Book traversal links for 5.11 Scenario Forecasting

5.11 Scenario Forecasting

| 5.11.1 | The expected practices articulated in this section relate to the regular estimation of ECL. As per current accounting requirements, institutions should estimate an unbiased and probability weighted ECL by evaluating a range of possible outcomes. Consequently, institutions should forecast economic conditions over the lifetime of their portfolio. All the macroeconomic variables employed as input in macro models should be forecasted until the longest maturity date of the institutions’ portfolio. | |||

| 5.11.2 | Institutions are encouraged to disclose macroeconomic scenarios in their annual reports. For this information to be meaningful, institutions should provide the values of the main economic drivers over the next three (3) years with the weight of each scenario. | |||

| 5.11.3 | Institutions should use the most recent set of models to forecast PD and LGD. If the most recent models are not used in the computation of ECL, this should be mentioned in monitoring and validation reports and reported to internal and external auditors because it has direct impacts on financial reporting. | |||

| 5.11.4 | Governance: Institutions can either develop macroeconomic forecasts internally or rely on third party providers. In both cases, a governance process should be put in place to guarantee the quality of forecasts. | |||

| (i) | If scenarios are developed internally, they should be constructed by subject matter experts with robust economic knowledge, within the institution. The scenarios should be reviewed by the Model Oversight Committee and the committee in charge of ECL oversight. | |||

| (ii) | If scenarios are developed externally, institutions should put in place an internal validation process, by which the forecasts are checked, errors are adjusted and economic consistency is ensured. Even if scenarios are provided by an external party, each institution remains the owner of the economic forecasts and therefore remains accountable for inconsistencies present in those scenarios. | |||

| (iii) | To support the adequate estimation of ECL, institutions should produce regular reports to present the aspects of macro scenario calibration discussed in this section. The report should address the source of scenarios, their economic consistency, their severity, weights and potential adjustments. | |||

| 5.11.5 | Weights and severity: As per current accounting requirements, institutions should use several weighed scenarios. At a minimum, institutions should employ one base, one upside and one downside scenario for each macro variable. In order to obtain an unbiased estimation of ECL, both the scenario weights and their associated severity should be jointly calibrated. For each variable, institutions should pay attention to the relative weight and severity of the downside scenario vs. the weight and severity of the upside scenario. Finally, it is recommended to estimate the ECL under each scenario in order to convey possible ECL volatility and support appropriate risk management. | |||

| 5.11.6 | Forward looking information: As per current accounting requirements, ECL should be based on forward looking information that is relevant reasonable and supportable. This should be understood as follows: | |||

| (i) | The economic information should be based on consensus, when possible, rather than a single source. | |||

| (ii) | The economic forecasts should be realistic in terms of trend, level and volatility. For instance, economic forecasts assuming a constant positive inflation should not push asset prices to excessive and unrealistic levels in the long term. This feature is particularly relevant for real estate collaterals. | |||

| (iii) | The divergence between the scenarios (base, upside, downside) should meet economic intuition and business sense. Such divergence should follow a logical economic narrative. | |||

| 5.11.7 | Benchmarks: Aside from ECL measurement, institutions employ existing scenarios for planning purposes, with varying severity and probability of occurrence. Amongst others, dedicated scenarios are used for the ICAAP, the recovery and resolution plan, and for stress testing purpose. These scenarios should not be employed as input for ECL computation because they do not represent an unbiased probability-weighted set of scenarios. Similarly, the macroeconomic scenarios provided by the CBUAE as part of regulatory enterprise-wide stress testing exercises should not be used as input for ECL computation. All these alternative scenarios can only be used as distant comparables for the ECL scenarios. However, this comparison should be made with caution because the calibration (severity, likelihood) of the ECL scenarios is likely to be different. | |||

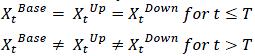

| 5.11.8 | The construction of the scenarios should be economically coherent and therefore should follow a set of rules to be consistent. Let Xt be a time series of the macroeconomic variable X at regular time steps t. For the purpose of articulating this point, we will use three scenarios. The time series of X corresponding to each scenario are noted Xtbase, XtUp and XtDown . | |||

| (i) | Scenarios should be constructed in such way that their values diverge after a given date, called the forecasting date, noted T. The time series for the three scenarios should be identical prior to the date of forecast and diverge after the date of forecast. Formally:

| |||

| (ii) | The portfolio date noted K employed in loss computation should be close to the forecasting date. Therefore, institutions should keep updating the macroeconomic forecasts along with the portfolio date, in order to minimize the time difference between T and K. It may happen that ECL reporting is done at a higher frequency than the update of macroeconomic forecasts. In this case, the time step at which scenarios start diverging occurs before the portfolio date K. Formally, for T<K:

| |||

| This misalignment is likely to create unwarranted effects in particular if scalers are used in PD modelling. Therefore, the maximum delay between the two dates should be no more than three months: K - T ≤ 3 months. If this difference is greater than three (3) months, the impact on the forecasted PD and LGD should be analysed and documented by the independent model validation team. | ||||

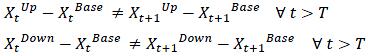

| (iii) | Beyond the forecasting start date, the upside and downside scenarios should not be constructed by a constant parallel shift (or scaling) of the base scenarios. Rather, the upside and downside scenarios should be constructed such that they display a gradual divergence from the base scenario through time (in growth rate terms if growth rates are applied). This property should apply to the stationary transformed macroeconomic variable. Consequently, the forecasted PD and LGD should follow the same pattern. Formally:

| |||

| (iv) | Any scaler subsequently constructed based on these scenarios should follow the same pattern: a gradual divergence from the base scenario. | |||

| 5.11.9 | The principles articulated in this section about scenario forecast should also be included in the scope of review of the validation process. The validation process should test, assess and document practices for scenarios forecasts, including the governance, scenario construction and calibration. | |||