Book traversal links for 2.1.6. Nesting

2.1.6. Nesting

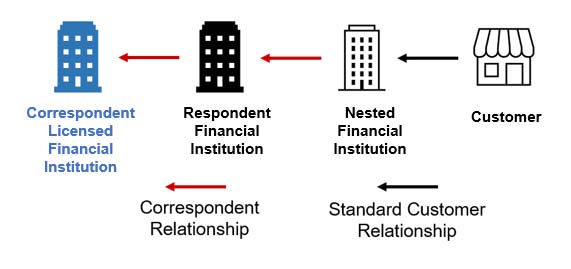

Effective from 1/8/2022Nesting is a form of intermediation that presents specific risks. In most Correspondent Banking Relationships that involve nesting, the respondent financial institution is not aware of individual transactions ordered by the ultimate customer; instead, the respondent sees bulk activity in the correspondent’s account that represents aggregate customer orders and perhaps also proprietary transactions by the correspondent. As a result, the transaction is intermediated because the respondent cannot see—nor assess the risk of— the original customer.

Although nesting can occur in the context of any financial service, some features of the Payment Sector— the long payment chains and the involvement of multiple parties—can increase the likelihood that nesting will take place. In particular, some Payment Sector participants specialize in providing financial services to dubious merchants or customers who would be rejected by larger financial institutions. A participant servicing these customers, frequently offering merchant acquiring or payment aggregation services, will establish a nested relationship with a third participant that in turn has a Correspondent Banking Relationship with a bank. Although all the parties involved must and may claim to perform appropriate merchant due diligence, in practice, the risk may be that the bank is relying on its correspondent, which is in turn relying on the nested financial institution, with the first two parties not having full visibility into the nested financial institution’s customer base or due diligence practices.