Book traversal links for 2.1.5. Intermediation

2.1.5. Intermediation

Effective from 1/8/2022The Payment Sector may be complex with a number of participants potentially involved in a single transaction. As a result, many payment transactions will be highly intermediated, with multiple financial institutions involved in a funds transfer. Additional entities (some of which may not be financial institutions) can potentially facilitate the transaction through the exchange of information. Intermediated transactions create risk because no regulated entity participating in the transaction has the visibility necessary to fully understand the transaction and the participants. Illicit transactions may have red flags when viewed as a whole, but may appear legitimate when seen from the perspective of each of the financial institutions involved. This creates a vulnerability that illicit actors can exploit. | |||||||||||||||||||||||

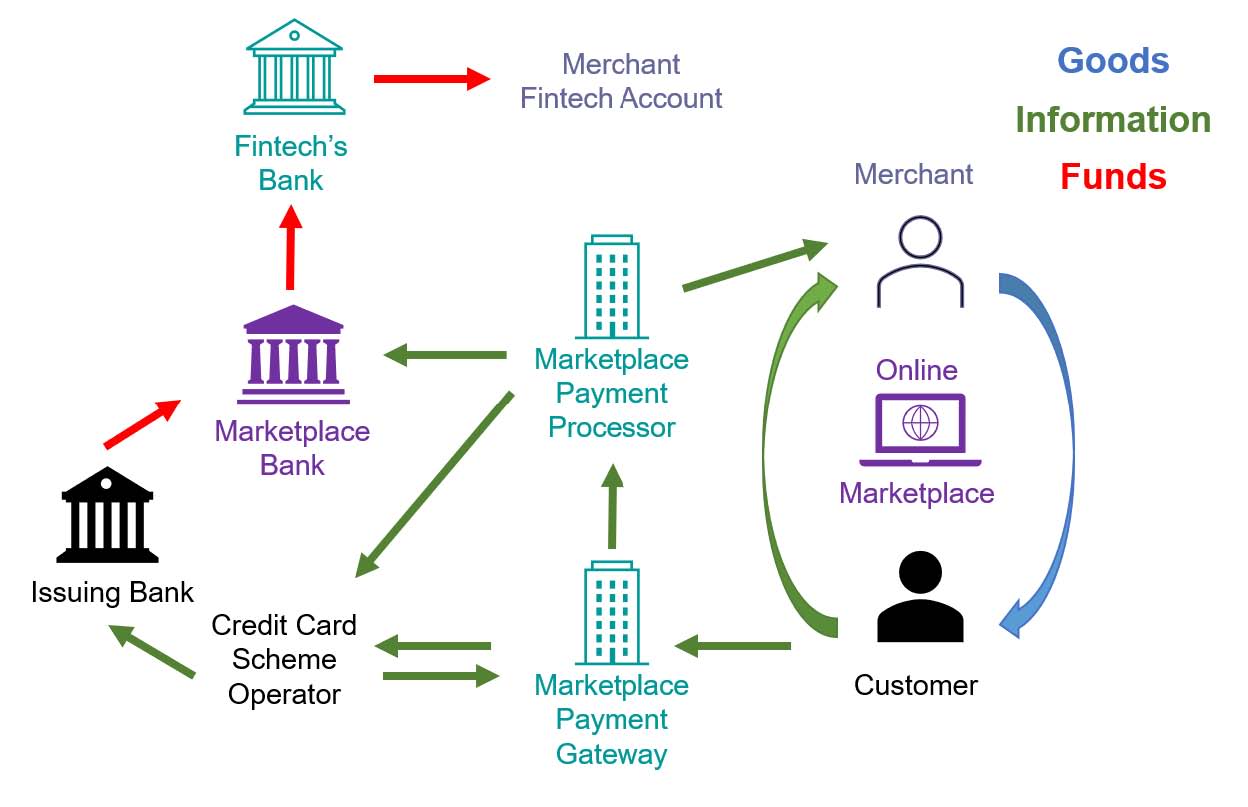

For example, consider the hypothetical transaction below, a purchase on an online marketplace that allows individual sellers to sell items directly to customers:

| |||||||||||||||||||||||

In this transaction, the customer is using a credit card to purchase goods from the merchant, but the merchant is not a participant in the credit card scheme. A number of Payment Sector participants help to bridge this gap and facilitate the transaction:

| |||||||||||||||||||||||

It is unlikely that any of the Payment Sector participants in this transaction have full visibility into the funds transfer chain. The banks are unlikely to have information on anyone other than their immediate customers or correspondents. The payment gateway likely does not identify the merchant. The fintech likely does not identify the customer. The marketplace payment processor is likely aware that the customer and merchant are engaging in a transaction, but may not know where the customer’s funds are coming from or where the merchant’s funds are going. And because the marketplace payment processor does not hold funds at any point in the transaction, it may not be regulated as a financial institution in all jurisdictions. In this instance, a marketplace payment processor may apply certain conditions on what types of customers and merchants it engages. For more information on how LFIs can mitigate and manage ML/FT risks related to this sector, including the risks arising from the use of NPPS, please see section 3 “Mitigating Risks.” | |||||||||||||||||||||||