capital instruments issued by a fully consolidated subsidiary of the bank to third party investors (including amounts under paragraph 37) may receive recognition in Tier 1 capital only if the instruments would, if issued by the bank meet all of the criteria for classification as Tier 1 capital.

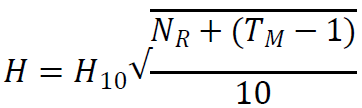

39.The amount of this capital that will be recognized in Tier 1 will be calculated as follows:

Total Tier 1 of the subsidiary issued to third parties minus the amount of the surplus Tier 1 of the subsidiary attributable to the third party investors.

- i.Surplus Tier 1 of the subsidiary is calculated as the Tier 1 of the subsidiary (after the application of regulatory deductions) minus the lower of:

- a.the minimum Tier 1 requirement of the subsidiary plus the capital conservation buffer (i.e. 11% of risk weighted assets) and

- b.the portion of the parent’s consolidated minimum Tier 1 requirement plus the capital conservation buffer (i.e. 11% of consolidated risk weighted assets) that relates to the subsidiary.

- ii.The amount of the surplus Tier 1 that is attributable to the third party investors is calculated by multiplying the surplus Tier 1 by the percentage of Tier 1 that is held by third party investors.

The amount of this Tier 1 capital that will be recognized in Additional Tier 1 will exclude amounts recognized in CET1 under paragraph 37.

Tier 1 and Tier 2 qualifying capital issued by consolidated subsidiaries (that is within the scope of regulatory consolidation)

40.Total capital instruments (i.e. Tier 1 and Tier 2 capital instruments) issued by a fully consolidated subsidiary of the bank to third party investors (including amounts under paragraph 37 and 39) may receive recognition in Total Capital only if the instruments would, if issued by the bank, meet all of the criteria for classification as Tier 1 or Tier 2 capital

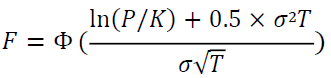

41.The amount of this capital that will be recognized in consolidated Total Capital will be calculated as follows:

Total capital instruments of the subsidiary issued to third parties minus the amount of the surplus Total Capital of the subsidiary attributable to the third party investors.

- i.Surplus Total Capital of the subsidiary is calculated as the Total Capital of the subsidiary (after the application of regulatory deductions) minus the lower of:

- a.the minimum Total Capital requirement of the subsidiary plus the capital conservation buffer (i.e. 13% of risk weighted assets) and

- b.the portion of the parent’s consolidated minimum Total Capital requirement plus the capital conservation buffer (i.e.13% of consolidated risk weighted assets) that relates to the subsidiary.

- ii.The amount of the surplus Total Capital that is attributable to the third party investors is calculated by multiplying the surplus Total Capital by the percentage of Total Capital that is held by third party investors.

The amount of this Total Capital that will be recognized in Tier 2 will exclude amounts recognized in CET1 under paragraph 37 and amounts recognized in AT1 under paragraph 39 above.

42.An illustrative example for calculation of minority interest and other capital issued out of consolidated subsidiaries that is held by the third parties is furnished as Appendix 4 in Guidance for Capital Adequacy of Banks in the UAE.

Other Instructions relating to the calculation of the amount of minority interest

43.All calculations must be undertaken in respect of the subsidiary on a sub-consolidated basis (i.e. the subsidiary must consolidate all of its subsidiaries that are also included in the wider consolidated group). However, the bank may elect to give no recognition (in consolidated capital of the group) to the capital issued by the subsidiary to third parties.

44.Where capital has been issued to third parties out of an SPV, none of this capital can be included in CET1. However, such capital can be included in consolidated AT1 or Tier 2 capital and treated as if the bank itself had issued the capital directly to the third-parties only if:

- i.it meets all the relevant entry criteria; and

- ii.the only asset of the SPV is its investment in the capital of the bank in a form that meets or exceeds all the relevant entry criteria (as required by criterion xiv for Additional Tier 1 and criterion ix for Tier 2 capital)

In cases where the capital has been issued to third parties through an SPV via a fully consolidated subsidiary of the bank, such capital may, subject to the requirements of this paragraph, be treated as if the subsidiary itself had issued it directly to the third parties and may be included in the bank’s consolidated AT1 or Tier 2 in accordance with the treatment outlined in paragraphs 39 and 41.

3. Regulatory Adjustments

45.This Standard sets out the regulatory adjustments to be applied to regulatory capital. In all cases, these adjustments are applied in the calculation of CET1.

3.1 Goodwill and Other Intangibles

46.Goodwill and all other intangibles must be deducted in the calculation of CET1 (this deduction includes mortgage servicing rights), including any goodwill included in the valuation of significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation. The full amount is to be deducted net of any associated deferred tax liability, which would be extinguished if the intangible assets become impaired or derecognized under the relevant accounting standards.

47.Banks are required to use the IFRS definition of intangible assets to determine which assets are classified as intangible and required to be deducted.

3.2 Deferred Tax Assets

48.Deferred tax assets (DTAs) that rely on future profitability of the bank to be realized are to be deducted in the calculation of CET1. Deferred tax assets may be netted with associated deferred tax liabilities (DTLs) only if the DTAs and DTLs relate to taxes levied by the same taxation authority and the relevant taxation authority permits offsetting.

49.The treatment for DTA are classified as:

- i.Where these DTAs relate to temporary differences (e.g. allowance for credit losses) the amount to be deducted is set out in the “threshold deductions”.

- ii.All other DTAs, e.g. those relating to operating losses, such as the carry forward of unused tax losses, or unused tax credits, are to be deducted in full net of DTL as described above.

50.The DTLs permitted to be netted against DTAs must exclude amounts that have been netted against the deduction of goodwill, intangibles and defined benefit pension assets, and must be allocated on a pro rata basis between DTAs subject to the threshold deduction treatment and DTAs that are to be deducted in full.

51.An over-instalment of tax or, in some jurisdictions, current year tax losses carried back to prior years may give rise to a claim or receivable from the government or local tax authority. Such amounts are typically classified as current tax assets for accounting purposes. The recovery of such a claim or receivable would not rely on the future profitability of the bank and would be assigned the relevant sovereign risk weighting.

3.3 Cash Flow Hedge Reserve

52.The amount of the cash flow hedge reserve that relates to the hedging of items that are not fair valued on the balance sheet (including projected cash flows) should be derecognized in the calculation of CET1. This means that positive amounts should be deducted and negative amounts should be added back.

53.This treatment specifically identifies the element of the cash flow hedge reserve that is to be derecognized for prudential purposes. It removes the element that gives rise to artificial volatility in common equity, as in this case the reserve only reflects one half of the picture (the fair value of the derivative, but not the changes in fair value of the hedged future cash flow).

3.4 Gain on Sale Related to Securitization Transactions

54.Derecognize in the calculation of CET1 any increase in equity capital resulting from a securitization transaction, such as that associated with expected Future Margin Income (FMI) resulting in a gain-on-sale.

3.5 Cumulative Gains and Losses Due to Changes in Own Credit Risk on Fair Valued Financial Liabilities

55.Derecognize in the calculation of CET1, all unrealized gains and losses that have resulted from changes in the fair value of liabilities that are due to changes in the bank’s own credit risk.

3.6 Defined Benefit Pension Fund Assets and Liabilities

56.Defined benefit pension fund liabilities, as included on the balance sheet, must be fully recognized in the calculation of CET1 (i.e. CET1 cannot be increased through derecognizing these liabilities).

57.For each defined benefit pension fund that is an asset on the balance sheet, the asset should be deducted in the calculation of CET1 net of any associated deferred tax liability, which would be extinguished if the asset should become impaired or derecognized under the relevant accounting standards.

58.Assets in the fund to which the bank has unrestricted and unfettered access can, with Central Bank’s approval, offset the deduction. Such offsetting assets should be given the risk weight they would receive if they were owned directly by the bank.

59.This treatment addresses the concern that assets arising from pension funds may not be capable of being withdrawn and used for the protection of depositors and other creditors of a bank. The concern is that their only value stems from a reduction in future payments into the fund. The treatment allows banks to reduce the deduction of the asset if they can address these concerns and show that the assets can be easily and promptly withdrawn from the fund.

3.7 Investments in Own Shares (Treasury Stock)

60.All of a bank’s investments in its own common shares, whether held directly or indirectly, will be deducted in the calculation of CET1 (unless already derecognized under the relevant accounting standards).

61.In addition, any own stock, which the bank could be contractually obliged to purchase, should be deducted in the calculation of CET1. The treatment described will apply irrespective of the location of the exposure in the banking book or the trading book. In addition:

- i.Gross long positions may be deducted net of short positions in the same underlying exposure only if the short positions involve no counterparty risk.

- ii.Banks should look through holdings of index securities to deduct exposures to own shares. However, gross long positions in own shares resulting from holdings of index securities may be netted against short position in own shares resulting from short positions in the same underlying index. In such cases, the short positions may involve counterparty risk (which will be subject to the relevant counterparty credit risk charge).

62.Following the same approach outlined above, banks must deduct investments in their own AT1 in the calculation of their AT1 capital and must deduct investments in their own Tier 2 in the calculation of their Tier 2 capital.

3.8 Reciprocal Cross Holdings in the Capital of Banking, Financial and Insurance Entities

63.Reciprocal cross holdings of capital that are designed to artificially inflate the capital position of banks will be deducted in full from CET1.

3.9 Investments in the Capital of Banking, Securities, Financial and Insurance Entities Where the Bank Owns up to 10% of the Issued Common Share Capital of the Entity

64.The regulatory adjustment described in this Standard applies to investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation and where the bank does not own more than 10% of the issued common share capital of the entity. In addition,

- i.Investments include direct, indirect and synthetic holdings of capital instruments. For example, banks should look through holdings of index securities to determine their underlying holdings of capital.

If banks find it operationally burdensome to look through and monitor their exact exposure to the capital of other financial institutions as a result of their holdings of index securities, Central Bank may permit banks, subject to prior supervisory approval, to use a conservative estimate. The methodology for the estimate should demonstrate that in no case will the actual exposure be higher than the estimated exposure. If a look-through or an acceptable estimate are not possible, the full amount of the investment should be accounted for.

- ii.Holdings in both the banking book and trading book are to be included. Capital includes common stock and all other types of cash and synthetic capital instruments (e.g. subordinated debt). It is the net long position that is to be included (i.e. the gross long position net of short positions in the same underlying exposure where the maturity of the short position either matches the maturity of the long position or has a residual maturity of at least one year).

- iii.Underwriting positions held for five working days or less can be excluded. Underwriting positions held for longer than five working days must be included.

- iv.If the capital instrument of the entity in which the bank has invested does not meet the criteria for CET1, AT1, or Tier 2 capital of the bank, the capital is to be considered common shares for the purposes of this regulatory adjustment.

- v.Banks may, with prior Central Bank’s approval, exclude temporarily certain investments where these have been made in the context of resolving or providing financial assistance to reorganize a distressed institution.

65.If the total of all holdings listed above in aggregate exceed 10% of the bank’s common equity (after applying all other regulatory deductions in full, apart from the deductions outlined in this Standard (paragraph 63 to 71)) then the amount above 10% is required to be deducted from CET1.

66.Amounts below the threshold that are not deducted are to be risk weighted as follows:

- i.Amounts below the threshold that are in the banking book are to be risk weighted as per the credit risk (i.e. investments that are not listed and not marked to market will be risk weighted at 150% and investments that are listed will be risk weighted at 100%).

- ii.Amounts below the threshold that are in the trading book are to be risk weighted as per the market risk rules.

- i.Investments include direct, indirect and synthetic holdings of capital instruments. For example, banks should look through holdings of index securities to determine their underlying holdings of capital.

3.10 Significant Investments in the Capital of Banking, Securities, Financial and Insurance Entities That are Outside the Scope of Regulatory Consolidation

67.The regulatory adjustment described in this Standard applies to investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation where the bank owns more than 10% of the issued common share capital of the issuing entity or where the entity is an affiliate of the bank. An affiliate of a bank is defined as a company that controls, or is controlled by, or is under common control with, the bank. Control of a company is defined as (1) ownership, control, or holding with power to vote 20% or more of a class of voting securities of the company; or (2) consolidation of the company for financial reporting purposes. In addition,

- i.Investments include direct, indirect and synthetic holdings of capital instruments. For example, banks should look through holdings of index securities to determine their underlying holdings of capital.

- ii. Holdings in both the banking book and trading book are to be included. Capital includes common stock and all other types of cash and synthetic capital instruments (e.g. subordinated debt). It is the net long position that is to be included (i.e. the gross long position net of short positions in the same underlying exposure where the maturity of the short position either matches the maturity of the long position or has a residual maturity of at least one year)

- iii.Underwriting positions held for five working days or less can be excluded. Underwriting positions held for longer than five working days must be included.

- iv.If the capital instrument of the entity in which the bank has invested does not meet the criteria for CET1, AT1, or Tier 2 capital of the bank, the capital is to be considered common shares for the purposes of this regulatory adjustment. If the investment is issued out of a regulated financial entity and not included in regulatory capital in the relevant sector of the financial entity, it is not required to be deducted.

- v.Banks may, with prior Central Bank’s approval, exclude temporarily certain investments where these have been made in the context of resolving or providing financial assistance to reorganize a distressed institution.

68.All investments included above that are not common shares must be fully deducted from CET1.

69.Investments included above that are common shares will be subject to the “Threshold deductions” treatment described in the section 4 below.

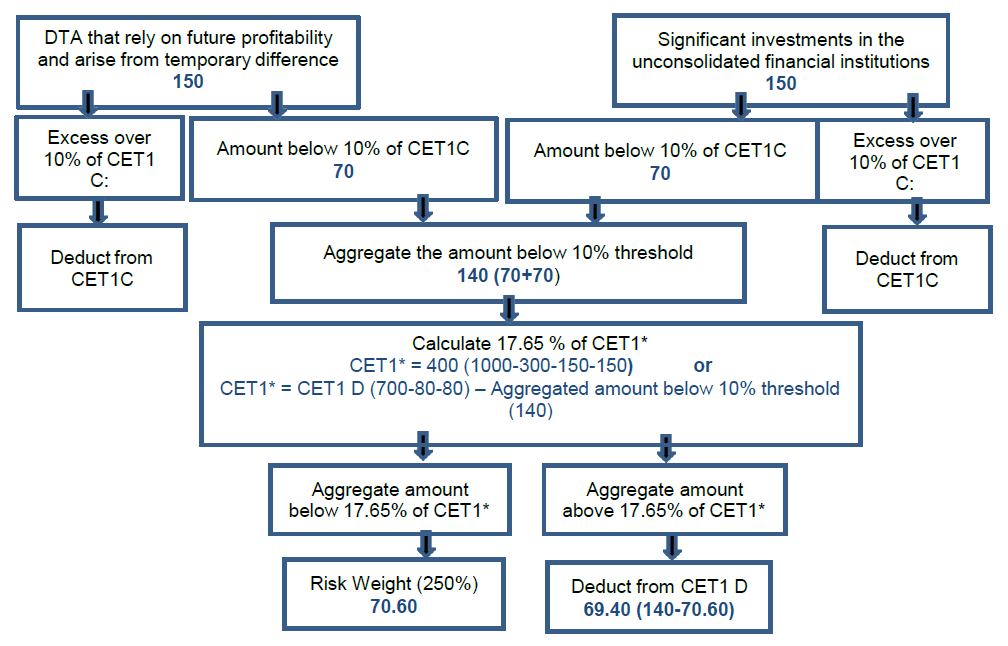

4. Threshold Deductions

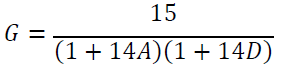

70.Instead of a full deduction, the following items may each receive limited recognition when calculating CET1, with recognition capped at 10% of the bank’s common equity (after applying all other regulatory deductions in full, apart from the deductions outlined in this Standard (paragraph 69 to 71)):

- i.Significant investments in the common shares of unconsolidated financial institutions (banking, securities and other financial entities) and insurance entities as referred to in Section 3.10 (paragraph 66). Any amount exceeding this 10% threshold is deducted from CET1 capital;

- ii.DTAs that rely on future profitability and arise from temporary differences. Any amount exceeding this 10% threshold is deducted from CET1 capital

The amount below the 10% threshold of the above two items are aggregated and must not exceed 15% of the Common Equity Tier 1 capital (after application of all other regulatory adjustments and the amount of significant investments in the common shares of unconsolidated financial institutions and deferred tax assets in full). The calculation for threshold deduction is explained with an example in Appendix 5 in Guidance for Capital Adequacy of Banks in the UAE.

71.The amount of the two items (outlined in paragraph 69) that are not deducted in the calculation of CET1 will be risk weighted at 250%.

Former deductions from capital

72.The following items, which under former Central Bank’s Regulations were deducted 50% from Tier 1 and 50% from Tier 2 (or had the option of being deducted or risk weighted), will receive a 1250% risk weight:

- i.Certain securitization exposures;

- ii.Non-payment/delivery on non-DvP and non-PvP transactions; and

- iii.Significant investments in commercial entities

5. Significant Investments in Commercial Entities

73.Significant investments in commercial entities are defined as investments in commercial entities that are, on an individual basis, greater than or equal to 10% of the bank’s CET1 capital (after the application of all regulatory deductions). The amount in excess of the threshold of 10% (for each individual investment) will be risk weighted at 1250%.

74.If the aggregate of the amount of such significant investments that is not in excess of the threshold (i.e. amount of such investments not risk weighted at 1250%) is greater than 25% of the bank’s CET1 capital (after the application of all regulatory deductions), the amount in excess of 25% must also be risk weighted at 1250%. The amount in excess will be allocated to individual investments in a proportionate basis (refer to Appendix 3 in Guidance for Capital Adequacy of Banks in the UAE for an illustrative example).

75.Amounts below the thresholds that are not risk weighted at 1250% are to be risk weighted as follows:

- i.Amounts below the thresholds that are in the banking book are to be risk weighted as per the credit risk rules (i.e. investments that are not listed will be risk weighted at 150% and investments that are listed will be risk weighted at 100%).

- ii.Amounts below the thresholds that are in the trading book are to be risk weighted as per the market risk rules.

6. Transitional Arrangements

76.Minority investment in banking, financial and insurance entities that are not deducted as per section 3.9 will be risk weighted at 100% if the entity is listed and 150% if the entity is unlisted. Application of risk weight for unlisted entities will have transitional arrangement as follows:

Year End of 2017 1st Jan 2018 1st Jan 2019 1st Jan 2020 onwards Risk weights 100% 115% 130% 150% 77.Equity investment in commercial entities that are below the thresholds as per section 5 will be risk weighted at 100% if the entity is listed and 150% if the entity is unlisted. Application of risk weight for unlisted companies will have transitional arrangement as follows:

Year End of 2017 1st Jan 2018 1st Jan 2019 1st Jan 2020 onwards Risk weights 100% 115% 130% 150%

III. Tier Capital Instruments

1. Introduction

1.This Standard must be read in conjunction with the Capital Regulations Circular No 52/2017, in which Tier Capital the Tier Capital Supply Standard defines criteria required for capital to be classified as Additional Tier 1 (AT1) and Tier 2 (T2). Non-exhaustive examples of features are optional calls, coupon payments, and distributable items.

2.The purpose of this Standard is to:

- •Clarify the requirements for classification of AT1 and T2 instruments in the UAE

- •Provide a robust Tier Capital instrument framework to the industry,

- •Support a standardisation of AT1 and T2 instruments in the market

- •Implement a clear application and approval process.

2. Capital Approval

3.Banks wishing to issue any type of capital, including AT1 and T2, must request approval of the Central Bank of the UAE prior to issuance of the instrument. The bank may only issue the intended capital component after having submitted documentation described in the Application Process in the Appendix to this Standard and after the Board of the Central Bank of the UAE has approved the issuance of the instrument.

4.The Central Bank requires banks to issue AT1 and T2 instruments that are simple and robust in absorbing loss. The capital instrument Standard intends to:

- •Ensure the soundness of individual institutions

- •Reduce the variety of capital instruments in the market

- •Regulate the quality of instruments issued in the UAE

- •Monitor the amount of capital being issued in the market; and

- •Enhance the financial stability of the banking sector.

3. Scope of Application

5.This Standard explains the requirements for Tier Capital instruments, the application process, and approval procedures followed by the Central Bank. It applies to all local banks operating in the UAE since only local banks are permitted to issue Additional Tier 1 or Tier 2 instruments. Foreign branches, however, are permitted to issue Tier 2 subordinated term loans from their Head Offices restricted to a maximum of 3% of their risk-weighted assets. Banks are responsible for ensuring that their capital instruments comply with all applicable requirements. This Standard will be updated from time to time to reflect relevant regulatory development.

4. Definitions and Interpretations

In general, terms in this Standard have the meanings defined in other Regulations and Standards issued by the Central Bank. In addition, for this Standard, the following terms have the meanings defined in this section.

- a.Capital Regulations, Standards and Guidance, means regulatory capital requirements for the maintenance of capital applicable to the issuer, including transitional rules. It includes the Capital Regulation, the Capital Standards, and Capital Guidance.

- b.Central Bank means the Central Bank of the United Arab Emirates.

- c.Distributable Items means the amount of the issuer's consolidated retained earnings and reserves after the transfer of any amounts to non-distributable reserves, all as set out in the most recent audited or auditor reviewed consolidated financial statements of the issuer or any equivalent or successor term from time to time as prescribed by the Capital Regulations, including the applicable criteria for Tier 1 capital instruments that do not constitute Common Equity Tier 1 Capital;

- d.Grandfathering is part of the transition process. In order to qualify for the grandfathering arrangements, an instrument must have a particular cut-off date. Any instrument entered into before 1st January 2018, which does not meet the qualifying criteria for the particular tier of capital, in this Standard will be grandfathered.

- e.Non-Viable: The bank shall be Non-Viable if it is at least (a) insolvent, bankrupt, unable to pay a material part of its obligations as they fall due or unable to carry on its business, or (b) any other event or circumstance occurs that the Central Bank deems necessary to declare the bank to be Non-Viable.

- f.Point of Non-Viability (PONV): A Point of Non-Viability means that the Regulator has determined that the bank has or will become non-viable without: (a) a write-down of the principal amount of the instrument, or (b) a public injection of capital (or equivalent support).

- g.Tier Capital Instruments: Capital instruments other than Core Equity Tier 1 (CET1) capital, that qualify for recognition as Additional Tier 1 (AT1) or Tier 2 (T2) regulatory capital instruments according to the requirements of this Standard.

5. General Requirements for Tier Capital Instruments

6.Tier Capital Instruments must fulfil the criteria described in these capital standards, including additional requirements described hereunder.

Point of Non Viability (PONV)

- i.The terms and conditions of Additional Tier 1 and Tier 2 instruments must have a provision that requires the principal amount of such instruments to be written-down upon the occurrence of a trigger event.

- ii.Banks will be informed in writing upon the occurrence of the bank’s financial position reaching a PONV in the view of the Central Bank.

- iii.When a PONV occurs on or after the issue date of the instrument, the instrument will be cancelled and all and any rights of any holder of the instrument for payment of any amounts under or in respect of the instrument (including, without limitation, any amounts that may be due and payable) shall be cancelled and not restored under any circumstances.

- iv.The write-down at the PONV will occur in full and be permanent in nature. A partial write-down may be considered only in exceptional cases as decided by the Central Bank.

- v.There must not be any impression to the holders that a write-down notice will be sent before the issuer can write-down the principal amount of the instrument.

- vi.If a bank issues Tier Capital out of a subsidiary and with the intention that such capital is eligible in the consolidated group’s capital, the terms and conditions must specify an additional trigger event. The trigger is the earlier of: (1) a decision that a write-down is required, without which the subsidiary would become non-viable, is necessary, as determined by the regulator of the subsidiary in the home jurisdiction, and (2) Central Bank has determined a Point of Non-Viability for the consolidated bank.

Subordination

7.To ensure subordination of Tier Capital instruments, Tier Capital instruments must be fully written-down upon liquidation or bankruptcy.

Solvency Conditions

8.Capital issuances must define Solvency Conditions in the terms and conditions of the instrument. Solvency Conditions must contain at least the following:

- i.The issuer must be solvent at all times.

- ii.Ability of the issuer to make payments on the obligations and any payments required to be made, on the relevant date, with respect to all senior obligations and pari passu obligations.

- iii.The total share capital of the issuer must be greater than zero at all times from the first day of the relevant coupon period to the time of payment of obligations.

Capital Event

9.If the instrument ceases to count as Tier Capital (for example due to a change in the Capital Regulation), the Central Bank will inform the bank in writing of such event accordingly.

10.A capital event may occur at any time, due to its unforeseen nature, on or after the issue date. Any attempt to redeem must be subject to the Central Bank’s prior written consent.

Redemption

11.To ensure that Tier Capital instruments comply with the capital requirements as defined in this Standard, any redemption of the instrument requires prior written consent of Central Bank, satisfaction of the solvency conditions and satisfaction of the requirements set out in the Capital Regulations, Standards, and Guidance.

12.The issuer may redeem all, but not some part, of the instrument. Only in certain exceptional cases would the Central Bank consider approving partial redemption.

13.The terms and conditions of the instrument must not include terms that in any way indicate that the repurchase or redemption of the instrument may occur at any time.

Redemption Notices

14.All notices are revocable before the relevant redemption date.

Special Purpose Vehicle (SPV)

15.Only Islamic banks may use a SPV for capital issuances. The requirements for these issuances are as follows:

- i.The Mudaraba contract between the issuer and the SPV:

- a.Must be subordinated.

- b.No such contract will be given on the cancelled coupons so that flexibility of payments is given at any time.

- ii.The contract must be specific enough and its scope is restricted to a change affecting the issuer, such as a restructure or a merger. The Central Bank will reassess the eligibility of the instrument.

- iii.Each capital instrument requires a separate SPV that should not engage in any other business or activity.

Currencies

16.Only instruments denominated in UAE Dirhams (AED) or US Dollars (USD) will be accepted for banks incorporated in the UAE. This also applies to instruments issued through a SPV by Islamic banks.

17.For issuances by subsidiaries, the respective local currency will be acceptable only in exceptional circumstances with the written approval of the Central Bank.

Specific Requirements for Additional Tier 1

Coupon Cancellation

18.In the event of a coupon cancellation (as stated in the terms and conditions of the instrument), the issuer (as bank or SPV) will not pay the coupon and the following events should be covered as a minimum (Non-Payment Event):

- i.The coupon payable, when aggregated with any distributions or amounts payable by the issuer as bank or SPV, on any pari passu obligations having:

- a.the same dates in respect of payment of such distributions or amounts as, or;

- b.otherwise due and payable on the dates for payment of the coupon, exceeds the Distributable Items (on the relevant date for payment of such coupon);

- ii.The issuer is, on that coupon date:

- a.in breach of the Capital Regulations and Standards including any payment restrictions due to breach of capital buffers imposed on the issuer by the Central Bank, as appropriate;

- b.or payment of the relevant coupon would cause it to be in breach thereof;

- iii.The Central Bank requires that the coupon due on the coupon date will not be paid (for any reason the Central Bank may deem necessary);

- iv.The Solvency Conditions are not satisfied or would no longer be satisfied if the relevant coupon was paid; or

- v.The issuer, in its sole discretion, has elected that coupon shall not be paid to holders of the capital securities on any coupon date, for example but not limited to, due to a net loss for that period. Other than in respect of any amounts due on any date on which the capital securities are to be redeemed in full, unless the redemption notice is revoked.

Therefore, cancellation of the distributions can be discretionary (v) or mandatory (i)-(iv). Any distributions on the instrument so cancelled, must be cancelled definitively and must not accumulate or be payable at any time thereafter.

Non-Payment Event Notice

19.All notices are revocable before a non-payment event is exercised.

20.Any failure to provide a notice of a non-payment event will not invalidate the right to cancel the payment of the coupon.

Enforcement Event

21.The right to institute winding-up proceedings is limited to circumstances where payment has become due. Solvency Conditions have to be met in order for the principal, coupon, or any other amount to be due on the relevant payment date. Payments on the instrument can be cancelled after which it will not be due on the relevant payment date. Upon the occurrence of an enforcement event, any holder of the instrument may give written notice to the issuer of the instrument. An enforcement event is related to a non-payment when due and to insolvency.

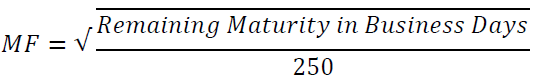

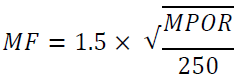

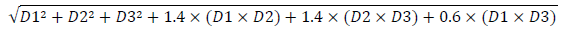

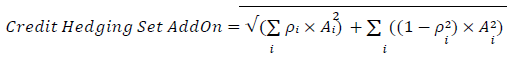

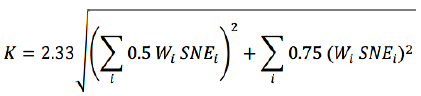

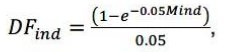

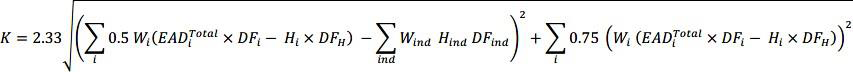

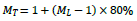

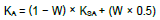

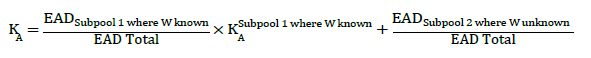

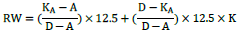

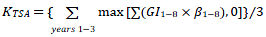

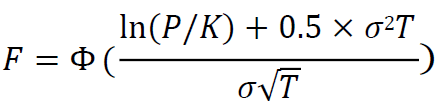

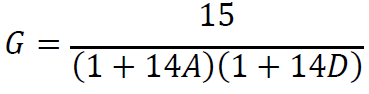

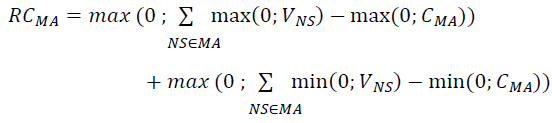

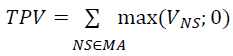

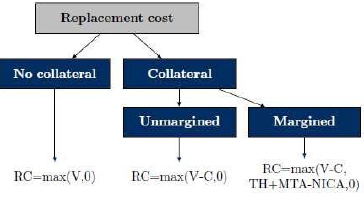

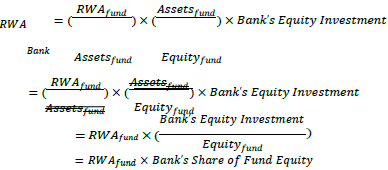

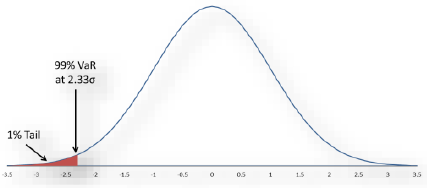

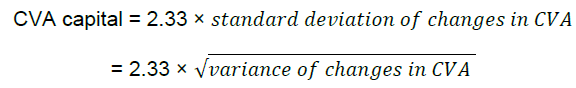

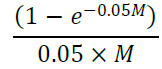

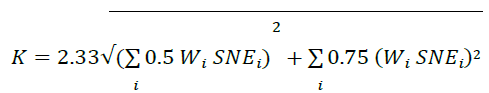

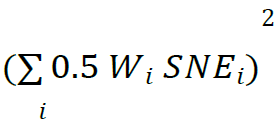

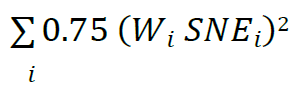

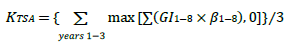

Maximum Distributable Amount (MDA):